Posted By thestatedtruth.com on February 14, 2010

Thoughts from the Frontline Weekly Newsletter

Between Dire and Disastrous

by John Mauldin

February 12, 2010

Path dependence explains how the set of decisions one faces for any given circumstance is limited by the decisions one has made in the past, even though past circumstances may no longer be relevant. In essence, history matters.

With regard to the future, the choices we make determine the paths we will take. As I have been writing for a long time, we have made a series of bad choices, often the easy choices, all over the developed world. We are now entering an era in which our choices are being limited by the nature of the markets. Not only are we in a path-dependent world, but the number of paths from which we may choose are becoming fewer with each passing year.

Our economic future is more and more a product of the political choices we make, and those are increasingly difficult. We have no good choices. We are left with choosing the best of bad options. Some countries, like Greece, are now down to choices that are either dire or disastrous. There is no “easy” button.

While German Chancellor Merkel has indicated a willingness to help, the German finance minister and other politicians are suggesting German cooperation will either not be forthcoming or only be there at a very high price; and the price is a severe round of “austerity measures,” otherwise known as budget cuts. Greece is being told that it must cut its budget to an 8.7% deficit this year and down to 3% within three years.

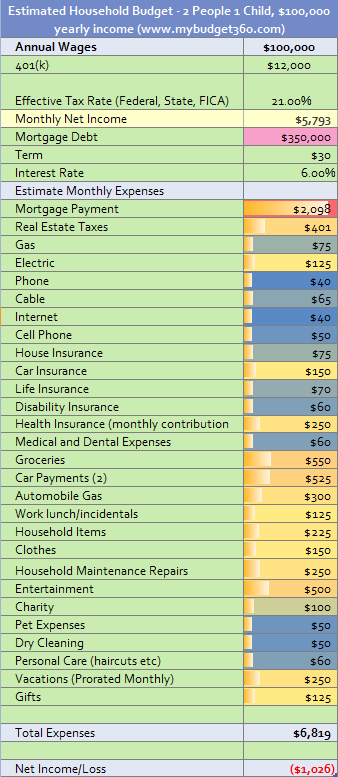

For my American readers, let’s put that into perspective. That is the equivalent of a $560-billion-dollar US budget cut this year and another such cut next year. That would mean huge cuts in entitlements, Social Security, defense, education, wages, subsidies, and on and on. And repealing the Bush tax cuts? That would just be for starters. No “let’s freeze the budget” and try and grow our way out of it, as we effectively did in the ’90s, or gradually cutting the budget a few hundred billion a year while raising taxes. That combination of tax increases and budget cuts would guarantee a US recession. Unemployment, already high, would climb higher.

Now, here is where it actually gets worse. If Greece bites the bullet and makes the budget cuts, that means that nominal GDP will decline by (at least) 4-5% over the next 3 years. And tax revenues will also decline, even with tax increases, meaning that it will take even further cuts, over and above the ones contemplated to get to that magic 3% fiscal deficit to GDP that is required by the Maastricht Treaty. Anyone care to vote for depression?

And add into the equation that borrowing another €100 billion (at a minimum) over the next few years, while in the midst of that recession, will only add to the already huge debt and interest costs. It all amounts to what my friend Marshall Auerback calls a “national suicide pact.”

Normally, a country in such a situation would allow its currency to devalue, which would make its relative labor costs go down. But Greece is in a currency union, and can’t devalue. Or it would restructure its debt (think Brady bonds) to try and resolve the problem.

The dire predicament is the one where Greece cuts its budgets and more or less willingly enters into a rather long and deep recession/depression. The disastrous predicament is where they do not make the cuts and are allowed to default. That means the government is plunged into a situation where it has to cut the entire deficit to what it can get in the form of taxes and fees, immediately. As in right now. And defaulting on the interest on the current bonds wouldn’t be enough, although it would help.

Why not just let Greece go under? Part of the argument has to do with moral hazard. If Germany bails out Greece, Ireland, which is actually making such cuts to its budget, can legitimately ask, “Why not us?” And will Portugal be next? And Spain is too big for even Germany to bail out. At almost 20% unemployment, Spain has severe problems. Its banks are in bad shape, with large amounts of overvalued real estate on their books (sound familiar?) and a government fiscal deficit of almost 10%. While Spanish authorities say they can work this out, deficits will remain high.

“It turns out from the BIS [Bank of International Settlements] numbers, that the largest holders of Greek debt are French, followed by the Swiss, although my guess is that a lot of that is hedged, and I don’t know that the BIS picks that up, and then the Germans. The numbers as of last June were France €86 billion, Switzerland €60bn, and Germany €44 billion. I have seen more recent numbers of France €73b, Switzerland €59b, and Germany €39b. In terms of GDP, for Germany it is minimal – just over 1%. Of more concern, for France it is nearly 3%, and for Belgium 2.5%. For Germany, the debts of Ireland, Portugal and Spain are much bigger problems. They may, however, worry that if there is a contagion, they will have to take marks on that debt. That would be a real problem – nearly 15x the size of the Greek issue.”

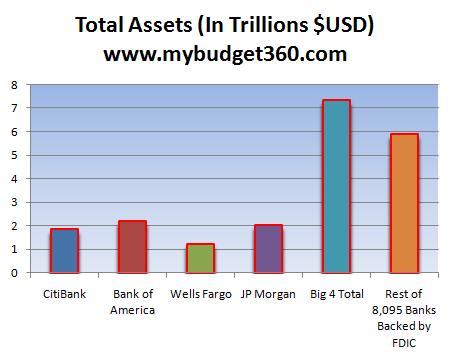

The recent credit crisis was over a few trillion in bad, mostly US, mortgage debts, with most of that at US banks. Greek debt is $350 billion, with about $270 billion of that spread among just three European countries and their banks. Make no mistake, a Greek default is another potential credit crisis in the making. As noted above, it is not just the writedown of Greek debt; it is the mark-to-market of other sovereign debt.

That would bankrupt the bulk of the European banking system, which is why it is unlikely to be allowed to happen. Just as the Fed (under Volker!) allowed US banks to mark up Latin American debt that had defaulted to its original loan value (and only slowly did they write it down; it took many years), I think the same thing will happen in Europe. Or the ECB will provide liquidity. Or there may be any of several other measures to keep things moving along. But real mark-to-market? Unlikely.

The entire EU is faced with no good choices. It is coming down to that moment of crisis predicted by Milton Friedman so many years ago. And there is no agreement on what to do.

Ultimately, this is a political decision for the Greek people. They have roughly four options. They can accept the austerity measures and sink into a depression for a few years. This would mean the total amount of debt would go up rather significantly, putting a very large crimp on future budgets. Debt is a constraint on growth. Debt-to-GDP is already over 100%. A recent paper by Reinhart and Rogoff (authors of the book This Time It’s Different) shows that when government debt-to-GDP goes over 90%, it reduces future potential GDP by over 1%. That locks in a slow-growth, high-unemployment future in an economy already saddled with government spending at 50% of GDP, which is by definition a drag on GDP growth.

The second option is that they can simply default and go into a depression for more than a few years. This would have the advantage of reducing the debt burden, depending on what terms the government settled on. Would bond holders get 50 cents on the euro? 25 cents? Stay tuned. But it would also most assuredly mean they would not be able to get new debt for some time to come, forcing, as noted above, severe cuts in government spending. From one perspective, it has the potential advantage of reducing government’s share of the economy, which is a long-term good but a short-term nightmare. But it also keeps Greece in the euro zone, which does have advantages. However, it does little to deal with the labor-cost differentials.

The third option is that they could vote to leave the European Union. While this is unthinkable to most Europeans, it is an option that may appeal to some Greeks. They could create their own currency and effectively devalue their debt. It would make their labor and exports cheaper. They would still be shut out of debt markets for some time. Any savings left in Greece would be devalued overnight. Those on pensions would find their buying power cut by a great deal. It is likely that inflation would become an issue. And it would be a full-employment act for legions of attorneys.

Most people scoff at this notion, but money is flying out of Greek banks into non-Greek ones, and to my way of thinking that is a suggestion that some Greeks think secession might be a possibility. It is also causing severe stress at Greek banks.

The final option is to promise to make the budget cuts, get some form of guarantee on their bonds, and borrow enough to make it another year – but not actually cut as much as promised; just make some cuts and then promise more next year if you will just bail us out some more. That just kicks the problem down the road for another year or two, until European voters (mostly German) get tired of taking on Greek debt.

The market is not going to let Greece continue to borrow without showing some serious efforts at cutting their deficit, and probably not even then without some external guarantees. The history of Greek debt is not a good one. They have been in default 105 years out of the last 200.

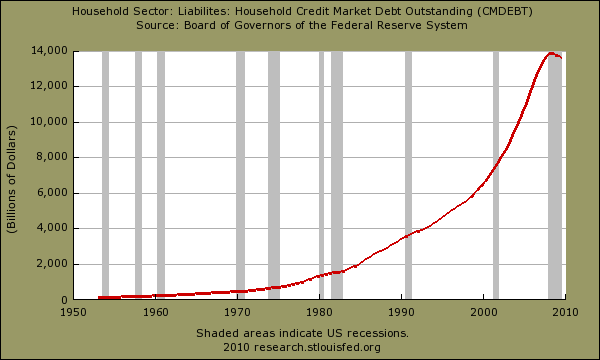

The lesson here? This is not just a Greek problem. Debt and out of control deficits are a problem all over the developed world. The Greeks are just the first. As Niall Ferguson wrote this week in the Financial Times, the contagion is headed to US shores unless we get our budget house in order. You cannot spend your way out of a fiscal crisis. The current path is simply unsustainable. At some point, we can become Greece. Yes, we have the advantage of having our debt denominated in dollars, but that is only an advantage up to a certain point.

Whether it is Japan or Portugal or the US or (pick a country), the body of evidence clearly shows that there is a limit to the amount of debt a sovereign country can handle without a crisis developing. That limit is different for each country, but there is a limit that the bond market will impose. And there are many countries in the developed world that are approaching that limit.

We are in the fullness of time approaching the End Game. In country after country, the choices that have been made over the last decades will yield a Greek situation, where there are no good choices. And the longer the hard choices are put off, the more difficult they will become.

Read the full article at www.frontlinethoughts.com

Category: Commentary, Economy, Finance, National News, Wall Street |

No Comments »

Tags: