Posted By thestatedtruth.com on January 14, 2010

Â

The End of Extend and Pretend

By Dan Amoss

Jacobus, Pennsylvania

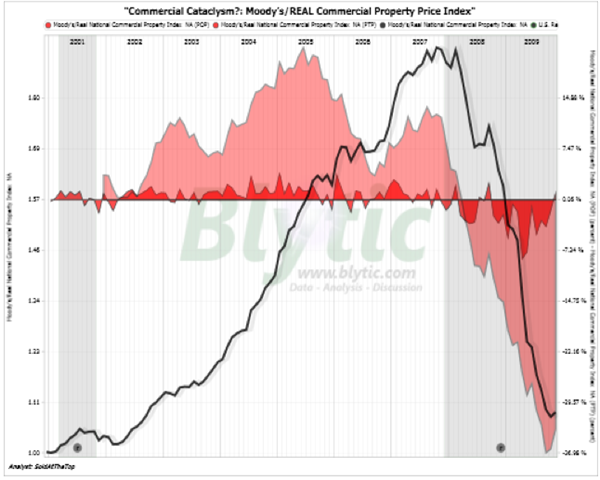

Attention REIT investors! The commercial real estate is a disaster-in- the-making – both for property investors and for the thousands of American banks that are carrying outsized exposure to commercial borrowers.

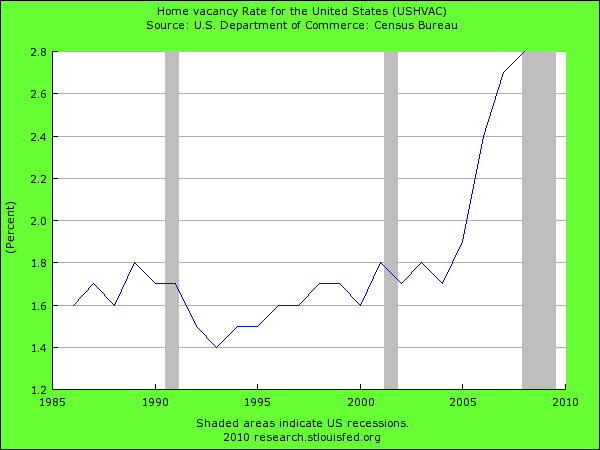

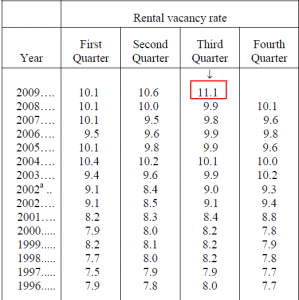

Commercial real estate borrowers and their lenders face a mountain of debt maturities over the next few years. And re-financing this debt will be next to impossible, thanks to soaring vacancy rates and plummeting property values. “Zombie buildings” are popping up all over the place, according to Crain’s New York Business.

“Virtually all the assets bought between ’05 and ’07 cannot be refinanced today without a significant capital infusion,” says Shawn Mobley, executive vice-president at real estate firm Grubb & Ellis Co. “These buildings need to be recapitalized to get back in the business of being active real estate.”

Unfortunately, these “zombie buildings” can’t compete for new tenants because they lack the money to cover brokers’ commissions and interior office reconstruction. The number of zombie buildings in the Chicago area is likely to grow in 2010, according to a forecast by Grubb & Ellis. For landlords, the trend means even top-quality office properties are likely to divide themselves into “haves” and “have- nots,” with the latter seeing their vacancy rates worsen because of the lack of financing.

We’ll see many more zombie buildings emerge in 2010.

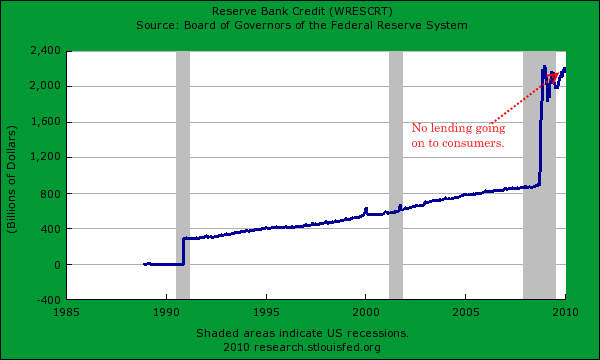

Many REIT investors seem to have grown complacent about the risks in the commercial real estate market. These investors seem to believe that banks will simply roll over underwater loans once they reach maturity, in the hopes that a future rebound in property values will catapult these loans back into solvency. This phenomenon is known as “extend and pretend.”

The “extend and pretend” strategy did not work for Japan’s banking system, and it won’t work for the US either. It won’t work because it will lead to a two-tiered commercial property market. In one tier, we’ll see property owners with affordable mortgages cut rents to fill their vacancies. In the other tier, we’ll see property owners and lenders hoping for a return to bubble values, and maintaining a high- mortgage, high-rent strategy.

Property owners in the high-rent tier may be making payments on their underwater mortgage for now. But once the low-rent tier starts winning all of the scarce leasing activity, vacancies in the high-rent, high- mortgage tier will accelerate and property-level cash flow will fall dramatically.

In other words, just because a mortgage happens to be performing now does not mean it will be viable in the long run. As commercial landlords with negative mark-to-market equity watch their tenants flee, they will stop making mortgage payments and surrender their properties to the lenders. Thus, sooner or later, commercial real estate will find its way down to the prices that would attract new investors and speculators. This process is known as “price discovery.”

By rolling over the maturing bubble-vintage loans made to underwater, but cash-flowing properties, the banking system (if allowed to do so by its regulators) would establish an artificially high price floor. Such industry-wide collusion would slow – but not prevent – the slide toward real-world pricing – the kind that would attract new investment.

But even if the process of price discovery in real estate is delayed by “extend and pretend” at banks, some measure of price discovery will come from the liquidation of properties that collateralize commercial mortgage-backed securities (CMBS). In these securities, when the underlying properties default on mortgages, the holders of the senior CMBS tranches usually push for liquidation. This means that junior tranche holders get wiped out, but losses to the senior tranches are minimized. The senior tranche holders have neither the patience nor the risk tolerance to hope for a rebound in property values. They just want their principal back as soon as possible.

One way or another, commercial real estate prices will fall toward their real-world prices…which are clearly below the prices that most banks are using today.

REITs, despite facing the toughest fundamental outlook in the history of the asset class, are trading at valuations typical of market peaks. Citigroup’s REIT team, in a recent research note, estimates that the REITs it follows are trading for 18 times estimated 2010 cash flow and a 7.2% implied cap rate. This is expensive in ANY market environment. Investors speculating in REITs at today’s high valuations give themselves no margin of safety.

Citigroup’s estimated 2010 cash flow for its REIT coverage universe assumes a strong rebound in demand for commercial space, which I do not expect. Demand will remain below supply for years, forcing REIT landlords to cut the asking price for rents on vacant space.

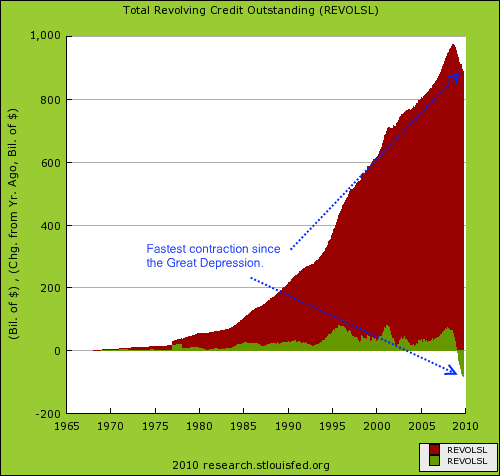

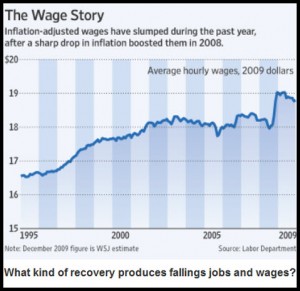

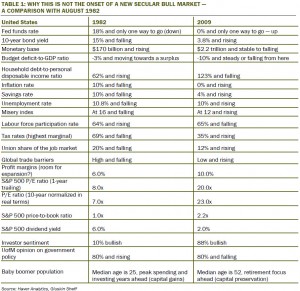

The REIT sector has already “priced in” the typical sharp post-WWII inventory-led economic recovery. But I expect a very tepid, narrow recovery with a “double dip” recession by late 2010. The current “recovery” is not typical. It is merely a stimulus-induced bounce in the midst of what will likely wind up as a decade-long deleveraging, downscaling economy.

So all that’s necessary for a 40% decline in the REIT index is for net operating income to fall 20% to 30% (through a combination of falling rents, rising tenant defaults, and higher interest rates on new CRE mortgages), and cap rates to increase by 200 to 300 basis points – just slightly above the long-term average. A slow economy could easily produce such an outcome…if not much worse.

Until next time,

Dan Amoss

for The Daily Reckoning

The above article does not represent the opinion of www.thestatedtruth.com and is intended for informational purposes only.

Category: Commentary, Economy, Finance, Real Estate |

No Comments »

Tags:

![[REITBANK]](http://s.wsj.net/public/resources/images/MI-BA793_REITBA_NS_20100112183317.gif)

![[Organ]](http://s.wsj.net/public/resources/images/OB-FF713_Organ_NS_20100108235457.jpg) Bloomberg NewsSource: Organ Procurement and Transplantation Network

Bloomberg NewsSource: Organ Procurement and Transplantation Network