John Mauldin’s 2010 Forecast: “The Year Of Uncertainty”

Posted By thestatedtruth.com on January 9, 2010

John Mauldin’s  “Thoughts from the Frontline Weekly Newsletter”

Those who are invested in the idea of a “V”-shaped recovery became excited over the jobs report last month. Unemployment rose by only 11,000 jobs, if you did not look at the underlying numbers or ignored the household survey. And the consumer confidence surveys have begun to rise. The Index of Leading Economic Indicators has now risen for six months in a row. Productivity is up. And surveys indicate that consumer spending is up. GDP growth in the fourth quarter looks to be in the 3%-plus range.

All reasons to be bullish, if you are looking for a reason to be bullish. If you don’t examine the underlying data, you can feel good. The problem is that when we look deeper into the data than just the headlines, there are concerns.

For instance, take the contention that consumer spending is rising. I called Philippa Dunne at The Liscio Report. They survey the various states about taxes, among other things. “Sales taxes are not up and the current survey we are doing is pretty bad.” She used the word “horrified” when commenting on some of the respondees’ replies at the various state tax offices. Further, today we find that credit card lending dropped $17 billion last month, the largest drop in history. And this was during Christmas!

Savings are up. Credit is down. Where did the rise in consumer spending come from? Remember, these are mostly surveys and/or comparisons with a disastrous 2008. And they compare same-store sales for chains like Best Buy, which no longer competes with the bankrupt Circuit City, or for chains that closed stores, forcing buyers to the remaining stores. The key to watch is sales taxes. When they are rising, consumer spending is rising.

Consumer confidence is rising, but from truly awful levels. The levels are still well below any level in previous recessions and certainly do not indicate a robust economic rebound.

A challenged consumer confidence survey is not surprising, given the fact that roughly 8% of the working population is getting some form of unemployment assisance. One in eight children in this country is living on food stamps. By the way, the total number of people on unemployment is about 300,000 worse than most media accounts report. The Extended (and Emergency) unemployment claims for those out of work more than 26 weeks are not seasonally adjusted. To get the total number of people on unemployment insurance of all kinds, you have to add the non-seasonally adjusted number of continuing claims, which is currently about 300,000 higher than the seasonal adjustment. Here is a chart from Philippa, at www.theliscioreport.com.

She explained, “For the week ended 12/19, 10.42 million Americans were receiving unemployment benefits, With 5.44 million Extended claims (week ended 12/19) and 4.98 million Continuing claims.

“But NSA jobless claims show a far different story. The advance number of actual initial claims under state programs, unadjusted, totaled 645,571 in the week ending Jan. 2, an increase of 88,000 from the previous week. There were 731,958 Initial claims in the comparable week in 2009… The advance unadjusted number for persons claiming UI benefits in state programs totaled 5,479,110, an increase of 388,729 from the preceding week. A year earlier, the rate was 4.0 percent and the volume was 5,317,388.

“So the actual, the real benefits paid (Initial, Continuing, and EUC claims) hit another record of 11.268 million.” (source: The Big Picture)

Today’s employment report was just terrible. The headline said we lost 85,000 jobs. That is from the establishment survey, where they call up larger businesses and ask them about their employment. They also do a household survey, where they survey about 400,000 households. That report reveals a much worse situation.

Last month, single women who are heads of households saw their unemployment ranks rise by a massive 127,000. The number of employed men fell by 214,000. The total number of unemployed in the survey rose by an enormous 589,000. Those classified as not in the work force (due to the fact that they did not look for jobs) rose by 843,000! That now means that in 2009 3.5 million people were dropped from the potential labor force count because they were discouraged.

If you add those to the 15.3 million who are unemployed, you get a much higher unemployment number than 10%. Getting that exact number is tricky, because if you are back in school (as some of my friends are) you are not looking for a job but are going to want one soon. And if the economy does rebound and jobs start to become available, then it is likely a large number of the discouraged 3.5 million will start looking for jobs and therefore be listed in the work force. Ironically, a recovering economy could see the unemployment number rise. During the recovery, it will be important to look at the total number of employed and not just at the unemployment rate.

Sidebar: As noted above, a large number of people were dropped from the official labor force. What that means is that even though the number of employed people fell, the unemployment rate did not. It will be interesting to see if a lot of those people just decided that December was not a good time to be looking, spent time with families, or decided it was too cold to get out. How many will start looking as we get into the new year? We could see a rise in the unemployment rate next month if a large number do look for work.

Look at the chart below from my friend Greg Weldon. (It just hit my inbox.) It shows the percentage of people who are participating in the work force. ( www.weldononline.com) It is sadly dropping, which means that incomes to families are dropping. The number of people I know who are looking for work or are struggling increases each week. It truly saddens me.

The Statistical Recovery

So why, if the employment picture looks so bad, are we getting positive GDP numbers? I coined the term “Statistical Recovery” last summer to describe an economy where the statistics are positive but it certainly doesn’t “feel” like a recovery. So, how is it that we see a rise in the statistics?

First, year-over-year comparisons are looking better, since 2008 was horrific. Second, inventory levels are about as low as they will go. In the way GDP is figured, a reduction in inventory reduces GDP. That was a negative figure for most of this recession. Simply because inventories not falling any more, it is easier to get a positive GDP.

Second, as I have written, there are one-time benefits for GDP from the federal stimulus. Roughly 90% of the 2.2% growth in GDP in the third quarter was attributable to the stimulus, and we will see a similar affect in the 4th-quarter numbers and at least through the first half of next year.

A reduction in imports is also a positive for GDP. Ee are buying less “stuff” from abroad, so that helps statistically.

Martin Feldstein, one of the great economists of our time, was quoted last week as saying that the recession is not over. Indeed, it you look at past recessions, it is not all that unusual (8 out of 11 times) for there to be positive GDP quarters in the midst of an ongoing recession.

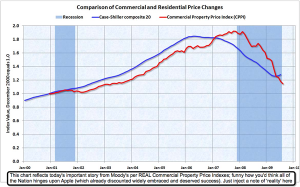

The Great Experiment

So this is the backdrop as we look into the future. Unemployment is rising and is likely to remain stubbornly high (over 10%) for some time, except for the few months this coming summer when the Labor Department will hire hundreds of thousands of temporary census workers. The savings rate is rising, and consumer spending is at the very least challenged. The stimulus starts to drop sharply in the latter half of the year. States, counties, and cities are short about $260 billion and will either have to cut services (and thus jobs) or increase taxes. Housing is likely to get weaker, as there are large numbers of defaults coming because of mortgage-rate resets this year and next (more on that in a few weeks). Valuations on stocks are in the high range, and do not portend well for long-term returns.

Further – and this is the most important item to me – Congress is likely to allow the Bush tax cuts to expire and to add insult to injury with some form of large tax increase for heath care. Between the local, state, and federal tax increases, we could see a massive increase in taxes of perhaps $500 billion in a $13-trillion economy, or about 4% of GDP.

Think about that for a moment. It is likely we will begin 2011 with close to 10% unemployment, if not higher. Christina Romer’s work shows that tax cuts have a three-times benefit to GDP. Tax increases presumably have a similar negative effect. (Ms. Romer, by the way, is President Obama’s Chairwoman of the Council of Economic Advisors. This is not a partisan idea.)

This is the great experiment to which we are going to be subjected. There are those who agree with Art Laffer and company that tax cuts are a positive for the economy (that would include your humble analyst). And there are those who contend that the economy did just fine in the Clinton years before the Bush tax cuts and that we will do just as well if we take them away. And further, taxing the rich a little more is not really going to change their behavior.

My contention is that if such a tax increase is enacted all at once, the economy will at a minimum dip back into a nasty recession. If I am wrong, then I will have to abandon one of my long-cherished beliefs. I will have to stop arguing that tax cuts are as important as I think. Right now, when I read the data and studies, they confirm my tax-cutting bias. But I have to be willing to change my mind if The Great Experiment proves me wrong.

But if you think unemployment is high now, you will really not like what happens if we dip back into recession. It could go a lot higher. They are truly risking a great deal if they decide to pursue this experiment.

Thus, I am faced with a great deal of uncertainty as I look into the future with my forecasts – and we will get into the bulk of the actual forecasts next week. I almost titled this letter “The Year of Waiting,” because there are so many important developments we are waiting on. Will they actually raise taxes in such a soft economy, or will cooler heads prevail and the increases be postponed, or at least phased in over 4-5 years? What will the health-care bill look like? There are so many things that could significantly change any predictions.

As I have written for years, the stock market drops an average of over 40% during a recession. If we go into a recession in 2011, it is highly unlikely that there will be an exception to the bear market rule. But this market seemingly wants to go higher. Smart people like my partner Steve Blumenthal argue with me that the technicals say we could go a lot higher in the short term. And he may very well be (and probably is) right.

This is a trader’s market. It is not time to buy and hold large indexes or high-beta stocks and expect to be made whole over the next ten years. Hope is not a strategy. But waiting for the “shoe to drop” is frustrating, I know. However, that is the situation we find ourselves in.

We will go into this next week, but the current environment is quite different than 1982, when the last bull market started. Rates were falling; they are now likely to rise over time. Taxes were going down. Valuations were at historical lows, not high and rising. Inflation was coming down. And on and on. The current environment is not one in which bull markets are born.

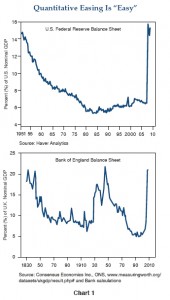

Whither the Fed?

The futures market is pricing in rate hikes from the Fed beginning this fall. I highly doubt a politicized Fed will hike rates with unemployment over 10%, ahead of a November election. We are going to have a very easy monetary policy for longer than most observers think.

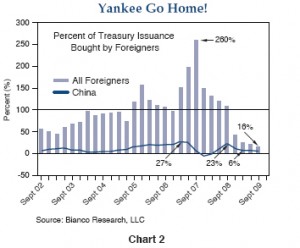

The Fed has painted itself into a very tough corner. Raising rates in a high-unemployment environment is risky. Bernanke knows what happened in 1937 and does not want a repeat. But by keeping rates too low for too long, they risk an asset bubble or two. And the federal fiscal deficit of over $1.5 trillion is not making their situation any easier.

The Fed has announced it is ending many of their various and sundry programs in the first quarter. They have essentially been the mortgage market. What will happen to rates? I think that is one of the reasons why Geithner has essentially lifted any limit on explicit guarantees for Fannie and Freddie. It will be seen as higher-paying government debt. It will also cost you, Mr. and Ms. Taxpayer, hundreds of billions in increased deficits, as they are telling those entities to eat the losses from large numbers of loan modifications. This is outrageous on so many levels. Congress should at least have to approve this.

It’s getting close to my eight pages, so let me end by saying that, as we face the next crisis – and we will (there is always another crisis) – we will find we have not fixed the causes of the last one. We still have banks too big to fail, we have not put the credit default swaps on an exchange, we have not reinstated Glass-Steagall, Barney Frank’s bill (which was not the one that came out of committee) now makes it exceedingly more difficult to short stocks, we keep in power the same people who missed the problems the last time, and the list of bad policies bought (typo intended) to you by bank lobbyists grows ever longer. If the current bill looks like it was written by the bank lobby, that’s because it was. But it means we will have to face the same problems all over again. But that is another story for another day. Next week we look at the dollar and other currencies, gold, commodities, bonds, emerging markets, and more.

John Mauldin

Copyright 2010 John Mauldin. All Rights Reserved:Â Â Â You have permission to publish this article electronically or in print as long as the following is included:

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

![[bankrupt]](http://s.wsj.net/public/resources/images/NA-BD183_BANKRU_NS_20100104195953.gif)

![[ye_marketboxsco]](http://s.wsj.net/public/resources/images/OB-FE728_ye_mar_E_20100103221251.jpg)

![[Homeward Bound]](http://s.wsj.net/public/resources/images/SJ-AE036B_03LED_NS_20091231181223.gif)