Posted By thestatedtruth.com on December 5, 2010

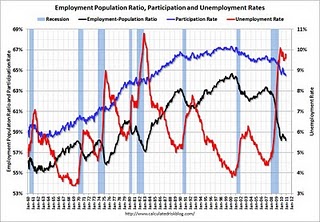

Here are a couple of zinggers…..Ben Bernanke: Economic recovery is very close to not being self-sustaining…..Anyone surprised on this one? …….and……We’re looking at ten, 15, 20 years from now, a situation where almost the entire federal budget will be spent on Medicare, Medicaid, Social Security, and interest on the debt. There won’t be any money left for the military or for any other services the government provides. We can only address those issues if we think about them now.  And more…..Q: The gap between rich and poor in this country has never been greater. In fact, we have the biggest income disparity gap of any industrialized country in the world. And I wonder where you think that’s taking America.   A: Well, it’s a very bad development. It’s creating two societies. And it’s based very much, I think, on– on educational differences The unemployment rate we’ve been talking about. If you’re a college graduate, unemployment is five percent. If you’re a high school graduate, it’s ten percent or more. It’s a very big difference. It leads to an unequal society and a society– which doesn’t have the cohesion that– that we’d like to see.

Â

Excerpts from the interview with Ben Bernanke on 60 Minutes (via the WSJ):

Federal Reserve Chairman Ben Bernanke appeared Sunday evening on CBS’s “60 Minutes†to discuss the state of the economy, the central bank’s controversial $600 billion bond-buying plan and the financial crisis. Following are excerpts from the interview with CBS’s Scott Pelley, as released by the network:

Q: The major banks are racking up profits in the billions. Wall Street bonuses are climbing back up to where they were. And yet, lending to small businesses actually declined in the third quarter. Why is that?

A: A lot of small businesses are not seeking credit, because, you know, because their business is not doing well, because the economy is slow. Others are not qualifying for credit, maybe because the value of their property has gone down. But some also can’t meet the terms and conditions that banks are setting.

Q: Is this a case of banks that were eager to take risks that ruin the economy being now unwilling to take risks to support the recovery?

A: We want them to take risks, but not excessive risks. we want to go for a happy medium. And I think banks are back in the business of lending. But they have not yet come back to the level of confidence that –or overconfidence –that they had prior to the crisis. We want to have an appropriate balance.

Q: What did you see that caused you to pull the trigger on the $600 billion, at this point?

A: It has to do with two aspects. the first is unemployment The other concern I should mention is that inflation is very, very low, which you think is a good thing and normally is a good thing. But we’re getting awfully close to the range where prices would actually start falling.

Q: Falling prices lead to falling wages. It lets the steam out of the economy. And you start spiraling downward. … How great a danger is that now?

A: I would say, at this point, because the Fed is acting, I would say the risk is pretty low. But if the Fed did not act, then given how much inflation has come down since the beginning of the recession, I think it would be a more serious concern.

Q: Some people think the $600 billion is a terrible idea.

A: Well. I know some people think that but what they are doing is they’re looking at some of the risks and uncertainties with doing this policy action but what I think they’re not doing is looking at the risk of not acting.

Q: Many people believe that could be highly inflationary. That it’s a dangerous thing to try

A: Well, this fear of inflation, I think is way overstated. we’ve looked at it very, very carefully. We’ve analyzed it every which way. One myth that’s out there is that what we’re doing is printing money. We’re not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way. What we’re doing is lowering interest rates by buying treasury securities. And by lowering interest rates, we hope to stimulate the economy to grow faster. So, the trick is to find the appropriate moment when to begin to unwind this policy. And that’s what we’re going to do.

Q: Is keeping inflation in check less of a priority for the Federal Reserve now?

A: No, absolutely not. What we’re trying to do is achieve a balance. We’ve been very, very clear that we will not allow inflation to rise above two percent or less.

Q: Can you act quickly enough to prevent inflation from getting out of control?

A: We could raise interest rates in 15 minutes if we have to. So, there really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation, at the appropriate time. Now, that time is not now.

Q: You have what degree of confidence in your ability to control this?

A: One hundred percent.

Q: Do you anticipate a scenario in which you would commit to more than 600 billion?

A: Oh, it’s certainly possible. And again, it depends on the efficacy of the program. It depends, on inflation. And finally it depends on how the economy looks.

Q: How would you rate the likelihood of dipping into recession again?

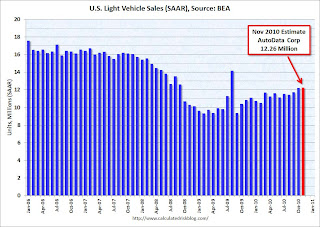

A: It doesn’t seem likely that we’ll have a double dip recession. And that’s because, among other things, some of the most cyclical parts of the economy, like housing, for example, are already very weak. And they can’t get much weaker. And so another decline is relatively unlikely. Now, that being said, I think a very high unemployment rate for a protracted period of time, which makes consumers, households less confident, more worried about the future, I think that’s the primary source of risk that we might have another slowdown in the economy.

Q: You seem to be saying that the recovery that we’re experiencing now is not self-sustaining.

A: It may not be. It’s very close to the border. — it takes about two and a half percent growth just to keep unemployment stable. And that’s about what we’re getting. We’re not very far from the level where the economy is not self-sustaining.

Q: [On calls to cut the deficit]

A: We need to play close attention to the fact that we are recovering now. We don’t want to take actions this year that will affect this year’s spending and this year’s taxes in a way that will hurt the recovery. That’s important. But that doesn’t stop us from thinking now about the long term structural budget deficit. We’re looking at ten, 15, 20 years from now, a situation where almost the entire federal budget will be spent on Medicare, Medicaid, Social Security, and interest on the debt. There won’t be any money left for the military or for any other services the government provides. We can only address those issues if we think about them now.

Q: How concerned are you about the calls that you’re beginning to hear on Capitol Hill that would curb the Fed’s independence?

A: Well, the Fed’s independence is critical. The central bank needs to be able to make policy without short term political concerns. In order to do what’s best for the economy. We do all of our analysis, we do all of our policy decisions based on what we think the economy needs. Not based on when the election is or what political conditions are.

Q: Is there anything that you wish you’d done differently over these last two and a half years or so?

A: Well, I wish I’d been omniscient and seen the crisis coming, the way you asked me about, I didn’t, But it was a very, very difficult situation. And– the Federal Reserve responded very aggressively, very proactively

Q: How did the Fed miss the looming financial crisis?

A: there were large portions of the financial system that were not adequately covered by the regulatory oversight. So, for example, AIG was not overseen by the Fed. … The insurance company that required the bailout, was not overseen by the Fed. It didn’t really have any real oversight at that time. Neither did Lehman Brothers the company that failed Now, I’m not saying the Fed should not have seen some of these things. One of things that I most regret is that we weren’t strong enough in in putting in consumer protections to try to cut down on the subprime lending problem. That was an area where I think we could have done more.

Q: The gap between rich and poor in this country has never been greater. In fact, we have the biggest income disparity gap of any industrialized country in the world. And I wonder where you think that’s taking America.

A: Well, it’s a very bad development. It’s creating two societies. And it’s based very much, I think, on– on educational differences The unemployment rate we’ve been talking about. If you’re a college graduate, unemployment is five percent. If you’re a high school graduate, it’s ten percent or more. It’s a very big difference. It leads to an unequal society and a society– which doesn’t have the cohesion that– that we’d like to see.

Q: We have talked about how the next several years are going be tough years in this country. But I wonder what you think about the ten year time horizon. Fifteen years. How do things look to you long term?

A: Long term, I have a lot of confidence in the United States. We have an excellent record in terms of innovation. We have great universities that are involved in technological change and progress. We have an entrepreneurial culture, much more than almost any other country. So, I think that in the longer term the United States will retain its leading position in the world. But again, we gotta get there. And we have some very difficult challenges over the next few years.

www.zerohedge.com

Links:

[1] http://blogs.wsj.com/economics/2010/12/05/bernanke-on-cbss-60-minutes/

Category: Commentary, Economy, Finance, Interest Rates, Bonds, National News, Wall Street, World News |

No Comments »

Tags: