Senate Blocks Middle Class Tax Cut Extension

Posted By thestatedtruth.com on December 4, 2010

As expected the Senate votes No on tax deal…..around and around we go, where we stop nobody knows! Democrats are demanding a one-year renewal of jobless benefits for hundreds of thousands of Americans or no deal on tax cuts. The benefits begin to expire this week.  But….Obama’s top economic advisers are in talks with key lawmakers on a potential deal that could renew all the lower rates, including those for the wealthiest, for one to three years, according to congressional aides.

From Reuters:

The two Democratic plans to renew low tax rates for individual income up to $200,000 and up to $1 million both failed in procedural votes, as Republicans argued that low tax rates for the wealthiest should also be extended.

No Republicans backed the Democratic proposals, and a few Democrats voted against them.

President Barack Obama expressed disappointment on Saturday and said negotiators needed to “redouble” their efforts in the next few days to reach an agreement on the tax cuts. He said doing so “will require some compromise.”

The rare Saturday votes were expected to fail, but Democrats wanted to show that they didn’t support an extension of the lower rates for higher-income individuals.

“It’s not that we want to punish wealthy people,” said Democratic Senator Charles Schumer, who had proposed extending the tax rates for those earning up to $1 million. “But they are doing fine and they are not going to spend the money and stimulate the economy.”

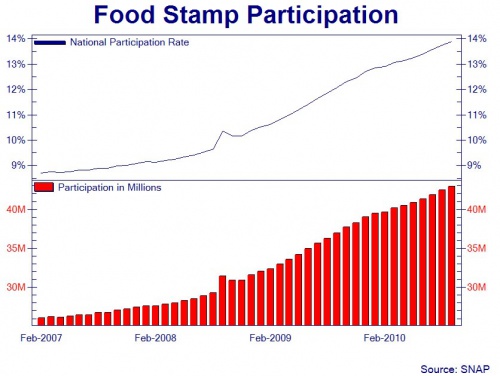

Food Stamp Participant Level Hits All Time Record High

Posted By thestatedtruth.com on December 3, 2010

The Supplemental Nutrition Assistance Program (SNAP) data is out and the number of poor Americans has set a new high – SNAP recipients just hit 42.9 million participants.

New Golf “Entitlement” Rules In Effect

Posted By thestatedtruth.com on December 3, 2010

The Government has recently appointed a new Golf Czar and major rule changes in the game of golf will become effective as of December 10, 2010.  This is a preview, as the complete rule book (expect 2,000 pages) is being rewritten as we speak. Â

Here are a few of the changes.:

Golfers with handicaps:Â

~ below 10 will have their green fees increased by 35%.Â

~ between 11 and 18 will see no increase in green fees.Â

~ above 18 will get a $20 check each time they play.

The term “gimme” will be changed to “entitlement” and will be used as follows:

~ handicaps  below 10, no entitlements.

~ handicaps from 11 to 17, entitlements for putter length putts.

~ handicaps above 18, if your ball is on green, no need to putt, just pick it up.

These entitlements are intended to bring about fairness and, most importantly, equality in scoring.

In addition, a Player will be limited to a maximum of one birdie or six pars in any given 18-hole round.

Any excess must be given to those fellow players who have not yet scored a birdie or par. Â Only after all players have received a birdie or par from the player actually making the birdie or par, can that player begin to count his pars and birdies again.

The current USGA handicap system will be used for the above purposes, but the term ‘net score’ will be available only for scoring those players with handicaps of 18 and above.

This is intended to ‘redistribute’ the success of winning by making sure that in every competition, the above 18 handicap players will post only ‘net score’ against every other player’s gross score. Â

These new Rules are intended to CHANGE the game of golf.

Golf must be about Fairness.  It should have nothing to do with ability, hard work, practice, and responsibility.  This is the “Right thing to do”, because the Government has been told that lazy, poor, dumb asses feel that the game gives them nothing!

Thank You

Thinking the Unthinkable

Posted By thestatedtruth.com on December 3, 2010

| Thinking the Unthinkable By Bill Bonner |

| Â |

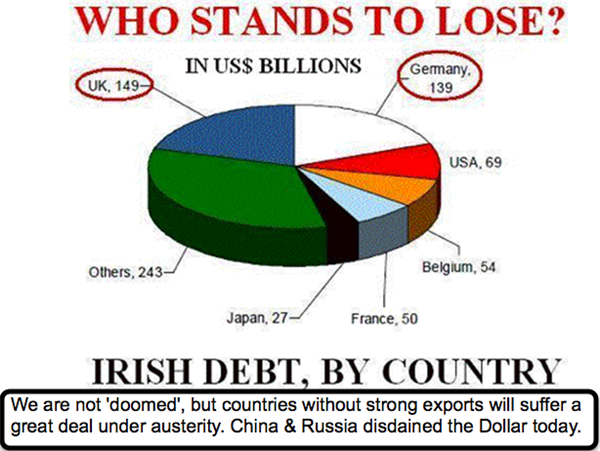

| This week, like the last one, was dominated by euro babel. Speaking in their various tongues, all at once, Europeans were talking nonsense. Especially Jose-Ignacio Torreblanca. The senior fellow at the European Council of Foreign Relations begins: “in an ideal world,” he says it is “fair and rational” for people to get what they’ve got coming… referring to the people who lent money to Irish banks. He even quotes the old Latin maxim: fiat iustitia, pereat mundus (follow the rules, even if the world should perish).He should have stopped there. Instead, he misses the point he has just made. This time it’s different, he says. Why? Because “there is a good chance that in real life the eurozone could be killed…”When the financial crisis hit in ’08, Europe might have let the chips fall where they may. But for nearly a century, elected officials have thought they could keep the chips from falling at all. Instead of merely consuming and redistributing the fruits of the economy; they pretended, by enlightened management, to increase them. Few people noticed the audacity of it. But in a downturn, government no longer lets wealth perish. It counteracts corrections with “stimulus.” And it doesn’t merely provide a stable currency, it manages a “flexible” currency system to help guarantee full employment and prevent debt crises.By the 21st century, diddling the economy has become second nature…but much less effective. In the US, the fiscal and monetary stimulus of the early ’30s – equal to about 8% of GDP – had a powerful effect. One year later the US economy was growing at an 11% rate. Nearly four score years later, a combined stimulus effort of about 30% of GDP produced a response of barely 2% GDP growth. As for last week’s 85 billion euro Irish bailout, the market rally was over by tea time the following day.The trouble with trying to get the outcome you want is that you end up getting the outcome you deserve anyway. Ireland guaranteed bank assets nearly 6 times greater than the nation’s GDP. Now, with unemployment at 20% and GDP down nearly 15% over the last two years, investors wonder how Ireland can possibly be good for the money. And they are beginning to wonder about Spain, Portugal, Italy and even France. Between them, French and German banks hold nearly a trillion euros worth of peripheral European nations’ debt. How long will it be before they go down too? The Irish bailout may cost about 100 billion euros. Spain is ten times as big.

These were “unthinkable” thoughts, said former Italian Prime Minister, Romano Prodi.The periphery states benefited from the low interest rates of the Eurozone. With lending rates at 3%, instead of the 10% rate it had before it took up the euro, Irish property boomed. Irish banks were able to lend their way to insolvency. When the bust came, potential losses became real losses. But insolvent institutions do not become more solvent by borrowing more money. By the time the fix for Ireland is fully implemented, the Irish government will be deeper in debt – with a quarter of its GDP needed for debt service. At that level, they will be sunk. And you can forget about “growing” out of this debt problem. This year, for the first time ever, more Europeans will retire than join the workforce. Retirees are not producers of tax revenues. They are consumers of it. Besides, how will the Irish economy grow at all, with the government cutting back by 10% of GDP over the next 4 years, probably followed by another 10% cut when this one proves insufficient? But that’s what happens. One manipulation leads to another improvisation. You pretend it’s a matter of principle, but you’ve already thrown out the “iustitia.” You’re just trying to get what you want, making it up as you go along. The euro is a managed paper currency, like the dollar. Still, it is not managed enough for many Europeans. The Irish might revolt, leave the euro, and bring back the punt. In the old days of drachma and pesetas, Europe’s sunny countries could scam their lenders with shady currencies. There is even a proposal to introduce a new currency, known either as the “medi” or the “sudo” – designed to help Europe’s periphery states to manage their way out of their financial obligations. A weaker currency would lower the real value of debts, employment contracts, pensions and just about everything else. “There will be no haircut on senior debt,” said Olli Rehn, the EU’s commissioner for economic and monetary affairs, still trying to keep the chips in the air. And why not? Because the consequences are unthinkable? No, he’s thought about them. He just doesn’t like them. But who cares? You can’t really manage an economy. You have to let it happen. Here we offer some constructive criticism: Stop worrying. What will happen if lenders suffer the losses they deserve? We don’t know. But we’d like to find out. Regards, Bill Bonner, |

90% Of Spains Air Traffic Controllers “Call In Sick” In Protest Over Austerity

Posted By thestatedtruth.com on December 3, 2010

So inquiring minds want to know…. what happens when the ‘Spanish Flu’ strain hits the United States!

Update from the AP:Â Â Â Spain orders its air traffic controllers to resume work or military will take over control of airspace. That’s some serious flu going around.

If you are reading this from an airplane, we can only hope your final destination is not Spain. Sky News has just broken news that virtually all Spanish air traffic is shut down after 90% of air traffic controllers have decided not to work due to sudden “illness” but thought to be mostly in protest of austerity.

China….Some Anomalies To Look At On A Closer Basis

Posted By thestatedtruth.com on December 3, 2010

Some interesting thoughts out of China………….

From Corriente Advisors. The anomalies in China are some what familiar:

- Excess floor space exceeds 3.3 billion square meters and there are still 200 m being built this year….

- The price to rent ratio is 39.4 times versus 22.8 times in America before the housing crises….

- Banks are hiding their exposure in Local Investment Vehicles…

- On a Sovereign level, China’s debt to GDP comes out at 107%, five times published numbers …

- China has consumed just 65% of the cement it has produced in the last six years….

- There are 200 m tons of excess steel capacity, more than the EU and Japan’s total production this year….

Live Chat With WikiLeaks Julian Assange Crashes Guardian Website

Posted By thestatedtruth.com on December 3, 2010

The Guardian, which earlier was conducting a live chat with Julian Assange from an undisclosed location, has generated such massive internet traffic that the entire Guardian website (which is the 16th top ranked site in Britain on a regular day getting tens of millions of hits) was knocked out. Looks to be back up now. Â

Full transcript from the Guardian……

WikiLeaks Domain Provider Drops Them Again…Vagabond, Now In Switzerland

Posted By thestatedtruth.com on December 3, 2010

WikiLeaks…. EveryDNS says it dropped the website after it became the “target of multiple distributed denial of service attacks.”  Â

WikiLeaks.org was forced to move its domain name to Switzerland after its U.S. service was withdrawn, may now be banned from French servers. It is “not acceptable†for servers in France to host the site, French Industry Minister Eric Besson said in a letter to the CGIET technology agency. The minister asked for measures to bar WikiLeaks from France, where it is partially hosted by Roubaix, France-based OVH SAS.

As we have said earlier, Game Over…..Julian Assange looks like a hot potato everywhere he goes! Rule number 1, don’t challenge, embarrass or attack the U.S. Government or any other government for that matter and think there won’t be serious repercussions to pay (nations will protect themselves and their national interests) , case in point is Panama’s strong man some years ago (1989), a guy named Manuel Noriega. Sounds like every country mentioned in WikiLeaks has the motivation to hack WikiLeaks website.Â

The United States has an extensive network of new world technology a lot of which is directed towards the involvement and protection of the internet. Some of this is done under the direction of The Defense Advanced Research Projects Agency (DARPA) which is an agency of the United States Department of Defense. They are involved (amoung other things) in the development of new technologies for use by the military including computer networking, as well as NLS and Internet technologies. In a chess match, we pick DARPA’s (computer geniuses) as the favorite to deny service by attacks (if so desired) over WikiLeaks internet based technologies ability to defend these attacks! Â

Bush Adviser Slams WikiLeaks

Former U.S. National Security Adviser Stephen Hadley lashed out at Wikileaks for damaging U.S. diplomacy with its recent document dump.

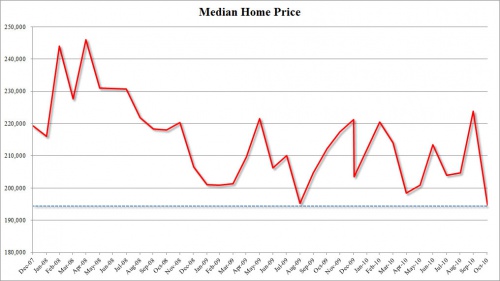

Was The Housing Pending Sales Number Really That Good?

Posted By thestatedtruth.com on December 2, 2010

Let’s dig a little deeper on this subject…..Here’s what Bloomberg had to say about this morning’s reported jump in pending home sales (signed sales agreements).

Pending sales of U.S. existing houses unexpectedly jumped by a record 10 percent in October, indicating the industry at the center of the last recession is stabilizing as the job market improves. Or maybe not!

The Wall Street Examiner breaks down these numbers and explains why.

Let’s focus on the actual, not seasonally adjusted number. In my housing updates in the Wall Street Examiner Professional Edition I convert the Realtors’ Pending Home Sales number to an actual number equating the index to the existing home sales number for the month that will be released late in the month. This number rose by 35,500 units or 9.2% m/m. Sounds good, right? Not so much when considering that September’s level of 385,500 is the worst September level in the past 15 years, including being the worst September since the housing collapse began in 2006-07.

Where does that leave the October number? At 421,000, it is the worst October since the housing collapse started, and the worst October level in the past 15 years. How is that recovery? To me, it looks like a dead cat bounce from an atrocious level in September, a simple reversion to trend, and a weak trend at that.

What about seasonality? Arbitrary seasonal adjustment factors produce a specific but entirely fictional number that almost always results in a false impression that conditions are better or worse than they actually are. Still, seasonality must be considered. The best way to do that is to compare the current month with the behavior of a representative sample of recent years.

As it turns out, October is typically an up month. This year’s gain of 35,500 compares with a gain of 29,000 last year. There was a gain of 40,500 in 2007 when the overall market collapse was in its infancy but the pundits were declaring their first of many false bottoms, and a gain of 77,000 at the tail end of the bubble in 2006. October 2008, at the nadir of the first wave of the housing crash, only saw a drop of 7,000. In the overall scheme of things, this year’s bounce from catastrophically low levels looks like nothing more than reversion to trend from weaker than trend.

Read more: http://www.businessinsider.com/pending-homes-sales-jump-joke-2010-12#ixzz171QIm6l9

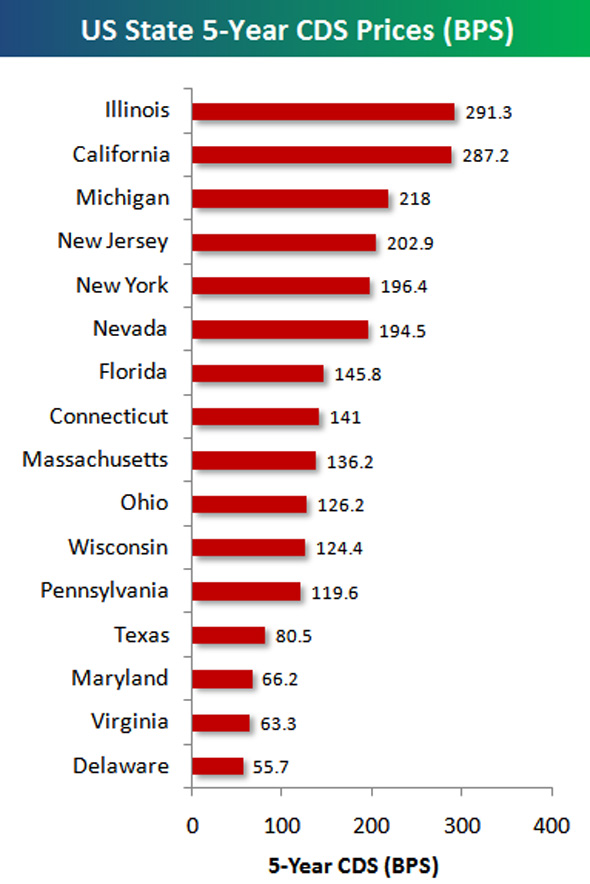

The 12 American States With Highest Borrowing Risk

Posted By thestatedtruth.com on December 2, 2010

A holder of a bond may “buy protection†to hedge its risk of default. In its simplest form, a credit default swap is a bilateral contract between the buyer and seller of protection. The CDS will refer to a “reference entity” or “reference obligor”, usually a corporation or government. The reference entity is not a party to the contract. The protection buyer makes quarterly premium payments the “spread” to the protection seller. If the reference entity defaults, the protection seller pays the buyer the par value of the bond in exchange for physical delivery of the bond. Â

A default is referred to as a “credit event” and include such events as failure to pay, restructuring and bankruptcy.

This chart from Bespoke Investment Group points out just where your state is in terms of the cost to insure its debt. The higher the cost, the more likely it defaults, or so the market would indicate.

Illinois has seen the largest surge in 2010, with its CDS price rising by 97%, according to Bespoke.

From Bespoke Investment Group:

Image: Bespoke Investment Group

Image: Bespoke Investment Group

Read more: http://www.businessinsider.com/state-cds-prices-2010-12#ixzz1703TQcrm

House Approves Tax Cuts For The Middle Class Earning Less Than $250,000

Posted By thestatedtruth.com on December 2, 2010

We’ll have to see how this plays out in the U.S. Senate over the next few days and weeks. But as everybody knows, time is running out for 2010.Â

WASHINGTON…..The U.S. House of Representatives approved legislation to make permanent tax cuts only for households earning less than $250,000 in a symbolic vote aimed at the Democratics as the expiration of the Bush tax cuts gets closer by the day.

The vote was 234-188, with 20 Democrats joining Republicans in opposition to the bill.

Democrats don’t have the votes in the Senate to pass a bill that extends only the middle-class cuts. Republicans and centrists such as Sen. Joe Lieberman (I., Conn.) insist that all the tax cuts be extended, including those for the wealthy.

Negotiations with Obama administration officials will continue to try and reach a bipartisan deal. The most likely outcome, according to congressional aides, is a temporary extension of all the tax cuts. If Congress doesn’t act by Jan. 1, tax cuts in place since 2001 will expire.

ECB Extends Liquidity Measures

Posted By thestatedtruth.com on December 2, 2010

This was a no brainer……from the ECB (European Central Bank)

The ECB has abandoned its plans to wind down emergency support for banks and government debt markets.  The ECB will continue to offer unlimited liquidity to banks for as long as necessary, ECB President Jean-Claude Trichet said at a news conference in Frankfurt Thursday. It had been slated for a phase-out in early 2011.

Mr. Trichet also said that he had never set a ceiling for the size of the Securities Market Program but instead it would be “commensurate” with what is needed to stabilize the sovereign debt market.

Stratfor Security Weekly…..Attacks on Nuclear Scientists in Tehran…Dr. Majid Shahriari Killed, Was Working On Iran’s Nuclear Program

Posted By thestatedtruth.com on December 2, 2010

Attacks on Nuclear Scientists in Tehran

By Ben West

On the morning of Nov. 29, two Iranian scientists involved in Iran’s nuclear development program were attacked. One was killed, and the other was injured. According to Iranian media, the deceased, Dr. Majid Shahriari, was heading the team responsible for developing the technology to design a nuclear reactor core, and Time magazine referred to him as the highest-ranking non-appointed individual working on the project.

Official reports indicate that Shahriari was killed when assailants on motorcycles attached a “sticky bomb†to his vehicle and detonated it seconds later. However, the Time magazine report says that an explosive device concealed inside the car detonated and killed him. Shahriari’s driver and wife, both of whom were in the car at the time, were injured.

Meanwhile, on the opposite side of town, Dr. Fereidoon Abassi was injured in a sticky-bomb attack reportedly identical to the one officials said killed Shahriari. His wife was accompanying him and was also injured (some reports indicate that a driver was also in the car at the time of the attack). Abassi and his wife are said to be in stable condition. Abassi is perhaps even more closely linked to Iran’s nuclear program than Shahriari was, since he was a member of the elite Iranian Revolutionary Guard Corps and was named in a 2007 U.N. resolution that sanctioned high-ranking members of Iran’s defense and military agencies believed to be trying to obtain nuclear weapons.

Monday’s incidents occurred at a time of uncertainty over how global powers and Iran’s neighbors will handle an Iran apparently pursuing nuclear weapons despite its claims of developing only a civilian nuclear program and asserting itself as a regional power in the Middle East. Through economic sanctions that went into effect last year, the United States, United Kingdom, France, Russia, China and Germany (known as the “P-5+1â€) have been pressuring Iran to enter negotiations over its nuclear program and outsource the most sensitive aspects the program, such as higher levels of uranium enrichment.

The Nov. 29 attacks came about a week before Saeed Jalili, Iran’s national security chief, will be leading a delegation to meet with the P-5+1 from Dec. 6-7 in Vienna, the first such meeting in more than a year. The attacks also came within hours of the WikiLeaks release of classified U.S. State Department cables, which are filled with international concerns about Iran’s controversial nuclear program.

Because of the international scrutiny and sanctions on just about any hardware required to develop a nuclear program, Iran has focused on developing domestic technologies that can fill the gaps. This has required a national initiative coordinated by the Atomic Energy Organization of Iran (AEOI) to build the country’s nuclear program from scratch, an endeavor that requires thousands of experts from various fields of the physical sciences as well as the requisite technologies.

And it was the leader of the AEOI, Ali Akhbar Salehi, who told media Nov. 29 that Shahriari was “in charge of one of the great projects†at the agency. Salehi also issued a warning to Iran’s enemies “not to play with fire.†Iranian President Mahmoud Ahmadinejad elaborated on the warning, accusing “Zionist†and “Western regimes†of being behind the coordinated attacks against Shahriari and Abassi. The desire of the U.N. Security Council (along with Israel and Germany) to stop Iran’s nuclear program and the apparent involvement of the targeted scientists in that program has led many Iranian officials to quickly blame the United States, United Kingdom and Israel for the attacks, since those countries have been the loudest in condemning Iran for its nuclear ambitions.

It seems that certain domestic rivals of the Iranian regime would also benefit from these attacks. Any one of numerous Iranian militant groups throughout the country may have been involved in one way or another, perhaps with the assistance of a foreign power. A look at the tactics used in the attacks could shed some light on the perpetrators.

Modus Operandi

According to official Iranian reports, Abassi was driving to work at Shahid Beheshti University in northern Tehran from his residence in southern Tehran. When the car in which he and his wife were traveling was on Artash Street, assailants on at least two motorcycles approached the vehicle and attached an improvised explosive device (IED) to the driver’s-side door. The device exploded shortly thereafter, injuring Abassi and his wife.

Images reportedly of Abassi’s vehicle show that the driver’s side door was destroyed, but the rest of the vehicle and the surrounding surfaces show very little damage. A few pockmarks can be seen on the vehicle behind Abassi’s car but little else to indicate that a bomb had gone off in the vicinity. (Earlier reports indicating that this was Shahriari’s vehicle proved erroneous.) This indicates that the IED was a shaped charge with a very specific target. Evidence of both the shaped charge and the utilization of projectiles in the device suggests that the device was put together by a competent and experienced bomb-maker.

An eyewitness account of the attack offers one explanation why the device did not kill Abassi. According to the man who was driving immediately behind Abassi’s car, the car abruptly stopped in traffic, then Abassi got out and went to the passenger side where his wife was sitting. The eyewitness said Abassi and his wife were about 2 meters from the car, on the opposite side when the IED exploded. Abassi appears to have been aware of the attack as it was under way, which apparently saved his life. The eyewitness did not mention whether he saw the motorcyclists attach the device to the car before it went off, but that could have been what tipped Abassi off. If this was the case, the bomb-maker may have done his job well in building the device but the assailants gave themselves away when they planted it.

In the fatal attack against Shahriari, he also was on his way to work at Shahid Beheshti University in northern Tehran in his vehicle with his wife, according to official reports. These reports indicate that he definitely had a driver, which would suggest that Shahriari was considered a person of importance. Their car was traveling through a parking lot in northern Tehran when assailants on at least two motorcycles approached the vehicle and attached an IED to the car. Eyewitnesses say that the IED exploded seconds later and that the motorcyclists escaped. Shahriari was presumably killed in the explosion while his wife and driver were injured.

The official account of the attack is contradicted by the Time magazine report, which cites a “Western intelligence source with knowledge of the operation†as saying that the IED that killed Shahriari detonated from inside the vehicle. Images of what appears to be Shahriari’s vehicle are much poorer quality than the images of Abassi’s vehicle, but they do appear to show damage to the windshield and other car windows. The car is still very much intact, though, and the fact that Shahriari’s driver and wife escaped with only injuries suggests that the device used against Shahriari was also a shaped charge, specifically targeting him.

Capabilities

Attacks like the two carried out against Abassi and Shahriari require a high level of tradecraft that is available only to well-trained operatives. There is much more going on below the surface in attacks like these that is not immediately obvious when reading media reports. First, the team of assailants that attacked Abassi and Shahriari had to identify their targets and confirm that the men they were attacking were indeed high-level scientists involved in Iran’s nuclear program. The fact that Abassi and Shahriari held such high positions indicates they were specifically selected as targets and not the victims of a lucky, opportunistic attack.

Second, the team had to conduct surveillance of the two scientists. The team had to positively identify their vehicles and determine their schedules and routes in order to know when and how to launch their attacks. Both attacks targeted the scientists as they traveled to work, likely a time when they were most vulnerable, an MO commonly used by assassins worldwide.

Third, someone with sufficient expertise had to build IEDs that would kill their targets. Both devices appear to have been relatively small IEDs that were aimed precisely at the scientists, which may have been an attempt to limit collateral damage (their small size may also have been due to efforts to conceal the device). Both devices seem to have been adequate to kill their intended targets, and judging by the damage to his vehicle, it appears that Abassi would have received mortal wounds had he stayed in the driver’s seat.

The deployment stage seems to be where things went wrong for the assailants, at least in the Abassi attack. It is unclear exactly what alerted him, but it appears that he was exercising some level of situational awareness and was able to determine that an attack was under way.

It is not at all surprising that someone like Abassi would have been practicing situational awareness. This is not the first time that scientists linked to Iran’s nuclear program have been attacked, and Iranian agencies linked to the nuclear program have probably issued general security guidance to their employees (especially high-ranking ones like Abassi and Shahriari). In 2007, Ardeshir Hassanpour was killed in an alleged poisoning that STRATFOR sources attributed to an Israeli operation. Again, in January 2010, Massoud Ali-Mohammadi, another Iranian scientist who taught at Tehran University, was killed in an IED attack that also targeted him as he was driving to work in the morning. While some suspected that Ali-Mohammadi may have been targeted by the Iranian regime due to his connections with the opposition, Abassi and Shahriari appear much too close to the regime to be targets of their own government (however, nothing can be ruled out in politically volatile Tehran). The similarities between the Ali-Mohammadi assassination and the attacks against Abassi and Shahriari suggest that a covert campaign to attack Iranian scientists could well be under way.

There is little doubt that the Nov. 29 attacks struck a greater blow to the development of Iran’s nuclear program than the previous two attacks. Shahriari appears to have had an integral role in the program. While he will likely be replaced and work will go on, his death could slow the program’s progress (at least temporarily) and further stoke security fears in Iran’s nuclear development community. The attacks come amid WikiLeaks revelations that Saudi King Abdullah and U.S. officials discussed assassinating Iranian leaders, accusations that the United States or Israel was behind the Stuxnet computer worm that allegedly targeted the computer systems running Iran’s nuclear program and the return home of Shahram Amiri, an Iranian scientist who alleged that the United States held him against his will earlier in the summer.

The evidence suggests that foreign powers are actively trying to probe and sabotage Iran’s nuclear program. However, doing so is not that simple. Tehran is not nearly as open a city as Dubai, where Israeli operatives are suspected of assassinating a high-level Hamas leader in January 2010. It is unlikely that the United States, Israel or any other foreign power could deploy its own team of assassins into Tehran to carry out a lengthy targeting, surveillance and attack operation without some on-the-ground help.

And there is certainly plenty of help on the ground in Iran. Kurdish militants like the Party of Free Life of Kurdistan have conducted numerous assassinations against Iranian clerics and officials in Iran’s western province of Kordestan. Sunni separatist militants in the southeast province of Sistan-Balochistan, represented by the group Jundallah, have also targeted Iranian interests in eastern Iran in recent years. Other regional militant opposition groups like Mujahideen-e Khalq, which has offered intelligence on Iran’s nuclear program to the United States, and Azeri separatists pose marginal threats to the Iranian regime. However, none of these groups has demonstrated the ability to strike such high-level officials in the heart of Tehran with such a degree of professionalism. While that is unlikely, they have the capability and a history of eliminating dissidents through assassinations. Furthermore, the spuriousness of many contradictory media reports makes the attacks suspicious.

It is unlikely that any foreign power was able to conduct this operation by itself and equally unlikely that any indigenous militant group was able to pull off an attack like this without some assistance. The combination of the two, however, could provide an explanation of how the attacks targeting Shariari and Abassi got so close to complete success.

“Attacks on Nuclear Scientists in Tehran is republished with permission of STRATFOR.”

<a href=”http://www.stratfor.com/weekly/20101201_attacks_nuclear_scientists_tehran”>Attacks on Nuclear Scientists in Tehran</a> is republished with permission of STRATFOR.

S&P Says ‘Wave Of Defaults’ Expected In 2012 As Interest Rates Rise

Posted By thestatedtruth.com on December 2, 2010

That’s why they call these types of high yield high risk bonds ,” Junk Bonds”……  High-yield, or junk, debt is rated below BBB- by S&P and an equivalent Baa3 by Moody’s Investors Service.

So the governments of the world take interest rates down to current ultra low levels and leave them there for a prolonged period, forcing investors to take more risk for yield, then when rates rise, the roof falls in as the bonds crash in value. These loses could be horrific for people dependent on yield for income. If this happens, the cost to governments because of higher interest rate expenses will also be huge, and what ever austerity measures we are seeing now will pale in comparison to 2012’s forced austerity.

Higher interest rates and refinancing risks will likely prompt a “second wave of defaults†in Europe in 2012 and 2013, particularly among leveraged buyouts, according to Standard & Poor’s.

The 12-month European default rate may rise to as high as 7.5 percent in 2012 from an expected 4 percent by the end of this year, S&P analysts led by Paul Watters in London said in a report. The rate reached a peak of 14.8 percent at the end of the third quarter of 2009.

The default rate could rise “materially†as a high proportion of loans in the high-yield B- and CCC categories remain vulnerable due to excessive leverage, the analysts wrote. A substantial number of weaker junk companies with 229 billion euros ($302 billion) of leveraged loans due by December 2015 could face difficulties refinancing, according to the report.

“A combination of overleveraged balance sheets and higher spread margins against a rising interest-rate environment will likely result in more restructurings as shareholders’ attention moves to creating value on new transactions,†the analysts wrote. “We therefore see a high likelihood of a second wave of defaults, mainly among leveraged buyouts.â€

Distressed Homes In U.S. Sell At 32%-41% Discount

Posted By thestatedtruth.com on December 2, 2010

The other shoe is dropping in real estate. The banks have a lot of inventory to sell, so this will take a while!Â

Sales of existing homes, which make up more than 90 percent of the market, declined more than forecast in October amid the foreclosure moratoriums and the absence of the tax credit of as much as $8,000, the National Association of Realtors reported Nov. 23. Purchases fell back in July to the slowest pace in a decade’s worth of record-keeping but have picked up since. The index of pending home resales jumped 10 percent in October after dropping 1.8 percent in September, the National Association of Realtors said today in Washington.

U.S. homes in the foreclosure process sold for about 32 percent less than non-distressed properties in the third quarter, the biggest discount in five years, and bank-owned real estate sold at an average 41 percent discount in the third quarter as buyer demand slumped, according to RealtyTrac Inc.

The average discount for bank-owned real estate, residences in default or those scheduled for auction rose from 29 percent a year earlier, RealtyTrac said in a report today. A quarter of all U.S. transactions involved those types of homes, according to the Irvine, California-based data seller.

Sales of foreclosure properties plunged 31 percent as the end of a buyer tax credit reduced purchases overall, RealtyTrac said. The decline came before loan servicers including Bank of America Corp. and JPMorgan Chase & Co. halted some home seizures amid claims that employees processed thousands of documents without verifying them.

Lenders are now more willing to negotiate lower prices for foreclosures, said Chmielewski, who said he sells 25 to 30 homes during a typical month. “We’re finding there’s more flexibility by banks,†he said in a telephone interview. “Offers that wouldn’t have been accepted a couple of years ago are now.â€

Fannie Mae began offering incentives on its seized homes in September, including giving as much as 3.5 percent of the sales price for closing fees. Brokers representing buyers of Fannie Mae’s foreclosed homes also stood to receive a $1,500 bonus for closing a sale, according to a Sept. 23 announcement.

Bank-owned real estate sold at an average 41 percent discount in the third quarter, up from 35 percent a year earlier, RealtyTrac said. Discounts for homes in default or scheduled for auction averaged 19 percent, compared with 18 percent a year earlier. Most of those properties were short sales, in which a lender accepts less than the balance on a mortgage, said Daren Blomquist a RealtyTrac spokesman.

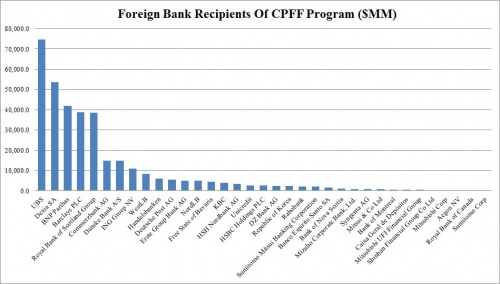

How The U.S. Fed Saved The World Banking System…The 35 Foreign Banks Bailed Out Are Listed Below

Posted By thestatedtruth.com on December 1, 2010

No wonder the fed didn’t want this material released………Geez, they really did save the World financial system between October 27, 2008 and August 6, 2009!

One may be forgiven to believe that via its FX liquidity swap lines the Fed only bailed out foreign Central Banks, which in turn took the money and funded their own banks. It turns out that is only half the story: we now know the Fed also acted in a secondary bail out capacity, providing over $350 billion in short term funding exclusively to 35 foreign banks, of which the biggest beneficiaries were UBS, Dexia and BNP.

The 35 companies in question:

UBS

Dexia SA

BNP Paribas

Barclays PLC

Royal Bank of Scotland Group

Commerzbank AG

Danske Bank A/S

ING Groep NV

WestLB

Handelsbanken

Deutsche Post AG

Erste Group Bank AG

NordLB

Free State of Bavaria

KBC

HSH Nordbank AG

Unicredit

HSBC Holdings PLC

DZ Bank AG

Republic of Korea

Rabobank

Sumitomo Mitsui Banking Corporation

Banco Espirito Santo SA

Bank of Nova Scotia

Mizuho Corporate Bank, Ltd.

Syngenta AG

Mitsui & Co Ltd

Bank of Montreal

Caixa Geral de Depósitos

Mitsubishi UFJ Financial Group

Shinhan Financial Group Co Ltd

Mitsubishi Corp

Aegon NV

Royal Bank of Canada

Sumitomo Corp

Cyber Warfare……From The Latest Issue Of Foreign Affairs

Posted By thestatedtruth.com on December 1, 2010

This excerpt from Art Cashin on the floor of The New York Stock Exchange

Cyber Warfare – Maybe because of the apparent success of the Stuxnet virus on the Iranian nuclear efforts, there has been a lot of floor chatter about the new age of cyber warfare. The chatter got a lot more active with the latest issue of Foreign Affairs. It contains an essay on the topic and a terrific interview with William Lynn. He is the deputy secretary for defense. He describes some of the unique features of cyber-security.

The first is that we use the word “asymmetric” fairly frequently now in warfare, but it is particularly true in cybersecurity. It requires a very low cost for people to develop cyberthreats, malware that can intrude on information technology systems.

On the other hand, defending against those threats requires a substantial investment. And let me just give you one nugget as an example of that. Some of the most sophisticated integrated defense software that is commercially available now have 5–ÂÂ10 million lines of code, and they are massive, work-intensive, difficult products to develop. The average malware has stayed constant over the last decade, and it’s about 175 lines of code.

So the disproportion there between the offense and the defense is substantial and will, I think, remain so for a while. I want to talk about how we might change that toward the end.

A second characteristic of cyberthreats is the difficulty of attribution. A keystroke can travel around the world twice in about 300 milliseconds. That is as long as it takes you to blink your eye. Yet the forensics of identifying an attacker can take weeks, months, or even years, and that is if you can do it at all. Going back and figuring out where an attack came from is extremely, extremely difficult and by no means a sure thing.

That has some real importance in that it starts to break down the paradigm of deterrence that was the undergirding of nuclear forces in the Cold War. If you don’t know who to attribute an attack to, you can’t retaliate against that attack, so you can’t deter through punishment, you can’t deter by retaliating against the attack. This is very different, of course, than, you know, with nuclear missiles, which, of course, come with a return address. You do know who launched the missile.

This is, I think, further complicated by the third attribute I’d talk about in terms of cyberthreats, which is that they are offense-dominant, that the Internet was not developed with security in mind. It was developed with transparency in mind; it was developed with ease of technological innovation; it was developed with openness in terms of the system design. But it was not developed with techniques of security management, like secure identification. Those kinds of techniques were not built into the networks.

Secretary Lynn recounts how the U.S. Defense system was invaded and compromised by a cyber attack in 2008 and how that was resolved. It is an instructive interview but not one to let you sleep easier.

A New Twist To The Internet

Posted By thestatedtruth.com on December 1, 2010

In a direct response to the domain seizures by U.S. authorities during the last few days, a group of established enthusiasts have started working on a DNS system that can’t be touched by any governmental institution.

Ironically, considering the seizure of the Torrent-Finder meta-search engine domain, the new DNS system will be partly powered by BitTorrent.

In recent months, global anti-piracy efforts have increasingly focused on seizing domains of allegedly infringing sites. In the United States the proposed COICA bill is explicitly aimed at increasing the government’s censorship powers, but seizing a domain name is already quite easy, as illustrated by ICE and Department of Justice actions last weekend and earlier this year.

For governments it is apparently quite easy to take over the DNS entries of domains, not least because several top level domains are managed by US-based corporations such as VeriSign, who work closely together with the US Department of Commerce. According to some, this setup is a threat to the open internet.

To limit the power governments have over domain names, a group of enthusiasts has started working on a revolutionary system that can not be influenced by a government institution, or taken down by pulling the plug on a central server. Instead, it is distributed by the people, with help from a BitTorrent-based application that people install on their computer.

According to the project’s website, the goal is to “create an application that runs as a service and hooks into the hosts DNS system to catch all requests to the .p2p TLD while passing all other request cleanly through. Requests for the .p2p TLD will be redirected to a locally hosted DNS database.â€

“By creating a .p2p TLD that is totally decentralized and that does not rely on ICANN or any ISP’s DNS service, and by having this application mimic force-encrypted BitTorrent traffic, there will be a way to start combating DNS level based censoring like the new US proposals as well as those systems in use in countries around the world including China and Iran amongst others.â€

Wikileak’s Says It Reopens Website In Sweden

Posted By thestatedtruth.com on December 1, 2010

Fed Released Details Of Its Emergency Lending (To Save The World) In 2007

Posted By thestatedtruth.com on December 1, 2010

Under orders from Congress pursuant to the Dodd-Frank financial legislation, the Fed has finally released details of its emergency lending starting in 2007.

Huffington Post is providing an excellent live-blogging round up as new discoveries are made from the Fed’s data release. Here are some of the more interesting insights:

Mutual funds, hedge funds and bond funds borrowed more than $71 billion from the Fed’s Term Asset-Backed Securities Loan Facility, the WSJ reported. This includes $7.1 billion borrowed by the massive bond fund PIMCO, run by veteran investor Bill Gross. Gross’s involvement in the details of the bailout, which included a campaign for public-private partnerships to unwind toxic assets, raised more than few eyebrows from critics.

***

Two European Megabanks Got A Windfall From The Fed … Two European megabanks — Deutsche Bank and Credit Suisse — were the largest beneficiaries of the Fed’s purchase of mortgage-backed securities. The Fed’s dollars also flowed to major American companies that are not financial players, including McDonald’s and Harley-Davidson, through unsecured short-term loans.

***

Wall Street firms teetering on the verge of collapse pledged more than $1.3 trillion in junk-rated securities to the Federal Reserve for cheap overnight loans….

The fact that Wall Street was able to pledge junk to the Fed in exchange for cheap financing is likely to enrage lawmakers who view the Bush and Obama-era crisis programs as largely benefiting Wall Street while “Main Street” has been left behind.

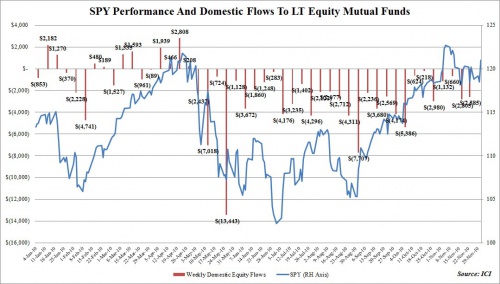

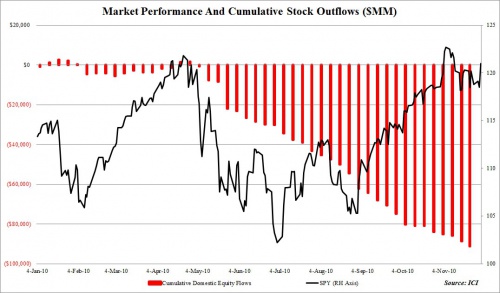

30’th Consecutive Week Of Equity Fund Outflows

Posted By thestatedtruth.com on December 1, 2010

Yes, you are wondering how this is possible while the market is going up? The logical answer is the powers to be (government) have total control of things for now….but if something should happen to change that (and it will), run baby run!

ICI reports for the week ending November 24, we had $2.6 billion in outflows from domestic equity funds, and it totals over $91 billion year to date.

Wikileaks Website Has Been Shut Down!

Posted By thestatedtruth.com on December 1, 2010

This shouldn’t be surprising…….what did he (Julian Assange) think would happen?

From Reuters: “Amazon.com ceases hosting services for WikiLeaks website – Senator Lieberman” and “DHS says Amazon has agreed to stop hosting WikiLeaks.”

Game Over…..Julian Assange looks like a hot potato.

Cumberland Advisors…..Explaining The Europe Contagion

Posted By thestatedtruth.com on December 1, 2010

David Kotok does a good job of explaining things about this complex problem in Europe.

Cumberland Advisors

European Contagion

December 1, 2010

First an update. We are scheduled to guest-host CNBC Worldwide Exchange from the London Studio on Friday, December 10. US viewers may see it at 5 AM New York time. We may start a little earlier. CNBC usually posts clips from these interviews on its website, www.CBNC.com

Let’s now get to the subject at hand.

Europe is confronting a contagion. It started in Greece but it does not end in Greece. It is spreading and has reached the obvious peripheral countries like Ireland, Portugal, Spain, and Italy. It is now affecting Belgium. The spread is not over.

The historical metaphor is the Asian contagion from 1997-1998. That started with Thailand and the baht and ended with the collapse of the Russian ruble and the Long Term Capital Management hedge fund. The end came when Greenspan and the US Fed intervened credibly and decisively. They stopped the bleeding. Markets then transitioned from being driven by fear to the process of restoration of stability. That was the sequence in 1997-1998.

In the Asian case, each currency was attacked and devalued. The countries did not have sufficient reserves. They were vulnerable and easy targets for global speculators.Â

The euro zone’s vulnerability is the huge overhang of sovereign debt.  It is denominated in euros, so there can be no country-by-country devaluation.  Each country has to be brought into a resolution process (rescheduling of payments).  The present system is based on a 440-billion-euro fund, with all 16 euro-zone member countries participating. That fund has a flawed concept.Â

The European Financial Stability Facility (EFSF) was created with the idea of burden sharing in proportion to size. The problem with this system is that it assumes the ability to pay. Therefore, when a country crosses from being a participant with a pledge of capital to receiving aid it has to be removed from the 440-billion pool and it becomes an entry on the liability side of the ledger.Â

Greece was first. It is small. Its EFSF capital share is 2.82% or 12.39 billion euros. The creators of this concept hoped that Greece was the end of the story. They failed to consider the market forces of contagion.Â

Portugal is 2.51%. Ireland is 1.59%. Take out those three countries and the original 440-billion-euro fund is down to 409 billion. This is still manageable, but the trend and the systemic flaw are becoming clear. When a country morphs over to the receiving side it gets relief at the expense of the others. Notice where the political incentive lies.Â

Now consider what the contagion threat means. Belgium is under attack. You can see that attack in the credit default swap pricing. Belgium is 3.48% of the fund. Â

The big ones are the developing risk. Spain is 11.90%. Readers can easily see where this is going.  So can the Germans and the French, who are the biggest in the fund. Germany is 27.19% and France is 20.385.Â

Clearly, the system must change. Equally clearly, the changes must now be made quickly and have to be done in the midst of the contagion. This pressured operational structure is the worst form of negotiation.

The solution lies with the European Central Bank. It must stop the bleeding with large and decisive action, just as the Federal Reserve did in 1998 with LTCM and just like the ECB and Fed jointly did after the Lehman-AIG fiasco. However, the ECB needs appropriate forms of assets (debt instruments) to acquire while maintaining its mandate. In addition, the ECB is divided internally by conflicting views on policy. Some would have had Greece default. Others fear inflation. Still others want to rely on hope and time instead of taking a proactive policy stance. They look at the debt-GDP ratio and believe it can be returned to manageable proportions over time. Â

The reluctant ECB members fail to realize a key issue. In a contagion, you do NOT have time. Time is not on your side.Â

Understanding contagion is hard for many policymakers and for investors. In a contagion, you cannot see the next freight train until it hits you. You do not know where the next shock originates. I use metastatic cancer as a metaphor. You know the source of the original tumor. It is Greece in the present-day euro crisis. It was Thailand in 1997. You know the type of cancer. It was lack of currency reserves in the Asian crisis. It is sovereign debt in the European crisis. However, you do not know where the cancer will next appear. You are unsure of its route of travel in the body.Â

The same is true of the financial linkages that intertwine the system of global financial interdependence.  No one knows all of them.  That is why we witnessed Sweden, Denmark, and the UK participating in the Ireland bailout. They are not in the euro zone but they do have banking interests, and those banking interests are linked to others who are bleeding. Bringing non-euro-zone members into a bailout was a first in European Monetary Union history.Â

Before this is over there will have to be a pan-European solution. It has to be big. It has to be rapidly deployable. It has to have the backing of the central banks. Moreover, it MUST be credible to markets. Europe has not reached that point yet, which is why there is more contagion risk and more contagion events in the future.

ECB president Trichet knows this. He is the one who lectured Bernanke about the Lehman failure. Now the shoe is on the other foot. That is why Trichet has tried to soothe markets with words. Now he must do it with deeds. We expect a large ECB response is coming. Markets expect it too, which is why they are rallying today.

In our firm, we have taken Europe to underweight. We have left the “strong euro†currency trade.  We have taken the US stock market to overweight.

Let me add a personal note. After years of research, my co-author Vincenzo Sciarretta and I wrote a book called Invest in Europe Now. Our publisher got the manuscript in final form in September 2009. Wiley released the book in March 2010. Greece blew up a month later. The first five chapters of the book are still valid. The rest of the book is obsolete. It would be written differently today.Â

David R. Kotok, Chairman and Chief Investment Officer

*********

Copyright 2010, Cumberland Advisors. All rights reserved.

The preceding was provided by Cumberland Advisors, This report has been derived from information considered reliable, but it cannot be guaranteed as to accuracy or completeness.

It is not our intention to state or imply in any manner that past results and profitability are an indication of future performance. This does not constitute an offer to sell or the solicitation or recommendation of an offer to buy or sell any securities directly or indirectly herein.

Please feel free to forward this Commentary (with proper attribution) to others who may be interested.

Archived Commentaries: http://www.cumber.com/comments/archiveindex.htm

The Debate….Bush tax cuts come now or are (forced) later….When the new Republican House majority arrives in January, it will make its first order of business a retroactive tax cut. Republicans would take front stage from that point on.

Posted By thestatedtruth.com on November 30, 2010

Democrats have left themselves in a tough spot on the Bush tax cuts. After delaying the issue until after the election and then being trounced in that election, they find themselves with little leverage.

If they cannot come up with a plan that can win 60 votes in the Senate, which means at least two Republican votes, Republicans can filibuster any bill. All of the tax cuts would then expire on Dec. 31. When the new Republican House majority arrives in January, it will be able to make its first order of business a retroactive tax cut — forcing President Obama and Senate Democrats to choose between a purely Republican plan and an across-the-board tax increase.

So the big question is whether Democratic leaders can come up with any compromise that centrist Democrats and a couple of Republican senators — Scott Brown, who represents liberal Massachusetts? George Voinovich of Ohio, who is retiring? — are willing to accept.

Much of the recent commentary about the tax cuts has skipped over this political reality. It’s instead focused on how tough the Democrats should be and whether they should insist on the expiration of all the Bush tax cuts on income above $250,000 a year. But that’s no longer one of their options. Unless they believe they will benefit more than Republicans from a standoff in which taxes go up, which is hard to believe with a Democrat in the White House, their only choice now is among various versions of retreat.

A small group of Obama administration officials and lawmakers from each party will be negotiating over the next few days, and two possibilities are getting the most attention.

The first is a millionaire’s tax, in which the Bush tax cuts would be extended only on income below $1 million. This would raise only half as much as Mr. Obama’s proposal — allowing the cuts to expire on all income above $250,000 — but it would still eliminate roughly 8 percent of the medium-term budget deficit. A millionaire’s tax would also mean that the tax code would again begin to distinguish between the merely affluent and the truly wealthy, as was the case decades ago.

The second, more likely option is to extend all the tax cuts — and to package them with other tax cuts and spending likely to do more to help the economy than the Bush tax cuts. (Remember, after President George W. Bush signed the cuts in 2001, the economy lost jobs for the next two years, and economic growth during his presidency was mediocre.) These other measures could include a tax cut for businesses that added workers, an across-the-board payroll tax cut and an extension of unemployment benefits.

Combining the two ideas — using the revenue from the millionaire’s tax to pay for job creation programs — may also be possible. Senator Mark Warner, a moderate Virginia Democrat, has been pushing a similar idea.

Today, the economy looks striking similar to the way it did at the start of the year, with the latest numbers again pointing to a recovery. Retail sales over Thanksgiving weekend were strong. The last jobs report showed more hiring than expected. Yet the outlook remains highly uncertain, partly because of the debt troubles in Europe.

The great historical lesson of financial crises is they tend to have bigger, longer-lasting effects than policy makers think. Congress and the White House now have a chance to take out an insurance policy against the risk that the recovery will fade in coming months, just as it did over the summer. Because the Bush tax cuts will expire unless new legislation is enacted, they offer a chance to get that insurance policy through Congress.

More at The NewYork Times at:http://www.nytimes.com/2010/12/01/business/economy/01leonhardt.html?hp

State Tax Revenues Show Improvement….But Still 7% Below Two Years Ago

Posted By thestatedtruth.com on November 30, 2010

Financial comparisons with 2009 will make almost anything look good, even state tax revenues which in the third quarter were up 2.6 percent compared with last year.

According to preliminary tax collection data compiled by the Nelson A. Rockefeller Institute of Government, 48 early reporting states collected 3.9 percent more in taxes, in nominal terms, from July through September 2010 vs. the same period in 2009.

Still, tax collections were 7 percent below the same period from two years ago, which means the pain that many states have been feeling wll last a while.

Banks Resisting Fannie, Freddie Demands To Buy Back Mortgages

Posted By thestatedtruth.com on November 30, 2010

Buy back mortgage contracts are getting interesting. It looks like a cat fight just starting…… You don’t think the banksters want to own that crap they sold to Fannie and Freddie do you? They thought it was a free ride. But now it doesn’t look so free……The expected amount so far refused exceedes $120 billion. This is just another problem for the Western financial world.Â

Fact: Securitized debt was manufactured to be sold, not to be bought back. It looks like the banks are getting their comeuppance!

2010-11-30

By Lorraine Woellert and Clea Benson

Fannie Mae and Freddie Mac are facing growing resistance as they attempt to push failed home loans off their books and onto the balance sheets of banks including Bank of America Corp. and JPMorgan Chase & Co.

The two government-owned mortgage companies are enforcing contracts that require lenders to buy back loans that didn’t meet underwriting standards. At the end of September, the companies reported, banks hadn’t responded to $13 billion in buyback requests. A third of those were at least four months old and Freddie Mac has begun to assess penalties for the delays.

Lenders say they are resisting buybacks because McLean, Virginia-based Freddie Mac and Washington-based Fannie Mae are unfairly second-guessing old appraisals, accusing originators of failing to verify income, or pinning failed loans on minor technical errors. Larger banks say they can handle the potential losses. Some smaller lenders say the strain could sink them.

About 40 percent of repurchase requests are rescinded after lenders provide additional paperwork, said John A. Courson, chief executive officer of the Mortgage Bankers Association, a Washington trade group.

“We’re burning a lot of stockholder resources, and clearly a lot of Fannie and Freddie resources, to have 40 percent of these things rescinded,†Courson said in an interview. “It hurts the banks and frankly we’re wasting government resources, too.â€

Democrat Group “The Third Party” Proposes Huge Changes For Social Security

Posted By thestatedtruth.com on November 29, 2010

We are all going to be real frugal if this plan see’s the light of day! Currently, individual retirees with $34,000 in outside income and couples with $44,000 must pay taxes on 85 percent of their benefits. The Third Way plan would require individuals earning $50,000 a year and couples receiving $60,000 to pay taxes on 100 percent of the benefit.Â

A Democratic-led policy group is proposing changes in Social Security that party members have resisted for years in an effort to pave the way for recommendations this week by President Barack Obama’s deficit- cutting commission.

Washington-based Third Way said its plan would raise the retirement age, trim or eliminate Social Security benefits for high-income retirees, limit cost-of-living increases and provide money to help young workers create private retirement accounts. The proposal, to be released after the presidential panel is due to issue its report on Dec. 1. “Whatever comes out of the commission is going to be a hot potato,†Gibbons said. “So we wanted to send something over that was especially hot.â€

Social Security costs will exceed tax revenue beginning in 2015, according to the trustees’ 2010 report. The shortfalls will be covered by the plan’s trust fund until 2037, when those reserves are projected to be exhausted. Over the next 75 years, the trust fund would need another $5.4 trillion in current dollars to pay all scheduled benefits.

Currently, individual retirees with $34,000 in outside income and couples with $44,000 must pay taxes on 85 percent of their benefits. The Third Way plan would require individuals earning $50,000 a year and couples receiving $60,000 to pay taxes on 100 percent of the benefit.

Social Security benefits would be reduced on a scale starting at individuals with $150,000 in outside income and couples with $250,000, and eliminated altogether for individuals earning $200,000 and couples with $400,000 in income.

The retirement age, now scheduled to rise to 67 in 2027, would gradually increase to 68 by 2041, to 69 by 2059, and to 70 by 2077. This would reduce total benefits by roughly $1 trillion by 2040, according to the plan.

The plan would provide annual subsidies of up to $500 to help workers under age 30 create 401(k)-style retirement savings accounts.

President Obama To Announce A Pay Freeze For Federal Workers

Posted By thestatedtruth.com on November 29, 2010

It looks like the republican tea party is having an effect of President Obama, but let’s not forget that this pay freeze comes at all time record high pay levels for government workers.  It looks like the can gets kicked down the road a while, then we’ll start to see pay CUTS!

By PETER BAKER

Published: November 29, 2010

WASHINGTON — President Obama plans to announce a two-year pay freeze for civilian federal workers on Monday in his latest move intended to demonstrate concern over sky-high deficit spending.

The president’s proposal will effectively wipe out plans for a 1.4 percent across-the-board raise in 2011 for 2.1 million civilian federal government employees, including those working at the Defense Department, but the freeze would not affect the nation’s uniformed military personnel. The president has frozen the salaries of his own top White House staff members since taking office 22 months ago.

“Clearly this is a difficult decision,†said Jeffrey Zients, deputy director of the Office of Management and Budget and the government’s chief performance officer. “Federal workers are hard-working and dedicated.†But given the deficit, Mr. Zients added, “we believe this is the first of many difficult steps ahead.â€

The pay freeze will save $2 billion in the current fiscal year that ends in September 2011, $28 billion over five years and more than $60 billion over 10 years, officials said. That represents just a tiny dent in a $1.3 trillion annual deficit, but it offers a symbolic gesture toward public anger over unemployment, the anemic economic recovery and rising national debt.

Mr. Zients said the president planned to announce the plan on Monday because of an approaching legal deadline for submitting a pay plan to Congress. But by doing it now, the president also effectively gets ahead of Republicans who have been talking about making such a move once they take over the House, and assume more seats in the Senate, in January. Some Republicans have gone further, proposing to slash federal worker salaries.

Mortgage Defaults, 492 Days Of Free Rent…..And Counting

Posted By thestatedtruth.com on November 27, 2010

The number of days since the average borrower in foreclosure last made a mortgage payment is now 492 days up from 382 days a year ago and a low of 244 days in August 2007.

Pensions: The Lump-Sum Gamble (Fleecing)

Posted By thestatedtruth.com on November 27, 2010

More than 90% of employees opt for a lump-sum payout from their pension plan when given the choice.  So the Pension Protection Act was signed in August of 2006 by President George W. Bush. But who does it protect. Well certainly not the employee!Â

Interestingly, the current change has received so little notice that most people aren’t aware of the new formula…..and unlike other moves that reduce pensions, employers aren’t even required to notify employees of the changes.

Below from Wall Street Journal……..

Employers had complained that the Treasury rate was so low that departing employees were getting a windfall on lump sum distributions and asked Congress for relief. S0 a new law was signed in August 2006 as part of the Pension Protection Act, and is to be phased in over five years, through 2012 .   The difference in payouts are substantial. Consider a 40-year-old who has earned a pension worth $3,000 a month at age 65. If the new rate had been used in December 2008, when the spread between corporates and Treasurys was a steep 3.77 points, his lump sum would have shrunk from $242,839 down to $71,148.

Under new rules that became effective in 2008, many larger companies have been quietly changing the way they calculate lump-sum payouts from their pension plans by phasing out their use of a Treasury-bond rate to calculate lump sums and replacing it with a higher composite corporate-bond rate. The result is substantially lower payouts to employees who are changing jobs, being laid off or retiring. In fact the hair cut can be anywhere from 10% to 60% or more, depending on age and other factors.

Younger employees face the largest reductions. A 55-year-old employee who took early retirement or switched jobs would get about 25% less under the new legislation, while a 45-year-old would take a 50% cut, according to calculations prepared for The Wall Street Journal by Beth Pickenpaugh, a pension actuary and financial adviser at Gianola Financial Planning in Columbus, Ohio.

Companies had been using the 30-year Treasury bond rate to calculate lump sums since 1994. Before then, they were using a lower rate, and complained that employees taking lump sums were getting a windfall. Companies persuaded Congress to let them replace it with a then-higher 30-year Treasury rate, which at the time was about 8%.

The change is being phased in over five years, through 2012, so someone contemplating changing jobs or retiring and taking a lump sum might want to evaluate the impact of taking a distribution before the change is fully phased in. Make sure that your advisor understands the calculations.

Pension Shortfall Widens Even With The S&P Rising

Posted By thestatedtruth.com on November 25, 2010

Inquiring minds want to know….how do we ever close this gap!

Corporate pensions in the Standard & Poor’s 500 Index with about $1 trillion in assets are now 77 percent funded this year, down from 82 percent at the end of 2009.  The $380 billion pension shortfall is the biggest since at least 1994, according to  David Bianco, chief U.S. equity strategist at Bank of America Merrill Lynch.

The pension plans have a median 8.1 percent expected rate of return. During the past 12 months, assets in the plans returned 11.4 percent while the funding status dropped $21 billion, “due primarily†to lower discount rates.

Derivatives Nearly Took Down The World Financial System Back In 2008-2009, Have We Learned Anything From That Near Death Experience

Posted By thestatedtruth.com on November 25, 2010

The answer is NO!…..Over the counter (OTC) derivatives are larger now then in 2008. Logic says that a currency or interest rate surprise could do the derivative trick next time around. These markets are huge and could sink a battle ship because of the sheer size of the markets they’re involvd in. We may limp through 2011, and hopefully so, but 2012-2014 should be on our calendar. It could be a dozer! All eyes on the road up ahead, let’s pay attention everybody! If you see dominos start to fall…..run baby run!

This is a total Western world currency problem whose basis is still not fully discussed (or understood). The essence of the problem is as much overspending and debt (by governments), but media forgets, facilitated by the national OTC derivative camouflage.

Jim Sinclair

It’s A New World For Debtors In Bankruptcy

Posted By thestatedtruth.com on November 25, 2010

A re-designed bankruptcy law was the end result of a huge successful lobbying effort by the banks back in 2005.Â

Congress hadn’t envisioned a surge in bankruptcies when it re-designed the bankruptcy law to make it harder for consumers to walk away from their debts. Americans are expected to file for bankruptcy-court protection this year at a rate of more then 1.6 million and this is more than any year since Congress overhauled the system in 2005.Â

But the face of a bankruptcy has changed during this recession, and we now see better-off Americans included along with those of the poorer in filings. While most debtors usually earn less than $30,000 and don’t have a college degree, last year more than a fifth of them actually did have a college degree. Beware though….. a bankruptcy can bring relief from bill collectors’s calls and exploding credit-card balances, but the downside is that a bankruptcy petition will stay on a credit report for up to 10 years.  Then also there is trying to adjust to living in a world without a credit card, and understanding that new credit opportunities will be few and far between.

Hungary’s`Nightmare’ Pension-Fund Ultimatum

Posted By thestatedtruth.com on November 25, 2010

From Bloomberg News

By Zoltan Simon Nov 25, 2010

Hungary is giving its citizens an ultimatum: move your private-pension fund assets to the state or lose your state pension.

Economy Minister Gyorgy Matolcsy announced the policy yesterday, escalating a government drive to bring 3 trillion forint ($14.6 billion) of privately managed pension assets under state control to reduce the budget deficit and public debt. Workers who opt against returning to the state system stand to lose 70 percent of their pension claim.

“This is effectively a nationalization of private pension funds, David Nemeth, an economist at ING Groep NV in Budapest, said in a phone interview. It’s the nightmare scenario.

Hungary is rolling back pension changes implemented more than a decade ago as countries from Poland to Lithuania find themselves squeezed by policies designed to limit long-term liabilities by shifting workers into private funds. Now the cost is swelling debt and deficit levels at a time when the European Union is demanding greater fiscal discipline.

China And Russia Decide To Renounce U.S. Dollar In Bilateral Trade

Posted By thestatedtruth.com on November 25, 2010

This has been ignored in the press. So why is this a big deal? Well, because there are more dollars outstanding abroad then in the United States, and we’re really just beginning to see this kind of dollar mischief. But trust the world, there will be more.

China, Russia Quit Dollar

By Su Qiang and Li Xiaokun (China Daily)

Updated: 2010-11-24

St. Petersburg, Russia – China and Russia have decided to renounce the U.S. dollar and resort to using their own currencies for bilateral trade, Premier Wen Jiabao and his Russian counterpart Vladimir Putin announced late on Tuesday.

Chinese experts said the move reflected closer relations between Beijing and Moscow and is not aimed at challenging the dollar, but to protect their domestic economies.

“About trade settlement, we have decided to use our own currencies,” Putin said at a joint news conference with Wen in St. Petersburg.

The two countries were accustomed to using other currencies, especially the dollar, for bilateral trade. Since the financial crisis, however, high-ranking officials on both sides began to explore other possibilities.

The yuan has now started trading against the Russian rouble in the Chinese interbank market, while the renminbi will soon be allowed to trade against the rouble in Russia, Putin said.

“That has forged an important step in bilateral trade and it is a result of the consolidated financial systems of world countries,” he said.

Putin made his remarks after a meeting with Wen. They also officiated at a signing ceremony for 12 documents, including energy cooperation.

The documents covered cooperation on aviation, railroad construction, customs, protecting intellectual property, culture and a joint communiqu. Details of the documents have yet to be released.

The European Union Hopes To Double Bailout Fund

Posted By thestatedtruth.com on November 25, 2010

Germany just said “No” Thought this was a shoe in but……

BERLIN—The European Commission floated a proposal Wednesday to double the size of Europe’s €440 billion bailout fund for indebted euro-zone countries, but the idea was quickly dismissed by Germany, according to people familiar with the situation.

The apparent disagreement between Brussels and Berlin comes amid uncertainty among financial-market participants over whether the funds that Europe has set aside for rescuing stricken euro-zone members would be enough to cope with a possible financial meltdown in Spain.

This is a no brainer, they have no choice!Â

The European Commission is pushing to double the size of Europe’s €440 billion ($586.52 billion) bailout fund for indebted euro-zone countries according to people familiar with the situation. But the proposal by the Commission is running into opposition from Germany, the EU’s biggest economy. Â

Median New Home Price Drops Back To Recession Lows

Posted By thestatedtruth.com on November 24, 2010

The October median new home price of $194,000 was the lowest recorded by the Census Bureau since the market peak.

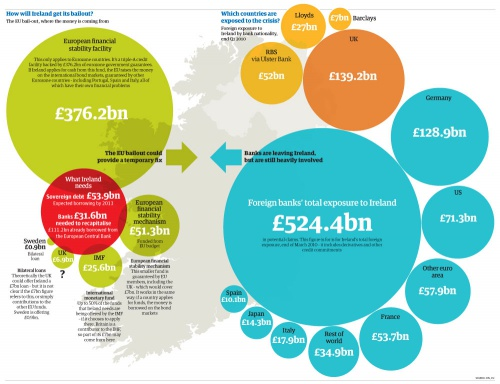

European Bailout…..Digging A Deep Hole With More Debt!

Posted By thestatedtruth.com on November 24, 2010

It seems that the European bailout buck will stop with Portugal unless more money is added (it will be). When Europe created the EFSF it did not think it would need to serially bail out everyone.  But now the EFSF needs more money to cover a bailout of Spain, and then what about Italy? Inquiring minds want to know!

From Dow Jones: “The European emergency fund, promoted as having the financial firepower to douse a financial crisis in the euro zone, may not even have enough money to cover a bailout of Spain. “[The fund] will be very close to the line, it will be precarious and it won’t leave anything for anybody else,” said Whitney Debevoise, a sovereign-debt lawyer with Arnold Porter and former World Bank executive director.”

Here is how the various bailout mechanisms in Europe operate, presented in this infographic by the Guardian.

A Worried Fed Lowers U.S. Growth Forecasts

Posted By thestatedtruth.com on November 23, 2010

So, the talking heads are pressing up U.S.  growth prospects while the Fed gets more worried. Hmm……

From The Wall Street Journal

Fed officials downgraded their assessment of the economy at a November meeting as they debated the benefits and costs of bond purchases, minutes showed.Â

Fed officials downgraded their growth projection to between 3% and 3.6% next year, compared to the 3.5% to 4.2% estimate it made in June. Fed officials forecast 2.5% growth in 2010, lower than the June prediction of between 3% and 3.5%. Though Fed critics warn its bond-buying program could spur inflation, the Fed projected inflation would remain below its informal objective of 2% through the forecast period.

The downwardly revised projections indicate the Fed might keep interest rates low for several years and suggests it is likely to follow through on plans to buy $600 billion in Treasury securities in the months ahead. The Fed said it stands ready to buy more securities if the forecast doesn’t improve or deteriorates

Copyright © 2025 The Stated Truth