Posted By thestatedtruth.com on November 13, 2010

John Mauldin says…….”If the Bush tax cuts are not extended, in my opinion it is almost a lock that we go into recession next year, unemployment goes to 12%, and underemployment gets even worse”. The only real way to pay for all these benefits will ultimately be a value-added tax, or VAT.    A VAT looks to be in our future and is a tax on everything you buy, like a state sales tax is, but it is a federal consumption tax that is added at each stage of manufacture or distribution.Â

November 12, 2010

By John Mauldin

Â

If the Bush tax cuts are not extended, in my opinion it is almost a lock that we go into recession next year, unemployment goes to 12%, and underemployment gets even worse. That is not a good climate for Obama and the Democrats in 2012. It is especially bad when you look at the number of Democratic Senate seats up for re-election that are in conservative states. The Republicans could take a serious majority in the Senate.Â

And then what? Right now Republicans are running on promises that they will not cut Medicare and Social Security, but are going to reduce spending and get us closer to a balanced budget. But everyone knows that the only way to get the budget into some reasonable semblance of balance will be to either cut Medicare benefits or increase taxes.”

There are only the two options. Yes, you can reform medical care, and I think much of Obamacare should certainly be repealed, but that does not get us anywhere close to dealing with the real issue, and that’s a fact. There are tens of trillions in unfunded liabilities in our future, which must be dealt with.

Let me be very clear on this. I am not really worried about the supposed $75 trillion in unfunded Medicare liabilities in our future. That is an impossible number. If something can’t happen it won’t happen. Long before we get to that apocalypse, we find a bond market that simply refuses to fund US debt at anywhere near an affordable cost. Crisis and chaos will ensue.

People only accept change when they are faced with necessity, and only recognize necessity when a crisis is upon them.

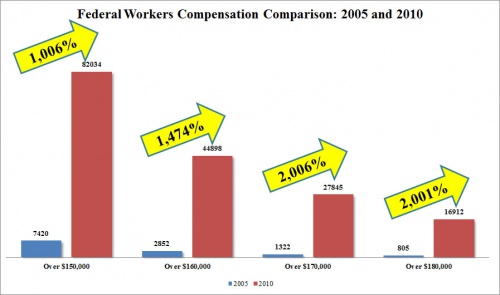

– Jean Monnet

The simple reality is that if We the People of the US want Medicare, in even a reformed and more efficient manner, we must find a way to pay for it. It will not be cheap. Raising income taxes on the “rich” is not enough. You have to go back and raise income taxes on the middle class, too. Oh, wait, that will be a drag on the economy and consumer spending. And in any event it will not be enough.

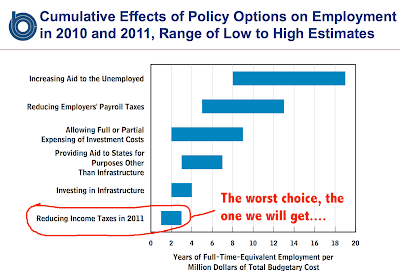

The only real way to pay for those benefits will be a value-added tax, or VAT. And while it could be introduced gradually, let there be no mistake that it will be a drag on economic growth. Government spending does not have a multiplier effect on the economy. It is at best neutral. What creates growth is private investment, increases in productivity, and increases in population. That’s it. Tax increases have a negative multiplier.

A significant VAT along with our current income taxes will give us an economy that looks more like the slow-growth, high-unemployment world of Europe. Can we figure out how to deal with that? Sure. But it is not growth-neutral.

Republicans in 2013 will be like the dog that caught the car. What do you do with it? The last time they (embarrassingly, we) really screwed it up. The defining political question of this decade will not be Iraq or Afghanistan, or the environment or any of a host of other problems. The single most important question will be what do you do with Medicare? Cut it or fund it? Reform it for sure, but reform is not enough to pay for the cost increases that will come from an increasingly aging Boomer generation.

There is no free lunch. At some point, Republicans cannot run on “no cuts in Medicare” and “no new taxes” and be honest. At least not this decade. Maybe when we have cured cancer and Alzheimer’s and heart disease and the common cold at some future point, medical costs will go down, but in the meantime we have to deal with reality.

You may be able to fool the voters, but you will not be able to fool the bond market. Not dealing with reality will create a very vicious response. Ask Greece.

And that is the national conversation we must have with ourselves. There is a cost to government. There is a cost to extended Medicare benefits. (I am blithely assuming we deal with all the “easy” stuff like Social Security, and make real cuts in other areas.)

For More :Â www.frontlinethoughts.com or www.JohnMauldin.comÂ

Category: Commentary, Economy, Finance, National News, News Letters, Wall Street, World News |

No Comments »

Tags: Comments from John Mauldin

Â