Greenlight Capital David Einhorn Says Second Financial Crisis Rolls Over Us If Interest Rates “Ever Go Up Again”

Posted By thestatedtruth.com on December 26, 2010

Beware of the “Ides of March”….This makes all the sense in the world, as the second crisis will likely be bigger and more dynamic then the first one.Â

Â

America is storing up a second financial crisis by keeping interest rates at record low levels, according to David Einhorn, the hedge fund manager who first publicly warned about the financial catastrophe facing Lehman Brothers.

“The crisis that required zero interest rates has passed,” said Mr Einhorn, who co-founded and runs Greenlight Capital, a $6.5bn (£4.2bn) fund. By not raising rates “it increases the chance that governments will over-borrow and fall into a debt trap”.

The criticism of the Federal Reserve comes as it embarks on another $600bn (£380bn) of quantitative easing – or printing money – in an effort to fire up a stronger recovery next year.

Interest rates around the western world, including in Britain, have sat at or below 1 pc since the near collapse of the financial system in 2008 triggered a global recession.

“If interest rates ever do go up again, you have another crisis,” Mr Einhorn told The Sunday Telegraph.

Those in favour of very low interest rates point to the support it has given the real estate market in the U.S.

Gasoline On A Roll To The Upside….Here Is A Breakdown Of What Goes Into Each Gallon Of Gas At The Pump

Posted By thestatedtruth.com on December 26, 2010

U.S. gasoline prices hit an average $3 a gallon for the first time in more than two years, according to AAA’s Daily Fuel Gauge Report.

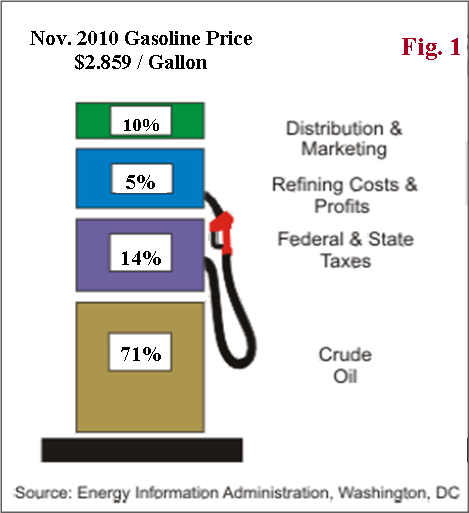

Crude oil is the biggest component, and accounts for about 71% of the price of gasoline as of Nov. 2010, based on EIA estimate (Fig. 1).  Roughly, for every one dollar increase in the per barrel (42 gallons) price of oil, gasoline prices rise 2.5 cents per gallon. So, a ten-dollar rise in crude price per barrel would add about 25 cents at the pump.Â

- The week-on-week crude inventory draw was largely due to refiners’ year-end strategy to minimize potential taxes on year-end inventory.Â

- Despite a weekly draw, crude oil, along with products inventories (except distillate), all saw a year-over-year increase (Fig. 2). Crude inventory level is still above the average range (Fig. 2), while gasoline inventory is also close to the high end of the average range.Â

- If there’s strong demand elsewhere around the globe, as many have suggested, there should not be such a build in the domestic inventory.

- The global physical oil market also tells a similar story. WSJ reported that the International Energy Agency (IEA) estimates OPEC spare capacity is around 6.4% of global demand, nearly double the level of late 2007. Data from Oil Market Intelligence also indicate the world oil inventories stood at 20 days worth of demand, up from 14 days in November 2007.

More at: http://www.businessinsider.com/crude-oil-speculators-2010-12

Banks In Jeopardy Rise To Nearly 100!

Posted By thestatedtruth.com on December 26, 2010

Nearly 100 U.S. banks that got bailout funds from the federal government now show signs they are close to failing.

The total, based on an analysis of third-quarter financial results by The Wall Street Journal, is up from 86 in the second quarter, reflecting eroding capital levels, a pileup of bad loans and warnings from regulators.

Europe In Trouble

Posted By thestatedtruth.com on December 25, 2010

David Rosenberg of Gluskin-Sheff checks in on Bloomberg. He’s keying off comments from Barclays’ Bomb Diamond about the possibility of a Euro breakup, which Rosenberg sees as possible.

It’s a matter of “when” not “if” noting that it was actually Germany that first breached its debt limits, and pointing out that the history of monetary unions is horrible, with the exception of the United States. All others have failed.

The roadmap? Not clear, other than complete financial disarray.

Cities Forced To Tap Homeowners By Raising Property Taxes…. How Else Are They Going To Pay For Exploding Workers’ Retirement And Health Costs? Inquiring Minds Want To Know!

Posted By thestatedtruth.com on December 25, 2010

The new world order will see tax hikes every where, it’s unavoidable!

Cities across the nation are raising property taxes citing rising pension and health-care costs for their employees and retirees.Â

Local officials and government workers say a confluence of factors is driving the increases, including the need to make up for staggering investment losses from the financial crisis and rising costs as more workers retire. In addition, benefit increases promised in flush times are coming due as revenue flounders, and some cities have skipped payments to their pension funds over the years.

Representatives of government workers, including for unions, don’t deny that pension costs are rising. But they blame local officials for failing to fund pensions adequately in better times.

“The main driver is the irresponsibility of local public officials who for years and years have not been funding their pensions,” said Henry Bayer, executive director of the American Federation of State, County and Municipal Employees Council 31 union, which represents 72,000 employees in Illinois.

Many local officials say they have been trying to right their pension funds without raising taxes. They have borrowed money from reserves, trimmed services and cut back on staff.

Some cities have also pushed unions to reopen contracts in an attempt to pare benefits or raise workers’ contributions for pensions and health care. They have faced stiff resistance from some unions that argue it’s unfair to penalize workers for a financial crisis that isn’t their fault. Others have agreed to some cutbacks.

State aid to many local governments and other revenue remain below precrisis levels. Nearly half of states reduced aid to local governments in 2010, and 20 states have proposed additional cuts in 2011, according to a December report by the Congressional Budget Office.

“Unless governments really want to squeeze essential services…there are likely to be a lot more property tax increases” across the country, said Don Boyd, a senior fellow at the nonpartisan Nelson A. Rockefeller Institute of Government at the State University of New York.

Oil Is Around $91 A Barrel, Here’s How It Effects Us

Posted By thestatedtruth.com on December 23, 2010

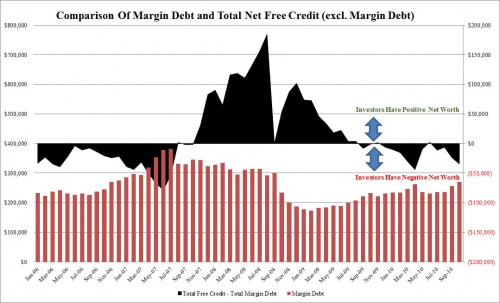

NYSE Margin Debt Continues Higher

Posted By thestatedtruth.com on December 22, 2010

Houses Are Down 30+ Percent, So Why Do Property Taxes Continue To Go Up

Posted By thestatedtruth.com on December 22, 2010

Though house prices have declined roughly 30% nationally since the 2006 peak of the housing bubble, property taxes have continued their decade-long rise, jumping $45 billion (over 10%)Â just since 2008.

Nationally, property taxes now dominate local tax revenues. Property taxes tripled from 1990 to 2005 in Florida.  But once the local government obtains that gargantuan revenue stream, it becomes the “baseline” for all future years.

According to U.S. Census Bureau data, the nation’s local governments will collect an estimated $476 billion in property taxes in 2010–almost double total state income tax revenues of $250 billion and considerably more than total sales tax revenues of $286 billion. That means property tax revenues are 66% higher than sales tax revenues–$190 billion more a year.

A decade ago, property taxes were roughly equivalent to sales taxes. In 2000, property taxes totaled $247 billion and sales taxes came in at $223 billion– a differential of roughly 10%. Sales taxes have increased by 28% since 2000– roughly in line with the rise in consumer prices (as calculated by the Bureau of Labor Statistics).

Property taxes, meanwhile, have far outstripped inflation, soaring from $247 billion in 2000 to $476 billion in 2010–a gargantuan increase of $229 billion, or 92%.

California property taxes have been limited to 1% of assessed value by the voter-mandated Proposition 13, passed in 1978. Assessed value is limited to a 2% increase per year. Additional parcel taxes can be added only through voter-approved bond measures and “special assessment districts” which fund municipal water districts, libraries and other local government services.

But assessed values are re-set to market valuations when a property is sold. As millions of homes were sold during the boom years, the assessed value of those homes skyrocketed, reaping huge increases in property taxes for local governments in California.

More at: http://www.businessinsider.com/property-taxes-rising-2010-12

The New Normal….Let’s Call It The Real World Of Economics! Time To Get Used To It!

Posted By thestatedtruth.com on December 21, 2010

Sounds like something Ross Perot might have said with his pointer in hand……Let’s call it Economics 101. Governments will be forced to lay off workers and cut back on services, causing social unrest as the Muni issues are addressed. “States clearly have been funding municipal governments—for now up to 40 percent of their total expenditures,” Meredith Whitney explained. “As the states become more compromised from a fiscal standpoint, that funding is going to end.” “People are complacent about these defaults. The news about all this isn’t out there yet.” Thanks Meredith.

Meredith Whitney:Â Wave of Muni Defaults to Spur Layoffs, Social Unrest

Published: Tuesday, 21 Dec 2010

Meredith Whitney Told CNBC Tuesday:

Responding to the uproar over her “60 Minutes” interview broadcast on CBS Sunday night, Whitney defended her prediction that at least 50 to 100 cities and towns could default on their debt as states and the federal government cut back on financial support.

“I appreciate that the reaction is so violent,” she said in a live interview with CNBC. “I didn’t put the debt on these states. We’re looking at the numbers. This is how it plays out.”

The big problem is that cash-strapped states will no longer be able to provide the financial support to municipalities as they have in the past, said Whitney.

The federal government is unlikely to bail out the states, added Whitney, because the cost—which she put at $1 trillion—would cause a political backlash. “Who in Nebraska’s going to want to bail out someone in Florida?” she said.

The Free Lunch Is Over! The Steak And Wine Has Turned Into A Baloney Sandwhich With Water

Posted By thestatedtruth.com on December 21, 2010

This pension issue will have to be addressed front and center very soon…..Virginia stopped requiring public employee pension contributions back in 1983, but the free lunch is now OVER! It’s a snow ball going down hill, and we all know how big the snow ball is at the bottom.  Kick the can down the road, until one day the snow ball turns into an avalanche and rolls over everyone!

2011: The Year Public Pension Plans Get Whacked

By Carla Fried        Â

Dec 21, 2010

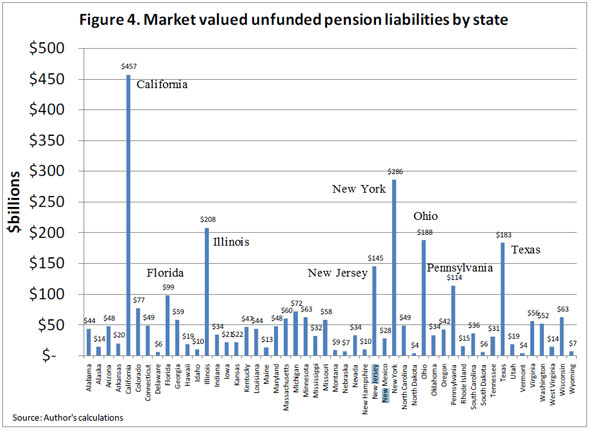

The traditional defined-benefit pension that is the dominant retirement plan for public-sector employees officially has a huge target on its back. And 2011 is shaping up as the year politicians begin to take serious aim at cutting promised benefits. What was a mere trickle of states and municipalities starting to address massive unfunded pension liabilities in 2010, which are now estimated to total more than $1 trillion, looks to grow to a torrent in 2011.

New Jersey Governor Chris Christie may be the most voluble agitator for pension cutbacks, but he’s got plenty of company across the country. Here’s what some other states and cities are considering:

Virginia. Governor Bob McDonnell recently proposed that Virginia’s public employees be required to chip in 5 percent of their pay to the state’s pension fund. Virginia stopped requiring public employee pension contributions in 1983.

Houston. Mayor Annise Parker has started the “conversation†by deeming the city’s three major pension plans covering Houston’s police, firefighters, and municipal employees unsustainable. “There’s a difference between a fair pension and a gold-plated pension, and the citizens of Houston have to know that we can find a fair balance in there,†Mayor Parker told the Houston Chronicle.

Maryland. A proposal released yesterday by a state pension commission would increase the years of service for workers to qualify for Maryland public retirement benefits. Employees would need 15 years on the job (up from the current 5) to qualify for retiree health benefits, and the vesting period for the state’s pension plan would increase from its current five years to 10 years. The commission also wants to shift half of teacher pension costs from the state to local counties.

Fed Treasury Holdings: $1,000,341,000,000

Posted By thestatedtruth.com on December 21, 2010

Auh, so my calculator doesn’t go that high, come again……..In layman terms, we’re talking about a trillion dollars!

Bank Of America May Wish It Was Bank Of Some Where Else!

Posted By thestatedtruth.com on December 21, 2010

WikiLeaks recently said it would target a large U.S. bank.  Bank of America was the rumored victim. This has now been confirmed.

Agence Press France is reporting:

Julian Assange confirmed that WikiLeaks was holding a vast amount of material about Bank of America which it intends to release early next year.

A Letter From The Postman……

Posted By thestatedtruth.com on December 21, 2010

A group of 52 business and financial luminaries have signed an open letter to U.S. Regulators (Geithner, Bernanke, et al.) on the need for national standards on mortgages.

The signators are an impressive yet eclectic group. As an example, we see Nouriel Roubini; William Dunkelberg (NFIB); Bob Eisenbeis; Chris Whalen and Jim Bianco. Many of these names are familiar to this blog through articles we have posted during the past few years. We suggest that politicians pay attention to these suggestions and make adjustments accordingly!

Here’s how they begin:

We the undersigned write to you regarding the urgent need to develop nationalstandards for originating, selling and servicing mortgage loans. The private residential mortgage securitization market is frozen as to new issuance. The housing marketis suffering from a dearth of credit, which is causing a serious lack of confidence among potential homebuyers.

A little bit later, they paint a bleak picture of potential consequences:

Why is there such urgency? Because of the ongoing litany of revelations pertaining to inadequate servicing, lost loan modification documents, and improper foreclosures which reveal significant problems in the mortgage servicing industry. Problems of this magnitude are a threat not only to the economic recovery, but to the safety and soundness of all insured depository institutions. Banks rely upon a functioning secondary market in home mortgages for liquidity management purposes. The chaotic situation in the mortgage market today demands immediate action to ensure all parties are treated fairly and to restore the confidence needed to support a recovery in real estate markets and the entire U.S. economy.

“…..to the safety and soundness of all insured depository institutions†(our emphasis) sounds like systemic risk. They certainly are right that the mortgage market is seizing up.

The foreclosure process seems to be frozen solid. That, in turn, is inhibiting new mortgage securitization.

Let’s hope the letter opens the discussion and moves the problem to page one where it belongs.

Quoted from Art Cashin on the floor of the New York Stock Exchange

A True Story From 1931

Posted By thestatedtruth.com on December 21, 2010

On or around this day in 1931, America was spiraling into the depths of the Depression. Thousands of banks had closed and there was a national panic that more closings might be imminent. And large corporations announced huge layoff programs, stunning many who thought they were safe. Those who had a job were grateful just to be employed.

Among those were a group of construction workers in New York City. As they stood amidst the rubble of demolished buildings in midtown Manhattan, they talked of how lucky they were that some rich guy had hired them for a new but risky development. And since it was near Christmas, they decided to celebrate the fact that they had a job.

They got a Christmas tree from a guy in a lot on the corner who apparently had discovered that folks with apartments don’t need 18 foot trees. So the workers stood the big tree up in the rubble and decorated it with tin cans and other items from the lot. A photographer saw it as a perfect symbol of 1931. It caught on immediately and each Christmas as the project proceeded a new tree was put up. And even after the project (Rockefeller Center) was completed, management put up a new (and much bigger) tree each and every year.

Cumberland Advisors Checks In With A Year End Update

Posted By thestatedtruth.com on December 21, 2010

Jobs, Risk, Uncertainty & Next Year:Â An Elaboration

December 21, 2010

Bob Eisenbeis is Cumberland’s Chief Monetary Economist. Prior to joining Cumberland Advisors he was the Executive Vice President and Director of Research at the Federal Reserve Bank of Atlanta. Bob is presently a member of the U.S. Shadow Financial Regulatory Committee and the Financial Economist Roundtable.

A number of readers have commented on my most recent yearend commentary. In it, I argued that regardless of what additional policy moves may be made, next year’s economic performance is largely baked in the cake. Furthermore, because of the lags in policy, we would be well into next year and the start of election season before we can begin to assess the impacts of the passage of the tax bill and the Fed’s QE2. Consequently, public focus will be dominated by continuing uncertainties and by concerns about employment, neither of which can be materially affected by additional policy moves in the short run.Â

The comments that have flowed in suggest that one point in the commentary may have been misinterpreted. That was the aside that the budget cost of the tax-stimulus package is estimated at $800 billion or more. This was not my estimate, but rather one that was widely cited in news reports.

Most of the respondents argued that the tax package might have little or no cost because it would stimulate growth, which would increase revenues. I didn’t think to go into the tax/cost issue at the time, but here are my thoughts on it.Â

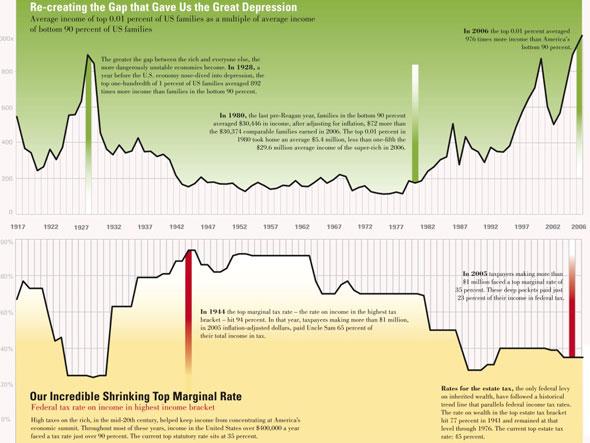

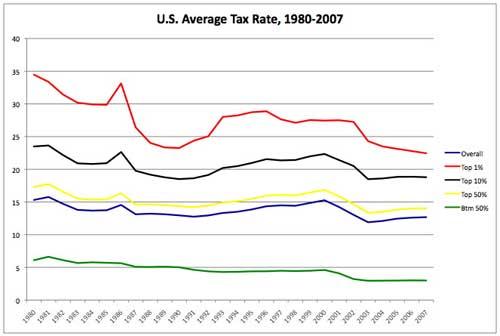

First, the $800-billion estimate in the press was essentially a comparative static estimate. That means it was arrived at by comparing revenues from the current marginal tax rates (which are now extended for two years) with how much additional revenue would have been collected from the new marginal tax rates had the tax cuts not been extended and nothing else had changed. No attempts were made to take into account the fact that, faced with higher marginal tax rates, tax avoidance activities would take place, especially by the “rich†and would reduce revenues that would be collected. For an interesting view on the relationship between taxing the rich and implications for revenues, see the attached chart. The chart shows that historically there is no significant relationship between marginal tax rates on the highest earners and tax revenues collected, even with the Alternative Minimum Tax. Interestingly, revenues collected average about 19% of GDP, hence the flat tax proposal.Â

At the same time, those who suggested that economic growth would be stimulated by extending the cuts ignored the research that suggests permanent tax cuts are what matter, not temporary tax cuts. Ricardian equivalence (a term attributed to the late-18th-century British economist David Ricardo who was also the father of the theory of comparative advantage) tells us that, faced with temporary tax cuts, rational taxpayers realize that their tax bills will have to go up in the future. Therefore, instead of increasing spending and consumption, they increase savings and pay down debt in anticipation of higher tax bills. A similar argument applies to temporary fiscal stimuli like the 2008 tax rebate. Studies of the impacts vary significantly, but surveys and related evidence suggest that most consumers spent a little of the rebate (about 1/3), then paid down debt and/or increased savings with the remainder. The bang was not big for the buck.Â

In truth, it is uncertain what the impacts will be or might have been when it comes to trying to evaluate the tax policies, especially over this next year. Clearly, no one believes that extension of the tax cuts is permanent. The budget uncertainty that results only exacerbates the other sources of uncertainty that I believe will be important in 2011.Â

Bob Eisenbeis, Chief Monetary Economist

Copyright 2010, Cumberland Advisors. All rights reserved.

The preceding was provided by Cumberland Advisors. This report has been derived from information considered reliable, but it cannot be guaranteed as to accuracy or completeness.

Please feel free to forward this Commentary (with proper attribution) to others who may be interested.

At The Train Station The Sign Says: Step To The Back Of The Line Please….Where Is That? How About 1.2 Miles To The Back Of The Line!

Posted By thestatedtruth.com on December 21, 2010

Great Britain….Thousands of Eurostar passengers joined giant lines and were forced to wait for up to seven hours today as the Channel Tunnel rail link was thrown into disarray.

Police were forced to turn away some passengers after the freezing weather conditions ruined journeys at London’s St Pancras station as speed restrictions and cancellations affected the service.

About 6,000 travellers endured freezing temperatures as queues snaked through the main terminal and out into the street stretching to an estimated length of 1.2 miles.

‘Epic Proportions’ Of Snow Expected In Colorado Mountains

Posted By thestatedtruth.com on December 21, 2010

Southern California is looking at record amounts of rain……Interestingly, it was a cool summer and there was no fire season in California this year!

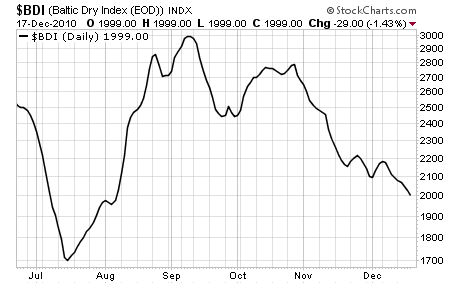

The Baltic Dry Index…..Heading In The Wrong Direction

Posted By thestatedtruth.com on December 20, 2010

The Baltic Dry Index (BDI) is a number issued daily by the London-based Baltic Exchange. It tracks worldwide international shipping prices of various dry bulk cargoes and provides “an assessment of the price of moving major raw materials by sea through 26 shipping routes measured on a timecharter and voyage basis”. So now you know!

Wikileaks Julian Assange Says He Has The Goods On A Big U.S. Bank

Posted By thestatedtruth.com on December 20, 2010

Stay tuned…..This will be a big story, maybe as soon as tomorrow. A heads up, last Friday Bank of America blocked all of Wikileaks payments. So… Is that a hint of a nervous banker?

According to an advance preview of an interview with Julian Assange by the Times of London’s Alexi Mostrous, the Wikileaks founder has announced that he has “enough material to make bosses of a major U.S. bank resign.”

Turn Out The Lights, The Party Is Over!

Posted By thestatedtruth.com on December 20, 2010

$2 Trillion Debt Crisis Threatens To Bring Down 100+ U.S. Cities

Way to go Meredith Whitney…..Logic says the states will be doing huge (really huge) cut backs and layoffs…..So inquiring minds want to know how the economy can grow in these circumstances. To all of the economists out there, it sounds like Meredith is one of the few that gets it!

More than 100 American cities could go bust next year as the debt crisis that has taken down banks and countries threatens next to spark a municipal meltdown, a leading analyst has warned.

Meredith Whitney, the U.S. research analyst who correctly predicted the global credit crunch, described local and state debt as the biggest problem facing the U.S. economy, and one that could derail its recovery.

“Next to housing this is the single most important issue in the U.S. and certainly the biggest threat to the U.S. economy,” Whitney told the CBS 60 Minutes programme on Sunday night.

“There’s not a doubt on my mind that you will see a spate of municipal bond defaults. You can see fifty to a hundred size-able defaults – more. This will amount to hundreds of billions of dollars’ worth of defaults.”

New Jersey governor Chris Christie summarised the problem succinctly: “We spent too much on everything. We spent money we didn’t have. We borrowed money just crazily. The credit card’s maxed out, and it’s over. We now have to get to the business of climbing out of the hole. We’ve been digging it for a decade or more. We’ve got to climb now, and a climb is harder.”

American cities and states have debts in total of as much as $2 trillion. In Europe, local and regional government borrowing is expected to reach a historical peak of nearly €1.3 trillion (£1.1tn) this year.

Illinois has spent twice as much money as it has collected and is about six months behind on creditor payments. The University of Illinois alone is owed $400 million, the CBS programme said. The state has a 21% chances of default, more than any other, according to CMA Datavision, a derivatives information provider.

“It’s all part of the same parcel: public sector indebtedness needs to be cut, it needs a lot of austerity, and it hit the central governments first, and now is hitting local bodies,” said Philip Brown, managing director at Citigroup in London.

U.S. states have spent nearly half a trillion dollars more than they have collected in taxes, and face a $1Â trillion hole in their pension funds.

More at: http://www.guardian.co.uk/business/2010/dec/20/debt-crisis-threatens-us-cities

Solstice Eclipse Overlap First In 456 Years For Canada

Posted By thestatedtruth.com on December 20, 2010

This year’s winter solstice will be an event that will occur on Tuesday in Canada and will coincide with a full lunar eclipse that hasn’t been seen in 456 years.

The celestial eccentricity holds special significance for spiritualities that tap into the energy of the winter solstice, the shortest day of the year and a time that is associated with the rebirth of the sun.

“It’s a ritual of transformation from darkness into light,” says Nicole Cooper, a high priestess at Toronto’s Wiccan Church of Canada. “It’s the idea that when things seem really bleak, (it) is often our biggest opportunity for personal transformation.

Ireland Gets A Warning From ECU

Posted By thestatedtruth.com on December 20, 2010

Isn’t it a little late for the ECU to be threatening about things here, the horse is already out of the barn! Does the ECU have an alternate plan or set of options here….Nope, that’s just what we thought, none!

The European Central Bank warned Ireland that proposed legislation revamping the country’s financial system could threaten some of the ECB’s operations, and pressed Irish officials for assurances that the central bank’s collateral rights will be protected.

The central bank chastised Dublin for its handling of two banks at the heart of Ireland’s crisis, Anglo Irish Bank Corp. and Irish Nationwide Building Society. Draft legislation aiming to restore those banks to financial health “appears to go beyond the position agreed with the IMF and the European Commission in liaison with the ECB, which envisaged a specific resolution plan for these two non viable banks,” the ECB said.

The ECB is concerned about its heavy exposure to Ireland. Though Ireland makes up less than 2% of euro-zone GDP, it accounts for about a quarter of ECB lending to euro-zone commercial banks as Ireland’s banks are increasingly shut out of the interbank lending market. In addition, Irish banks have borrowed about €40 billion ($53 billion) through emergency liquidity assistance available from the Irish central bank.

In the wake of Ireland’s €67.5 billion rescue package agreed to last month with the European Union and International Monetary Fund, the ECB decided to continue making unlimited loans available to banks throughout the currency bloc, at the ECB’s low interest rate, through at least the first quarter of 2011.

Parts from www.thewallstreetjournal.com

Riots Erupt In Bangladesh After Stock Market Plunges 6.7%

Posted By thestatedtruth.com on December 19, 2010

Oh please, they got to be kidding? What are they protesting? Did anyone protest when they made money in the stock market. NO!

After the stock market plunged on Sunday by 552 points or 6.72%, angry investors took to the streets, “threw bricks at police, marched in the streets shouting slogans, and staged a sit-down protest.” Â

“The rising value of the stocks in recent years has attracted hundreds of thousands of small-scale or retail investors in Bangladesh, says the BBC’s Anbarasan Ethirajan in Dhaka. It became a popular investment for ordinary people, often providing higher returns than bank deposits and savings.“

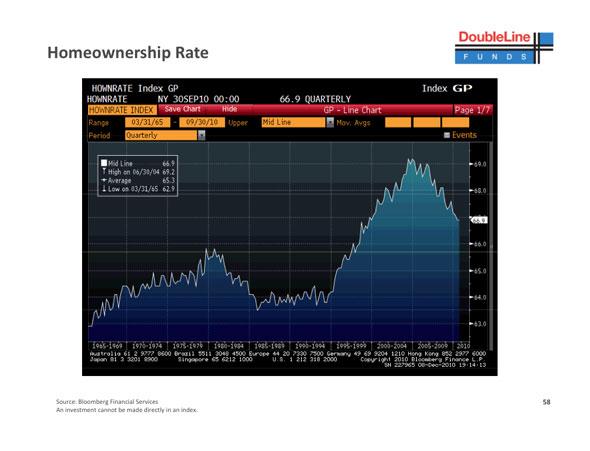

Home Ownership Rates Continue To Decline

Posted By thestatedtruth.com on December 19, 2010

The highest ownership rate of all time was 69.2% around 2005-2006, the low going back to 1965 is 62.9%, and we are currently at 66.9%. The bottom line: It looks like we have a ways to go on the down side!

So What Gives Here In The Stock Market?

Posted By thestatedtruth.com on December 19, 2010

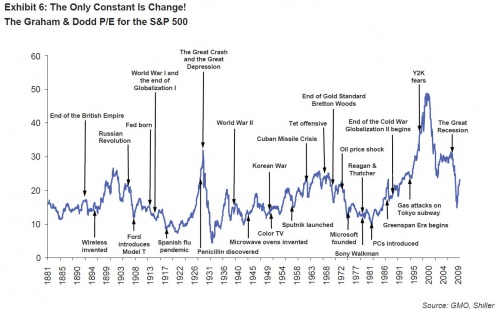

This chart pretty much sums things up……a trading range looks like the most likely scenario at best. If not, well…..everyone probably knows what the alternative would look like. Hint, the word starts with a D as in Down.

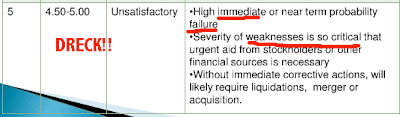

Credit Unions Show Interesting Changes

Posted By thestatedtruth.com on December 19, 2010

Some interesting changes were made on December 16’th concerning Credit Unions!  Stay Tuned!

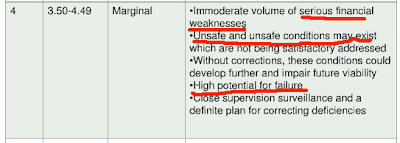

As of the end of  November, 372 federally insured credit unions with assets of $43.4 billion were designated as CAMEL code 4 or 5. In addition, there were 1,792 CAMEL 3 credit unions with assets of $158.2. Overall, 22.3 percent of all credit union assets are in CAMEL code 3, 4 or 5 credit unions.

What does CAMEL 4-5 mean? Answer:

Â [1]

[1]What does CAMEL 3 mean?

Minutes of a board meeting by the National Credit Union Administration show a meeting took place on December 16th. The exact same day that Congress was voting to approve S.4036. The language:

New sub-part C of Part 708a establishes procedural and substantive requirements for converting a credit union to a bank through merger.

They change the rules so that the commercial banks can play in this space? This change to the charter is also interesting:

The new requirements apply to direct mergers as well as transactions where the credit union first converts to a mutual savings bank (MSB) and then merges with another bank without operating as a stand-alone MSB.

This suggests that a Credit Union can become a Mutual Savings Bank in the morning, and in the afternoon it can merge or sell itself to a commercial bank. What do they need to get all of this done? SECRECY, of course. From the NCUA 12/16 minutes:

Finally, the proposed amendments to Parts 708a and 708b revise existing rules to enhance the secrecy and integrity of the voting process in MSB and insurance conversions.

Given that this can now be accomplished with the desired level of secrecy we would anticipate that the process will commence sometime in 2011. Some of the big banks will step in and buy up the shells of a number of the corporate Credit Unions.

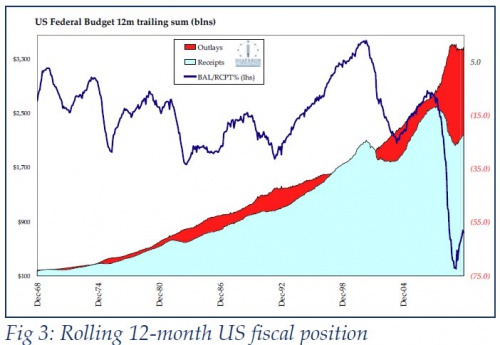

U.S. Federal Budget Chart

Posted By thestatedtruth.com on December 19, 2010

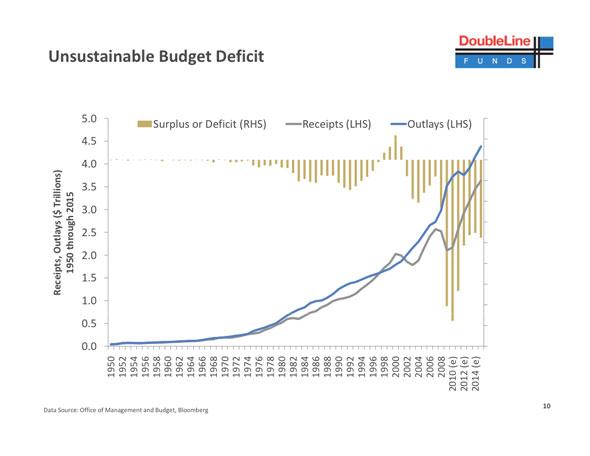

Well, the receipts (aqua color) aren’t looking so good, but the outlays (red color) are rolling to the upside. Just the opposite of what should be happening.

Â

President Obama Is Expected To Announce Cuts To Social Security During His State Of The Union Address According To Politico Which Quotes “Well-Placed Sources.”

Posted By thestatedtruth.com on December 19, 2010

Austerity anyone? This will be political suicide for the Democrats, plain and simple.

“The tax deal negotiated by President Barack Obama and Senate Republican leader Mitch McConnell of Kentucky is just the first part of a multistage drama.” Next up on the path of what many see as the terminal alienation of the president from his liberal constituency, will occur during the State of the Union Address, when the President is expected to announce cuts in Social Security, according to Politico which quotes “well-placed sources”.

The U.S. debt will be about $14.1 trillion by the end of January, just $200 billion away from the debt ceiling breach. Therefore, as Robert Kuttner of politico speculates: “The idea is to pre-empt an even more draconian set of budget cuts likely to be proposed by the incoming House Budget Committee chairman, Rep. Paul Ryan (R-Wis.), as a condition of extending the debt ceiling’.

Britain On Track For Coldest Winter Ever

Posted By thestatedtruth.com on December 18, 2010

Coldest December (so far)Â since records began as temperatures plummet to minus 10CÂ bringing travel chaos across Britain…..

Britain skidded to a halt today as the big freeze returned by grounding flights, closing rail links and leaving traffic at a standstill.

Tonight the nation is braced for another 10 inches of snow and more sub-zero temperatures, with no let-up in the bitterly cold weather. The Arctic conditions are set to last through Christmas and New Year’s day and maybe beyond as temperatures plummeted to -10c (14f) the Met Office said. This December is ‘almost certain’ to become the coldest since records began in 1910.

Quote Of The Day

Posted By thestatedtruth.com on December 18, 2010

“Make Each Day A Masterpiece!”

John R. Wooden – UCLA Basketball Coach

All The More Reason To Ask How The Real Estate Bubble Got So Large

Posted By thestatedtruth.com on December 17, 2010

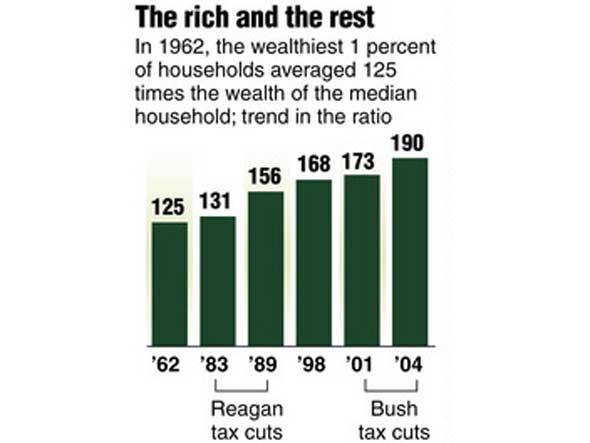

The Wealth Gap

Posted By thestatedtruth.com on December 17, 2010

Â

U.S. Tax Rate Chart

Posted By thestatedtruth.com on December 17, 2010

From: http://www.businessinsider.com/20-more-tax-facts-that-will-make-your-head-explode-2010-4#tax-rates-are-declining-for-everyone-especially-the-top-1-19

Copyright © 2025 The Stated Truth