Posted By thestatedtruth.com on May 22, 2011

One has to respect Jim Grant’s views….we couldn’t have said it better ourselves!

From AP:

A graduate of Indiana University, Grant, 64, was a Navy gunner’s mate before starting his journalism career at the Baltimore Sun in 1972. He then joined the financial weekly Barron’s before starting Grant’s Interest Rate Observer in 1983.

As stocks were falling last week, Grant visited The Associated Press in New York to talk about why it’s not just stock investors who should be worried. Below are excerpts, edited for clarity, from a wide-ranging conversation in which he lit into the Federal Reserve for our current troubles, warned of 10 percent inflation and waxed nostalgic for a time when Washington had the courage to let prices fall in crises rather than goose them up and prolong our agony.

Q: What’s your view of the stock market?

A: The Federal Reserve has unilaterally taken it upon itself to levitate asset prices. It is suppressing interest rates. When you’re not getting anything on your savings, you are inclined to go out and buy something, anything, to generate either income or the expectation of capital gains. So the things that we take as prices freely determined are in fact manipulated.

A few months ago, (Fed Chairman) Ben S. Bernanke, Ph.D., the former chairman of the Princeton economics department, stood before the cameras of CNBC and said that the Russell 2000 is making new highs. The Russell! He sounded like another stock jockey. He was taking credit for new highs in the small cap equities index. The Fed, as never before, or rarely before, is now the steward of this bull market. One wonders what it will do if stocks pull back significantly.

Q: Are stocks overvalued?

A: Some big multinationals left behind in the past ten years (like) Wal-Mart, Cisco Systems, Johnson & Johnson appear to be attractively priced. But generally speaking, things are rich.

Q: What would you have done in the financial crisis if you had been in Bernanke’s position?

A: Resign. I don’t know. I have great faith in the price mechanism, in the mechanics of markets. I think there should have been much less intervention and we should have let some chips fall, many chips fall.

Before the Great Depression, there was a great depression (lower case `g’) in 1920-21. Within 18 months, the GDP was down double digits and commodity prices collapsed. Harry Truman lost his haberdashery in Kansas City. It was very painful, but it ended. And the Fed, during that depression, actually raised its discount rate and the Treasury ran a surplus. The reason it ended was the so-called real balance effect — that is, prices came down and people with savings saw things that were cheap and they invested. That’s the fast and ugly approach.

The slow and ugly approach is to mitigate, temporize and forestall to give us time to work ourselves out of difficulties. That’s the current approach. I think it’s intended to be a more humane approach, but I wonder about its humanity. I mean these college kids get out of school and they’ve got nothing. It’s awful — 9 percent unemployment and going nowhere except sideways.

Q: But Bernanke has succeeded by some measures. Big companies are flush with cash, their profits are on track to hit a record this year and the riskiest among them are raising money at the lowest rates ever. Who could have imagined this during the depths of the financial crisis?

A: Let’s go back to the previous cycle of 2002-3. Cisco Systems was for 15 minutes the costliest company on the face of the earth, and digital technology was about to raise every human being out of poverty. OK, so that cycle ends — Bang! — with general disarray in the stock market. What do we do? Well, we press down interest rates and we give residential real estate a little helping hand. What’s not to like? Home ownership rates are rising. Stocks are up. Risky companies are issuing debt at levels never before imagined.

Who would have dreamt such an outcome was possible after the tech bust? And that ended noisily and here we are again and our monetary masters have devised new, even more audacious methods of stimulus. In three or four years we’ll look back and say, `Can you believe we fell for this again?’

It does seem improbable that the inflation rate would ever get beyond 3.5 percent, let alone knock on the door of 10 percent. But I’m here to tell you it’s going to 10 percent.

Q: Won’t policymakers come down hard if we get even 6 percent inflation and try to lower that?

A: Sometimes they can’t control things. We had 6 percent inflation before. Washington is full of well-intentioned people. Ben Bernanke keeps saying that what we really need is a little inflation. He says we’ll get 2 percent or a little bit more. You shouldn’t even think that, let alone say it out loud. That’s such bad luck to tempt fate by saying that you can calibrate things like that. You can’t do that.

Q: So with inflation ahead, are you buying gold at $1,480 an ounce?

A: I am not buying it now. I have bought it in the past. Gold is a very difficult investment because its value is indeterminate. It is the reciprocal of the world’s confidence in the likes of Ben Bernanke. I think the price will go higher.

Q: Let’s talk about the dollar. Washington says it wants a strong dollar.

A: It’s disingenuous when (Treasury Secretary) Tim Geithner says he’s for a strong dollar. What he means to say is the economy stinks and we need even greater oomph from our exports and for that we would like a much lower dollar in a measured, managed kind of decline. That’s what he wants, and he wants it by November 2012.

Q: What’s wrong with a weak dollar? Caterpillar recently said it is nearly doubling its capital spending because the weak dollar allows it to sell more overseas. It plans to spend much of that on factories in the U.S., paying construction workers to build them and hiring people to work in them.

A: Well, that is the Caterpillar story. The whole manufacturing story in the U.S. is very sunny, and it’s in part due to the state of the dollar. But if (prosperity) were as easy as debasing one’s currency, think of all the countries that would be prosperous that are rather the opposite. Argentina would be booming. And Weimar Germany would not be a story of failure but of success.

If the world were to lose confidence in (the dollar) we would suddenly be in a much less advantageous financial position. The U.S. is uniquely privileged in that we alone may pay our bills in the currency that only we may lawfully print. That’s our prerogative as the reserve-currency country. But it has seduced us into a state of complacency. We never actually pay the rate of interest that we might be expected to pay — the real rate of interest — on Treasury debts.

It’s great for now that we’re paying 2.5 percent or whatever on our public debt. But wouldn’t it be better if there were an accurate price signal that was telling us that we’re borrowing too much?

Q: If investors lose their faith in the dollar, what would replace it?

A: I think there will be a gold standard again in your lifetime, if not mine. It’s the only answer to the question, if not the dollar, then what?

Q: Where should people put their money now?

A: The trouble with the present is that nothing is actually cheap. My big thought is that our crises are becoming ever closer in time. The recovery time from the Great Depression was 25 years. The stock market peaked in 1929. It got back there in 1954. We had a peak in 2000, crash, levitation, then the biggest debt crisis in anybody’s memory. The cycles are becoming compressed. The temptation to become invested at peaks of these shorter cycles is ever greater.

Perhaps one way to proceed is to hold cash at the opportunity cost of not much in Treasury bills. You make nothing, but you want to have this money when things are absolutely, not just relatively, cheap. This time of full or overvaluation shall pass. On recent form, it’ll pass in a thunderclap and there will be a panic and it’ll seem as if the world’s ending. And that’s when somebody who is nimble can get fully invested in a comfortable way.

It won’t feel comfortable, it will feel awful, but I think that’s the way to do it. I mean everything (you could invest in) is either uninteresting or rich, it seems to me.

Q: What about Treasury bonds?

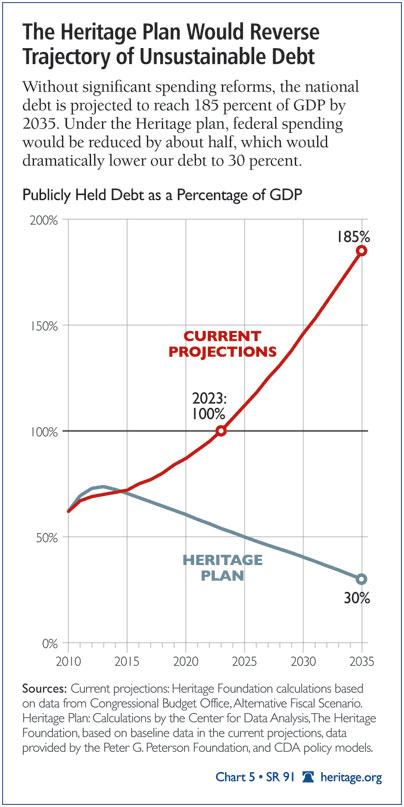

A: I think it’s useful to imagine how things might look ten years hence. What will one’s children, heirs or successors think about a purchase today of ten-year Treasurys at 3.25 percent? They’ll look back and say, `What were they thinking?’ The (federal deficit) was running at 10 percent of GDP, the Fed had pressed its interest rates to zero, it had tripled the size of its balance sheet, and they bought bonds? Treasurys are hugely uninteresting, as is similar government debt the world over.

Q: Any last thoughts?

A: Because the Fed has coaxed or cajoled people into stocks, including many financial non-professionals, I think it has moral ownership of the market in a way that no recent Fed has had. Either the stock market owns the Fed, or vice versa but they are too intertwined now. If stocks pull back by 20 percent, how can Bernanke just sit there and say, `I want a bear market?’ I think he has some moral responsibility for the finances of the non-professionals who bought.

Q: Does this mean the Fed might announce QE 3, a third round of quantitative easing to lower rates and raise stock prices?

A: Yeah, it means QE 3 through QE N.

Category: Commentary, Commodities, Economy, Finance, Interest Rates, Bonds, National News, News Letters, Wall Street |

613 Comments »

Tags: Grants Interest Rater Observer, Interest rates, Jim Grant