Posted By thestatedtruth.com on July 19, 2011

Unlike back in the day when everything was East vs. West….the Soviets and China vs NATO and the United States, we are now interconnected to everywhere and everything. There used to be an old saying, “One man’s pain is another man’s gain”, but now one man’s pain very well may end up being pain for all men (and women) the world over because the Western world no longer has financial discipline. We have never been so interlinked before. In the past, it would have been nonsense to think a small country like Greece could jeopardise the entire world economy. So you might ask why has this changed, please explain?

Well, we’ll try….lets start with unregulated derivatives. There are now so many bets in the system concerning the economy, national sovereign debt, stock market hedges, real estate and interest rate hedges etc., that nobody honestly has a clue how big or really bad a negative outcome might be. If one side of the derivative doesn’t get paid on a contract, then it will likely set off a chain reaction of dominoes, that’s because much of the action is repetitious or laid off to other players and so forth on down the line, so if one of the participants doesn’t get paid, neither will the lower rungs. That’s what threatened to happened in 2008, and that’s why the banks were saved along with the large brokerages and insurance companies. Don’t think it can’t happen again. The derivative pools are now larger than ever….so are the banks. Another negative unexpected surprise connected to derivatives could set off the greatest economic calamity in human history. The years 2012-2014 could be very tough indeed. Capice!

Here is a crude definition of a Derivative A derivative is a financial instrument whose value depends on underlying variables. The most common derivatives are futures, options, and swaps but may also include other tradable assets such as a stock or commodity or non-tradeable items such as the temperature (in the case of weather derivatives), the unemployment rate, or any kind of (economic) index. A derivative is essentially a contract whose payoff depends on the behavior of a benchmark and the bets can be made on either side of an outcome. So in a cruel example, let’s say someone could bet on their neighbors house burning down…if it burns down, they would collect on the insurance bet, but let’s say 100 other participants also held insurance in addition to the homeowner, they would all benifit from the negative event. This might also create an unintended incentive to lite the match. Get the drift. But laws don’t allow this kind of a thing on a house….but they do allow particpants to bet on the demise of countries and companies. Sometimes just the bet itself, if big enough, can make the event more likely to happen.

In todays world there are many positive and negative derivative outcomes possible. Just in the world economy itself, handsome payoffs will go to players if in the event certain things happen during a set time line covered in the contract. Sometimes those outcomes can be gamed and ganged up on especially if the players are large and multiple in number….if it happens at the wrong time or to the wrong thing (such as an unexpected interest rate rise or currency collapse etc.) we’ll all be in trouble.

The essay on Greece reviewed below is by Graham Summers of Phoenix Capital Research and was posted on ZeroHedge

07/19/2011

This is a continuation of my first essay, How Greece Could Create Another Round of Systemic Risk Pt 1. That essay focused on how Greece, while a small player in the Eurozone, could trigger another round of systemic risk as a result of the interlaced European banking system.

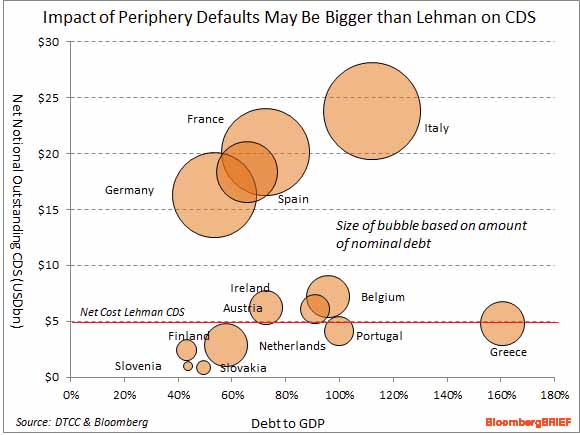

Now this is where things get REALLY tricky. Because of the intertwined nature of the derivatives market, a Greek default could result in systemic risk for the simple fact that if one of the banks that goes down with Greece has extensive exposure to Spain as well, then things could get ugly very, VERY fast.

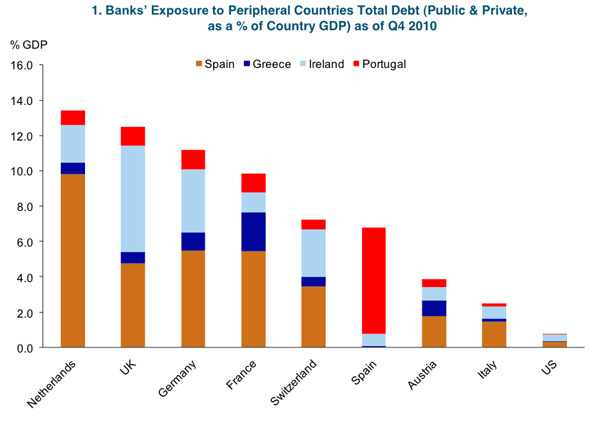

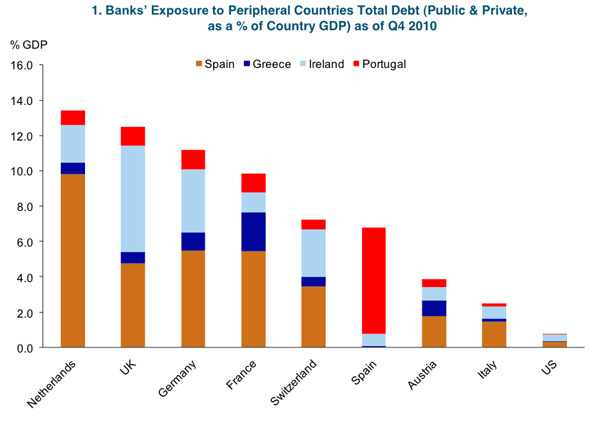

Indeed, as stated before, 70% of exposure to Portugal, Ireland, Greece, and Spanish debt is from foreign entities. The below chart from BusinessInsider does an excellent job of revealing just how big systemic risk is based on EU debt.

The above chart shows the bank exposure to peripheral countries debt as a percentage of GDP. For instance, UK bank exposure to Irish debt is roughly equal to a little over 6% of UK GDP, German exposure to Spanish debt is north of 5% of German GDP, etc.

To say that systemic risk is a MAJOR problem for the EU would be the understatement of the year. For instance, if Portugal defaults, Spain’s banks will get taken to the cleaners. This in turn could trigger a HUGE systemic collapse as exposure to Spanish debt is equal to 4% or more of GDP for Switzerland, France, Germany, the UK, and the Netherlands.

And it’s not as though the US is somehow free from this either. Altogether the US has $390 billion worth of exposure to PIGS (Portugal, Ireland, Greece, and Spain) debt. While not an enormous amount of money relative to US GDP (it’s roughly 3% or so), we must remember that the US commercial banks have over $240 TRILLION in derivative exposure on their balance sheets.

And 82% of this ($200 trillion) is related to interest rates.

This is why Europe is BIG deal: a collapse in the bond markets there would push interest rates through the roof and result in various interest rate spreads (LIBOR, Treasury to Swiss Franc, etc) going haywire, which in turn could trigger another Lehman type event in the derivative market.

Remember, the financial system is even more leveraged today than it was during the Tech Bubble. So a derivative collapse from anywhere could trigger a sharp sell-off as banks and institutions have to sell positions to meet margin/ redemption calls. Which in turn would result in more selling and so forth.

www.zerohedge.com

Category: Commentary, Economy, Finance, Interest Rates, Bonds, National News, Wall Street |

3 Comments »

Tags: Connected, derivatives, Greece, World Economy