Posted By thestatedtruth.com on October 3, 2011

We should say this is a horrific economic crisis that’s about to get (out of) hand…..Debt is a very cruel master. It will almost always bring more pain and suffering than you anticipated. It is easy to get into debt, but it is very difficult to get out of debt. In the end, we will see that the debt-fueled prosperity that the western world has been enjoying for decades was just an illusion.

You can never solve a debt problem with more debt, which is what governments are trying to do, it has never worked. The next several years are going to be incredibly clear on why debt is bad.When the dominoes start to fall, we are going to witness a financial avalanche which is going to destroy the finances of millions of people. But you have been warned….don’t let this warning go unheeded!

All across the western world, governments and major banks are rapidly becoming insolvent. So far, the powers that be are keeping all of the balls in the air by throwing around lots of bailout money. But now the political will for more bailouts is drying up and the number of troubled entities seems to grow by the day. Right now the western world is facing a debt crisis that is absolutely unprecedented in world history. Europe has had a tremendously difficult time just trying to keep Greece afloat, and several much larger European countries are now on the verge of a major financial crisis. In addition, there is a growing number of very large financial institutions all over the western world that are also rapidly approaching a day of reckoning.

If things go really badly, things could totally fall apart in a few weeks. But more likely it will be a few more months until the juggling act ends.

Right now, the banking system in Europe is coming apart at the seams. Because the global financial system is so interconnected today, when major European banks start to fail it is going to have a cascading effect across the United States and Asia as well.

The financial crisis of 2008 plunged us into the deepest recession since the Great Depression.

The next financial crisis could potentially hit the world even harder.

The following are 12 quotes from insiders that are warning about the horrific economic crisis that is almost here….

#1 George Soros: “Financial markets are driving the world towards another Great Depression with incalculable political consequences. The authorities, particularly in Europe, have lost control of the situation.”

#2 PIMCO CEO Mohammed El-Erian: “These are all signs of an institutional run on French banks. If it persists, the banks would have no choice but to delever their balance sheets in a very drastic and disorderly fashion. Retail depositors would get edgy and be tempted to follow trading and institutional clients through the exit doors. Europe would thus be thrown into a full-blown banking crisis that aggravates the sovereign debt trap, renders certain another economic recession, and significantly worsens the outlook for the global economy.”

#3 Attila Szalay-Berzeviczy, global head of securities services at UniCredit SpA (Italy’s largest bank): “The only remaining question is how many days the hopeless rearguard action of European governments and the European Central Bank can keep up Greece’s spirits.”

#4 Stefan Homburg, the head of Germany’s Institute for Public Finance: “The euro is nearing its ugly end. A collapse of monetary union now appears unavoidable.”

#5 EU Parliament Member Nigel Farage: “I think the worst in the financial system is yet to come, a possible cataclysm and if that happens the gold price could go (higher) to a number that we simply cannot, at this moment, even imagine.”

#6 Carl Weinberg, the chief economist at High Frequency Economics: “At this point, our base case is that Greece will default within weeks.”

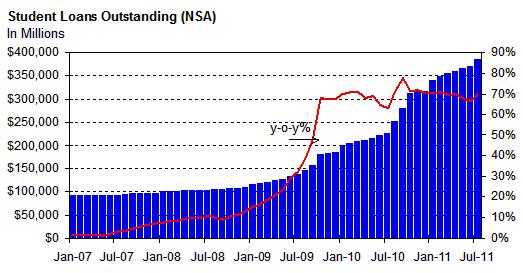

#7 Goldman Sachs strategist Alan Brazil: “Solving a debt problem with more debt has not solved the underlying problem. In the US, Treasury debt growth financed the US consumer but has not had enough of an impact on job growth. Can the US continue to depreciate the world’s base currency?”

#8 International Labour Organization director general Juan Somavia recently stated that total unemployment could “increase by some 20m to a total of 40m in G20 countries” by the end of 2012.

#9 Deutsche Bank CEO Josef Ackerman: “It is an open secret that numerous European banks would not survive having to revalue sovereign debt held on the banking book at market levels.”

#10 Alastair Newton, a strategist for Nomura Securities in London “We believe that we are just about to enter a critical period for the eurozone and that the threat of some sort of break-up between now and year-end is greater than it has been at any time since the start of the crisis”

#11 Ann Barnhardt, head of Barnhardt Capital Management, Inc.: “It’s over. There is no coming back from this. The only thing that can happen is a total and complete collapse of EVERYTHING we now know, and humanity starts from scratch. And if you think that this collapse is going to play out without one hell of a big hot war, you are sadly, sadly mistaken.”

#12 Lakshman Achuthan of ECR: “When I call a recession…that means that process is starting to feed on itself, which means that you can yell and scream and you can write a big check, but it’s not going to stop.”

*****

In my opinion, the epicenter of the “next wave” of the financial collapse is going to be in Europe. But that does not mean that the United States is going to be okay. The reality is that the United States never recovered from the last recession and there are already a lot of signs that we are getting ready to enter another major recession. A major financial collapse in Europe would just accelerate our plunge into a new economic crisis.

If you want to read something that will really scare you, then you should check out what Dr. Philippa Malmgren is saying. Dr. Philippa Malmgren is the President and founder of Principalis Asset Management. She is also a former member of the Bush economic team.

Malmgren is claiming that Germany is seriously considering bringing back the Deutschmark. In fact, she claims that Germany is very busy printing new currency up. In a list of things that we could see happen over the next few months, she included the following….

“The Germans announce they are re-introducing the Deutschmark. They have already ordered the new currency and asked that the printers hurry up.”

This is quite a claim for someone to be making. You would think that someone that used to work in the White House would not make such a claim unless it was based on something solid.

If Germany did decide to leave the euro, you would see an implosion of the euro that would be truly historic.

The only way that the euro would have had a chance of working is if all of the governments using the euro would have kept debt levels very low.

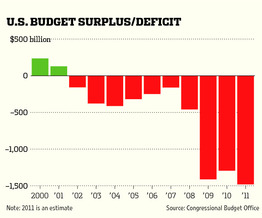

Unfortunately, the financial systems of the western world are designed to push governments into high levels of debt.

The truth is that the euro was doomed from the very beginning.

Now we are approaching a day of reckoning. We have been living in the greatest debt bubble in the history of the world, but the bubble is ending. There are several ways that the powers that be could handle this, but all of them will lead to greater financial instability.

In the end, we will see that the debt-fueled prosperity that the western world has been enjoying for decades was just an illusion.

Debt is a very cruel master. It will almost always bring more pain and suffering than you anticipated. It is easy to get into debt, but it can be very difficult to get out of debt.

There is no way that the western world can unwind this debt spiral easily.

The only way that another massive economic crisis can be put off for even a little while would be for the powers that be to “kick the can down the road” a little farther by creating even more debt.

But in the end, you can never solve a debt problem with more debt.

The next several years are going to be an incredibly clear illustration of why debt is bad.

When the dominoes start to fall, we are going to witness a financial avalanche which is going to destroy the finances of millions of people.

Parts from www.zerohedge.com

Category: Commentary, Economy, Finance, Inspirational, National News, Personal Net Worth, Wall Street |

49 Comments »

Tags: Europe Banks, Financial Warnings, Insolvent Banks