Time To Send Off Another Letter To Your Congressman….Household Income Figures Since 1975, All Of Us Pinions Vs Memebers Of Congress

Posted By thestatedtruth.com on September 20, 2013

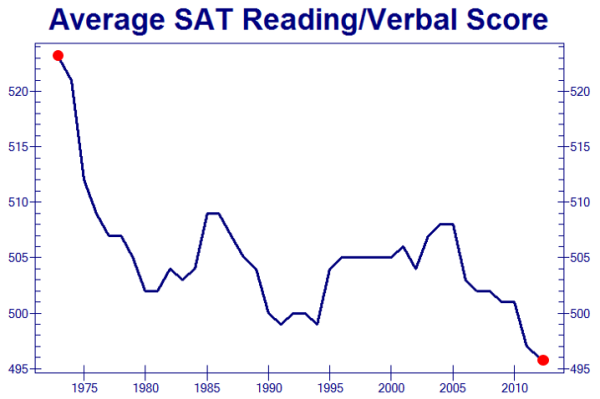

Here’s a full history of the Census Bureau’s figures for median household income. Notice that median household income in 2012 is below the 1989 figure. That’s 23 years. Not so good.

Now let’s look at things from 1975, which is the begining of these records…..Median household income has increased by a cumulative, grand total of 11% or $5,229 over 37 years (from $45,788 in 1975 to $51,017 in 2012). Remember, we’re talking total household income here. Pitiful to say the least!

But this is where things get interesting…in 1975 a Member of Congress (House of Represenitives and Senators) recieved pay of $44,600 and the median household income was $45,500, Let’s push ahead to 2012, actually 2010 is the latest data available for Congress, and we see a Member of Congress had a pay of 174,000 (according to the Congressional Reasearch Service) vs median household income of (approx) $51,300. So, while the rest of use pinions had a raise in our total household income of 11% all total since 1975, our finest men and women of Congress (bums) saw an increase of 339% in their income!

In addition to this, our finest in Congress excluded themselves from Obama Care, yep, but we are saddled with it, and they exluded themselves from the laws of stock insider trading! Yes, they are allowed to trade and profit from stocks on non public information.

Get out the pen and send off a copy of this report to your Congress person! Let them know just how mad you are.

Source: Wise Dog

Interesting Tid Bit On Our Privacy From Back In 1978

Posted By thestatedtruth.com on September 18, 2013

Question…..Did anybody think that our privacy was being compromised back in 1978? Answer….Probably not. But sure enough and to our surprise it’s the wrong answer.

Back on February 24, 1978 The Rockford Files Season 4 Episode 12 was viewed on NBC and the following caption was shown at the end of ‘ The House On Willis Street’ part 2. This episode was about new secret computer centers being set up to gather records on 250 million citizens.

Here is the caption that ran at the end of that show, NBC Prime Time:

“Secret information centers, building dossiers, on individuals exist today. You have no legal right to know about them, prevent them, or sue for damages. Our liberty may well be the price we pay for permitting this to continue unchecked.”

Member,

U.S. Privacy Protection Commission

Hmm? That was 35 years ago and most computer power came from mainframes or new mini computers which were rapidly replacing the mainframes. Here are some ancient computer systems of that era….. IBM’s System 370’s, SperryRand UNIVAC’s, Data General Eclipse’s and Digital Equipments Vax 11 Series etc. PS…. In the Rockford episode, Sperry UNIVAC’s looked to be running!

Source: Wise Dog

Donald Kohn Comments Send Him To The Back Of The Line For Next Fed Chairmanship

Posted By thestatedtruth.com on September 16, 2013

Wise Dog Sources believe that Kohn is NOT a deregulator as Summers was perceived to be, and his comments that we review below essentially take him out of the Federal Reserve Chairman job opening!

Wikepedia: Donald Lewis Kohn (born November 7, 1942) is an American economist who served as the former Vice Chairman of the Board of Governors of the Federal Reserve System. He is considered a moderate dove on monetary policy. He retired after 40 years at the central bank in September, 2010.

So here we go…..Donald Kohn drops the following headline bomb-shells at a Brookings’ event this morning:

More Headlines (via Reuters):

- KOHN: GREATER FINANCIAL TRANSPARENCY NEEDED TO ENSURE STABILITY

- KOHN COMMENTS ON PRINCIPLES OF PROTECTING FINANCIAL SYSTEMS IN GENERAL

- KOHN: US IN EXPERIMENTAL STAGE OF REGULATING FINANCIAL RISKS

- KOHN: US REVIEWING INDICATORS OF FINANCIAL RISKS FOR POTENTIAL DEEPER DIVES

- KOHN: DON’T EXPECT TOO MUCH FROM FINANCIAL SYSTEM OVERSIGHT

- KOHN: FINANCIAL OVERSIGHT WON’T PREVENT MAJOR CRISES, RATHER BUILD SYSTEM RESILIENCE

Ian Talley at the Wall Street Journal …..notes some other – ‘less-than-uber-dovish’-comments:

“Very easy monetary policy often builds imbalances that may become so large that can’t be countered by regulation,”

…

“Problems can arise when one policy [monetary or financial regulation] is leaning so hard in one direction, the other can’t compensate, can’t achieve its objectives. And in these extreme kinds of circumstances, each policy may need to pay more attention to the objectives of the other’s.”

…

“We can see in the United Kingdom, in my role on the financial policy committee in the U.K., how useful it is to have an autonomous group, an autonomous voice, that can say to the monetary authorities, or the governmental authorities, you’re pushing so far in this direction, we’ve used our regulatory tools, but we think you are creating instabilities.”

The Sources Used In This Article Are Thought To Be Reliable: Wise Dog, and www.zerohedge.com

Five Years After A World Economic Meltdown, BIS (Bank of International Settlements) Ex-Chief Economist Warns “It’s Worse This Time”

Posted By thestatedtruth.com on September 15, 2013

It’s concerning how so many people now think that “things are different this time”! But since complacency has hit an all time record, it’s unlikely to end well.

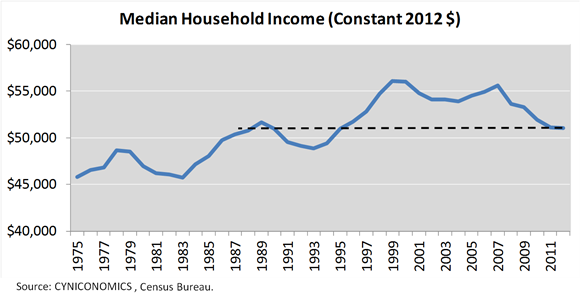

The Swiss-based BIS `bank of central banks’ said a hunt for yield was luring investors en masse into high-risk instruments, “a phenomenon reminiscent of exuberance prior to the global financial crisis”.

The former chief economist at the BIS now warns, “this looks like to me like 2007 all over again, but even worse.” The share of “leveraged loans” or extreme forms of credit risk, used by the poorest corporate borrowers, has soared to an all-time high of 45% , 10 percentage points higher than at the peak of the crisis in 2007.

As The Telegraph reports, ex-BIS Chief Economist William White exclaims, “All the previous imbalances are still there. Total public and private debt levels are 30pc higher as a share of GDP in the advanced economies than they were then, and we have added a whole new problem with bubbles in emerging markets that are ending in a boom-bust cycle.”

Crucially, the BIS warns, nobody knows how far global borrowing costs will rise as the Fed tightens or “how disorderly the process might be… the challenge is to be prepared.” This means, in their view, “avoiding the tempatation to believe the market will remain liquid under stress – the illusion of liquidity.”

The Swiss-based `bank of central banks’ said a hunt for yield was luring investors en masse into high-risk instruments, “a phenomenon reminiscent of exuberance prior to the global financial crisis”.

…

[The BIS] was the only major global body that clearly foresaw the global banking crisis, calling early for a change of policy at a time when others were being swept along by the euphoria of the era.

Mr White said the five years since Lehman have largely been wasted, leaving a global system that is even more unbalanced, and may be running out of lifelines. “The ultimate driver for the whole world is the US interest rate and as this goes up there will be fall-out for everybody. The trigger could be Fed tapering but there are a lot of things that can go wrong. I very am worried that Abenomics could go awry in Japan, and Europe remains exceedingly vulnerable to outside shocks.”

…

The BIS quietly scolded Bank of England Governor Mark Carney and his eurozone counterpart Mario Draghi, saying the attempt to use “forward guidance” to hold down long-term rates by rhetoric alone had essentially failed. “There are limits as to how far good communications can steer markets. Those limits have become all too apparent,” said Mr Borio.

Think its different this time and that we are indeed invincible – after all Maria Bartiromo and Hank Paulson told us so on Meet The Press this morning, right? Wrong! Here are the facts… (Via The BIS),

A trend favouring riskier lending was also evident in the syndicated loans market. A concrete manifestation was the growing popularity of “leveraged” loans, which are extended to low-rated, highly leveraged borrowers paying spreads above a certain threshold. The share of these loans in total new signings reached 45% by mid-2013, 30 percentage points above the trough during the crisis and 10 percentage points above the pre-crisis peak.

So just as leveraged loans were gaining in importance, a declining portion of the new issuance volume featured creditor protection in the form of covenants.

Covenant light loans have ended badly in the past……and the probabilities are they will likely end badly now!

Mr White said the world has become addicted to easy money, with rates falling ever lower with each cycle and each crisis. There is little ammunition left if the system buckles again. “I don’t know what they will do: Abenomics for the world I suppose, but this is the last refuge of the scoundrel,” he said.

The NSA Knows All About Your Credit Card Spending Habits

Posted By thestatedtruth.com on September 15, 2013

Wise Dog Sources:

For the third time in the past few weeks Tyler Durden of Zero Hedge has scooped a block buster story on the tracking and recording habits of the NSA (National Security Agency). You can review the previous two stories right here at The Stated Truth by scrolling down to September 2nd (Say It Ain’t So….The Hemisphere Project (Formerly Known As) Hudson Hawk) Involves Over 4 Billion Recorded Phone Calls Per Day)……and September 8th (NSA Has Full “Back Door” Access To iPhone, BlackBerry And Android Smartphones, Documents From Germany’s Spiegel Reveal).

The latest report from Germany’s Spiegel says that “The National Security Agency (NSA) widely monitors international payments, banking and credit card transactions” and has even created an internal branch titled appropriately enough “Follow The Money” (FTM). Once collected, the data then flows into the NSA’s own financial databank, called “Tracfin,” which in 2011 contained 180 million records. Some 84 percent of the data is from credit card transactions.

The NSA’s Tracfin data bank also contained data from the Brussels-based Society for Worldwide Interbank Financial Telecommunication (SWIFT), a network used by thousands of banks to send transaction information securely. SWIFT was named as a “target,” according to the documents, which also show that the NSA spied on the organization on several levels, involving, among others, the agency’s “tailored access operations” division. One of the ways the agency accessed the data included reading “SWIFT printer traffic from numerous banks,” the documents show.

From Zero Hedge………

With the NSA already tracking and recording every form of communication and electronic data exchange, it would hardly come as a surprise that the final piece of the puzzle was also actively being intercepted and collected by General Keith Alexander’s superspy army: money, or rather tracking the global flow thereof.

Which is why we were not surprised to learn just this, following the latest report from Germany’s Spiegel that “The National Security Agency (NSA) widely monitors international payments, banking and credit card transactions” and has even created an internal branch titled appropriately enough “Follow The Money” (FTM). Once collected, the data then flows into the NSA’s own financial databank, called “Tracfin,” which in 2011 contained 180 million records. Some 84 percent of the data is from credit card transactions.

Stated simply: every time you “charge it” and a credit card is swiped, literally or metaphorically, the NSA knows all about it and if it triggers a specific filter, congratulations: the NSA will be tracking your every transaction in perpetuity.

Further NSA documents from 2010 show that the NSA also targets the transactions of customers of large credit card companies like VISA for surveillance. NSA analysts at an internal conference that year described in detail how they had apparently successfully searched through the US company’s complex transaction network for tapping possibilities.

Their aim was to gain access to transactions by VISA customers in Europe, the Middle East and Africa, according to one presentation. The goal was to “collect, parse and ingest transactional data for priority credit card associations, focusing on priority geographic regions.” In response to a SPIEGEL inquiry, however, a VISA spokeswoman ruled out the possibility that data could be taken from company-run networks.

Odd: we fail to recall smartphone makers admitting the NSA has full back door access to their products, and only got confirmation following yet another report from Spiegel last weekend. Which is why we tend to take VISA’s “ruling out” of any possibility with a grain of salt, and would rather be far more curious what if any backdoor funding channels exist between credit card processors and the espionage service to the US government. You know, to help soothe their consciences and what not.

But while collecting credit card data was to be expected, what is even worse is that the NSA has also secretly planted itself in the nexus of the entire global USD-intermediated financial transactions system courtesy of SWIFT.

The NSA’s Tracfin data bank also contained data from the Brussels-based Society for Worldwide Interbank Financial Telecommunication (SWIFT), a network used by thousands of banks to send transaction information securely. SWIFT was named as a “target,” according to the documents, which also show that the NSA spied on the organization on several levels, involving, among others, the agency’s “tailored access operations” division. One of the ways the agency accessed the data included reading “SWIFT printer traffic from numerous banks,” the documents show.

What is curious is that while the NSA and its henchmen, in this case the GCHQ, had no qualms about violating personal privacy at every level, it is only when banks were threatened that someone feel like perhaps a line was crossed:

But even intelligence agency employees are somewhat concerned about spying on the world finance system, according to one document from the UK’s intelligence agency GCHQ concerning the legal perspectives on “financial data” and the agency’s own cooperations with the NSA in this area.

In other words, America’s unsupervised uber spies, when not checking in on their former significant others, spend the bulk of their time tracking who is buying what, where, and with whose money.

They also know how much anyone in the world has spent on credit card-based purchases, what the source of that money is, and what the purchase was. In other words: absolute monetary and financial surveillance.

And since SWIFT is insolved, it likely also means a full blanket coverage of who buys what stock, and furthermore, leaves open to abuse the knowledge of which equities or FX pair the Fed, for example, is buying ahead of time in order to prevent yet another daily stock market plunge.

Which means that not only everyone would be fascinated in gaining access to the NSA’s $29.95/month stock-picking newsletter, a bigger issue is that suddenly all money laundering on the global arena may grind to a halt. How this could impact capital flows in a world in which parking oligarch capital in assorted “free markets” is the only recourse for concerned billionaires who have no desire to be Cyprused, and where oligarch money laundering is one of the main drivers behind the US housing recovery for example, remains to be seen.

Arctic Ice Area Is Highest In Seven Years…Sets Record For Ice Growth

Posted By thestatedtruth.com on September 14, 2013

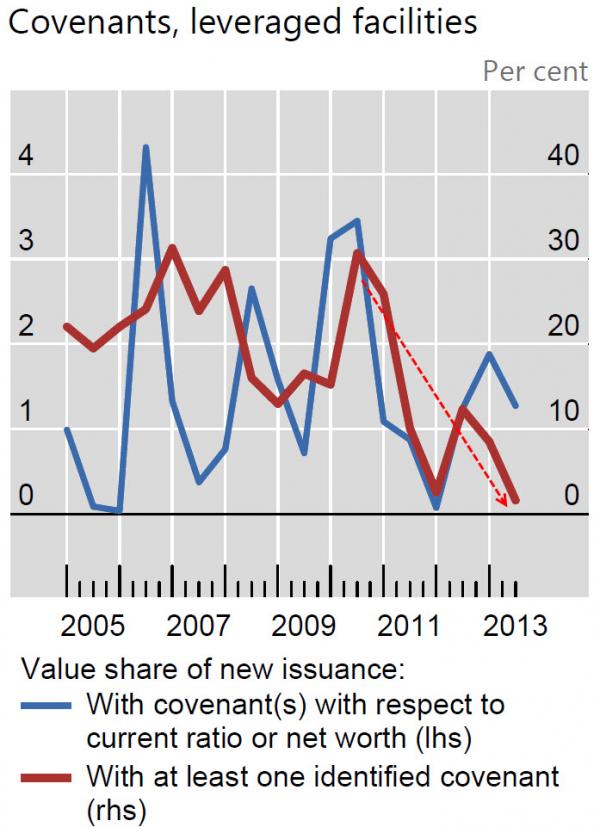

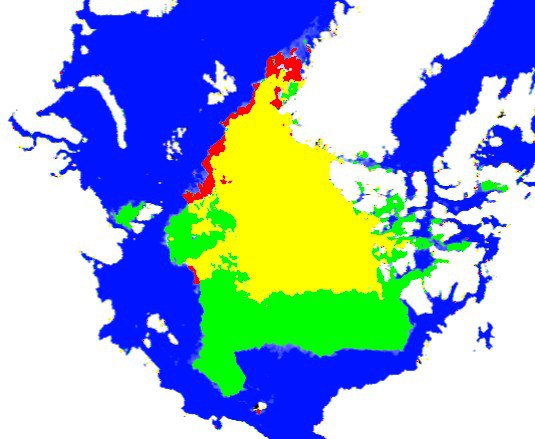

So….what was that shuffle back in 2007 by Al Gore about the ice melting by 2013? Hmm…According to Climate Depot “Arctic ice area is increasing, as new ice is forming rapidly north of 80N. Ice area is the highest since 2006. The year over year change in Arctic sea ice area has blown away the record for ice growth, by more than a factor of two.”

On the map below ‘Green shows ice present in 2013 which was not present on this date in 2012. Red shows the opposite. Ice extent has increased by 67% over the past year.’

Some Interesting Tid Bits About Silver…Or As Some Call It – Poor Man’s Gold

Posted By thestatedtruth.com on September 12, 2013

Silver appears to be the metal of the future….especially when one considers that 2/3 of all silver produced worldwide is a by product of lead, copper and zinc mining.

Major silver users include the electronic and circut board industry, water purification and growing industrial uses in China, including production of energy saving solar panels.

Silver

Atomic Number: 47

Symbol: Ag

Atomic Weight: 107.8682

Discovery: Known since prehistoric time. Man learned to separate silver from lead as early as 3000 B.C.

Electron Configuration: [Kr]5s14d10

Word Origin: Anglo-Saxon Seolfor or siolfur; meaning ‘silver’, and Latin argentum meaning ‘silver’

Properties: The melting point of silver is 961.93°C, boiling point is 2212°C, specific gravity is 10.50 (20°C), with a valence of 1 or 2. Pure silver has a brilliant white metallic luster. Silver is slightly harder than gold. It is very ductile and malleable, exceeded in these properties by gold and palladium. Pure silver has the highest electrical and thermal conductivity of all metals. Silver possesses the lowest contact resistance of all metals. Silver is stable in pure air and water, although it tarnishes upon exposure to ozone, hydrogen sulfide, or air containing sulfur.

Silver is the best conductor of electricity of all elements. In fact, silver defines conductivity, all other metals are compared against it. On a scale of 0 to 100, silver ranks 100, with copper at 97 and gold at 76. Silver is commonly used in electrical circuits and contacts. Silver is also utilized in batteries where dependability is mandatory and weight restrictions apply, such as those for portable surgical tools, hearing aids, pacemakers and space travel.

80% more conductive than aluminum

50% more conductive than gold, 6% more conductive than copper

Has superior thermal conductivity

Transfers heat efficiently; doesn’t overheat

Source: Wise Dog

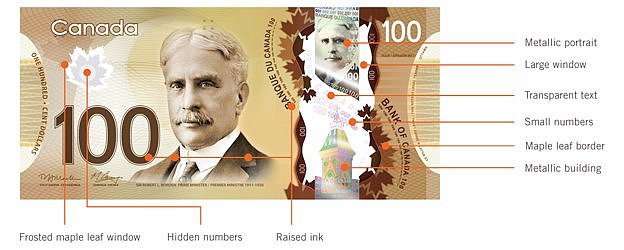

Are New Bank Notes Around The World Going To Be Made Of Polymer?

Posted By thestatedtruth.com on September 12, 2013

“Wise Dog” sources say the new normal in money has started a change from paper to plastic! The reason being that after initial increased costs, the extra durability of the notes would mean they would last longer. Canada has already adopted the polymer banknote because it’s cheaper to issue then paper notes.

Other countries paying with plastic include:

- Australia was the first to issue polymer notes, in 1988

- Countries including New Zealand. Mexico, Singapore, Fiji and then Canada followed suit

- Mauritius started issuing the notes in August

- “The Bank of England has said it would print notes on polymer only if we were persuaded that the public would continue to have confidence in, and be comfortable with, our notes,”

Wise Dog

9-11-2001 Remembered Twelve Years Later

Posted By thestatedtruth.com on September 11, 2013

As remembering one of the toughest days in our history passes, let’s not forget those innocent kind souls who lost their lives on September 11, 2001. God Bless America, Land Of The Free and Home Of The Brave.

Vladimir Putin, Russia’s President Does An Op-Ed With The New York Times…..

Posted By thestatedtruth.com on September 11, 2013

Hmm…..This has to be a first, a Russian president does an editorial in a major U.S. newspaper! Unbelievable! Truely, it really is. Inquiring minds want to know if Russia’s leading newspaper Pravda would allow President Obama to pen his own Op-Ed in Moscow. Just curious!

Here is a major exert on a Russian point of disagreement:

“I carefully studied his (President Obama) address to the nation on Tuesday. And I would rather disagree with a case he made on American exceptionalism, stating that the United States’ policy is “what makes America different. It’s what makes us exceptional.” It is extremely dangerous to encourage people to see themselves as exceptional, whatever the motivation. There are big countries and small countries, rich and poor, those with long democratic traditions and those still finding their way to democracy. Their policies differ, too. We are all different, but when we ask for the Lord’s blessings, we must not forget that God created us equal.”

A version of this op-ed appears in print on September 12, 2013, on page A31 of the New York Times edition with the headline: A Plea for Caution From Russia.

Vladimir V. Putin is the president of Russia.

Wise Dog

Stanley Druckenmiller Reviews Key Issues That In His Opinion Will Effect The U.S. Economy

Posted By thestatedtruth.com on September 11, 2013

Pay attention everybody, there will be a quiz on this….Stanley Druckenmiller (one of the most successful money managers of all time) addresses key issues for the U.S. economy going forward. Here are a few snip-its.

On what he is most uncomfortable about:

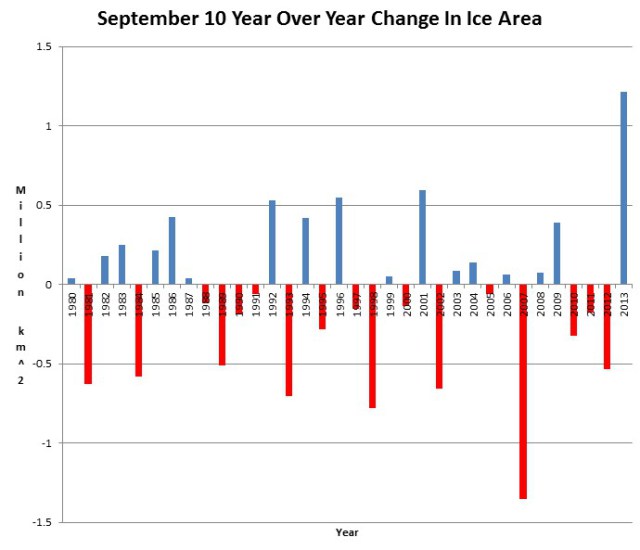

“Let’s first set the table and looking at what is going on in the last 35-years. Then I want to get into the demographic problem and why it is so scary from here and why I don’t understand the current dialogue that is taking place over the situation. It is completely uninformed. If you go back to 1960 when I was sever years old, about 20-percent of the federal budget government outlays were transfer payments or what we call entitlement. That number has gone up to 72-percent over this 35 year period. The problem with that, first of all, the good news on that, as I said, seniors are much better off, it’s been a tremendous accomplishment, poverty rate is way down for seniors, but these are transfer payments and there is no productive investment or no looking to future coming out of this. If you look at how we get form 20-percent to 70-percent, almost all of that money went to the elderly. If you took an elderly person back in 1960, 40-percent of government outlays per capita went to them. That number is 71-percent all stop where did that come out of? It came out of children, came out of investments and things like education, infrastructure, thing like that. And that crowding out effect creates a problem going forward because these are not productive investments.”

“It is important shaping the debate. We have always heard the term, ‘you don’t want to leave the next generation with less than the current generation If you are A 29-37 year old in this country, your net worth is less than 29-37 year old in 1983. Those are staggering statistics. This is the first generation where a 30-year old is worth literally is worth less than his parents. If you look at older people, their net worth has doubled over this timeframe. Again, because this money has been transferred.

Druckenmiller continues…..

On what we see in asset prices is illusory:

“My first mentor and boss, Dr. Ellison from Pittsburg used to tell me, it takes hundreds of millions of dollars to manipulate a stock up but the minute you have this phony buying stock, it can go down on no volume. It can just re-price immediately. I personally think as long as this game goes on, assets will stay elevated. When he removed that prop, let’s face it, the Fed says they’re targeting asset prices. Those prices can adjust immediately. June was instructive. If you did not believe before the exit was going to be tough, the mere hunt that maybe in three months, if the economy is good, we might go from $85 billion a month to buying $65 Billion a month, cause that kind of havoc and risk around the world. How in the world does anyone think when the actual exit happens that prices are not going to respond? It is silly.”

And….

On what asset class has been manipulated most because of QE:

“I would say stocks. I have been really wrong on the bond market in the last three or four months. I have been waiting for this decline for two years and completely missed it. First of all, the stuff we were talking about earlier in the show, that is too far down the road in my opinion, for the bond market to pay attention. I have always found in bonds, if you can predict a relative change in the economy, relative to consensus, you will make money in bonds if you get that equation right… Yes [even in the world of QE]. Two or three months ago, I thought people were overly optimistic on the U.S. economy. It is my judgment that assessment turned out to be correct. But bonds went down anyway for not economic reason because we have the unwind going on. For whatever reason. While I anticipated down the road, I did not think it would happen while the economy was softening.”

Geez…If The U.S. Government Ever Learned How To Cut The Red Tape, Our Economy Would Suddenly Grow Like A Weed

Posted By thestatedtruth.com on September 10, 2013

They got to be kidding…..Nope!

President Barack Obama signed the Patient Protection and Affordable Care Act (PPACA) and its companion Health Care and Education Reconciliation Act (HCERA) back in March of 2010. It has been learned from reliable sources that the Federal Register now has a total of (at least) 109 final regulations governing how Obamacare will be implemented. These regulations add up to 10,516 pages in the Federal Register, or more than eight times as many pages as there are in the Gutenberg Bible, which has 642 two-sided leaves or 1,286 pages.

Inquiring minds wonder how many pounds these regulations actually weigh in at, just for Obama Care!

NSA Has Full “Back Door” Access To iPhone, BlackBerry And Android Smartphones, Documents From Germany’s Spiegel Reveal

Posted By thestatedtruth.com on September 8, 2013

This won’t go away…..it’s the new normal in communications.

Germany’s Spiegel, broke a story saying that the NSA can spy not only on Android smartphones but tap user data on all iPhone and BlackBerry devices “including contact lists, SMS traffic, notes and location information about where a user has been”. Spiegel reports, citing”internal NSA documents that the NSA has the capability of tapping user data from the iPhone, devices using Android as well as BlackBerry, a system previously believed to be highly secure. The documents also indicate that the NSA has set up specific working groups to deal with each operating system, with the goal of gaining secret access to the data held on the phones.”

From Spiegel:

The United States’ National Security Agency intelligence-gathering operation is capable of accessing user data from smart phones from all leading manufacturers. Top secret NSA documents that SPIEGEL has seen explicitly note that the NSA can tap into such information on Apple iPhones, BlackBerry devices and Google’s Android mobile operating system.

The documents state that it is possible for the NSA to tap most sensitive data held on these smart phones, including contact lists, SMS traffic, notes and location information about where a user has been.

In the internal documents, experts boast about successful access to iPhone data in instances where the NSA is able to infiltrate the computer a person uses to sync their iPhone. Mini-programs, so-called “scripts,” then enable additional access to at least 38 iPhone features.

The documents suggest the intelligence specialists have also had similar success in hacking into BlackBerrys. A 2009 NSA document states that it can “see and read SMS traffic.”

It also notes there was a period in 2009 when the NSA was temporarily unable to access BlackBerry devices. After the Canadian company acquired another firm the same year, it changed the way in which it compresses its data. But in March 2010, the department responsible at Britain’s GCHQ intelligence agency declared in a top secret document it had regained access to BlackBerry data and celebrated with the word, “champagne!”

The documents also state that the NSA has succeeded in accessing the BlackBerry mail system, which is known to be very secure. This could mark a huge setback for the company, which has always claimed that its mail system is uncrackable.

In response to questions from SPIEGEL, BlackBerry officials stated, “It is not for us to comment on media reports regarding alleged government surveillance of telecommunications traffic.” The company said it had not programmed a “‘back door’ pipeline to our platform.”

The Recovery Trudges On

Posted By thestatedtruth.com on September 8, 2013

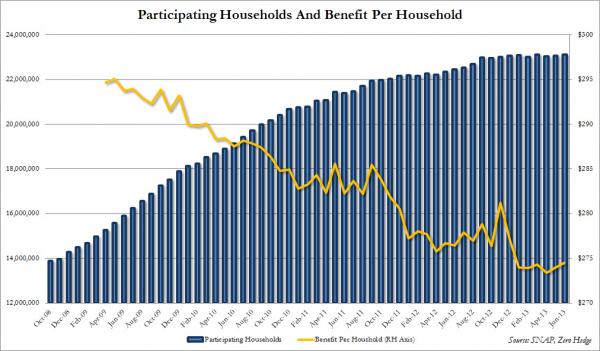

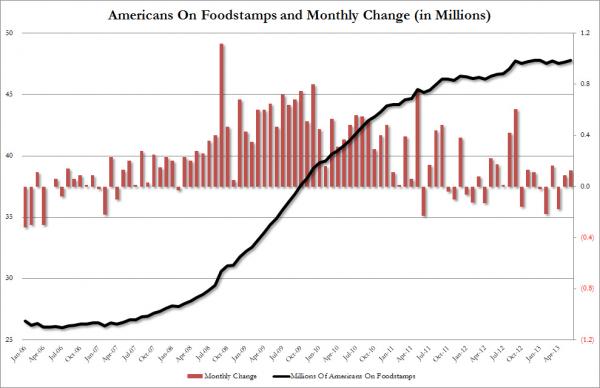

And this is during an economic recovery!

In June, the number of households receiving foodstamps rose to 23.117 million, an increase of 45.9k in one month, and also a new record high. The average monthly benefit per household was: $274.55, just off the record.

In June an additional 125,059 individual Americans started using Foodstamps. The increase to 47.8 million was not a record high missing that particular record, set in December 2012, by 31,771.

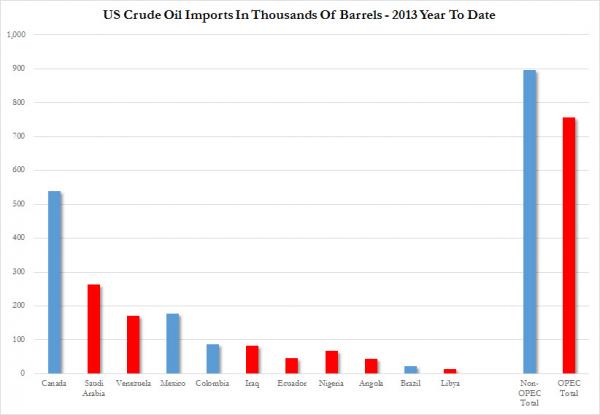

Here Are The Most Recent U.S. Crude Oil Import Charts….

Posted By thestatedtruth.com on September 4, 2013

The U.S. isn’t “oil independent” just yet, but we’re working on it! As you can see from the charts below, most of the OPEC oil imported by the US comes from places other then the Middle East. Saudi Arabia and Libya are the exceptions.

2013 July vs June Chart Below…….

2013 Year To Date Chart below…..

Source: Census Bureau

Alaska Has Record Cold In Its Northern Interior

Posted By thestatedtruth.com on September 2, 2013

Burrrr……

An August 31st cold airmass and clear skies allowed for temperatures to plunge to record low levels in the Alaskan northern Interior.

Most notably, Bettles recorded a low of 15ºF Saturday morning. This is by far the lowest temperature of record at Bettles in August. The previous record at the Bettles in August was 22ºF on August 30, 1969. At old Bettles, about four miles downriver from the current townsite, a low of 20ºF was measured on August 24, 1948.

Other low temperatures included 17ºF at both Chandalar DOT and Coldfoot DOT and a chilly 13F at the Norutak Lake RAWS west of Bettles.

Say It Ain’t So….The Hemisphere Project (Formerly Known As) Hudson Hawk) Involves Over 4 Billion Recorded Phone Calls Per Day

Posted By thestatedtruth.com on September 2, 2013

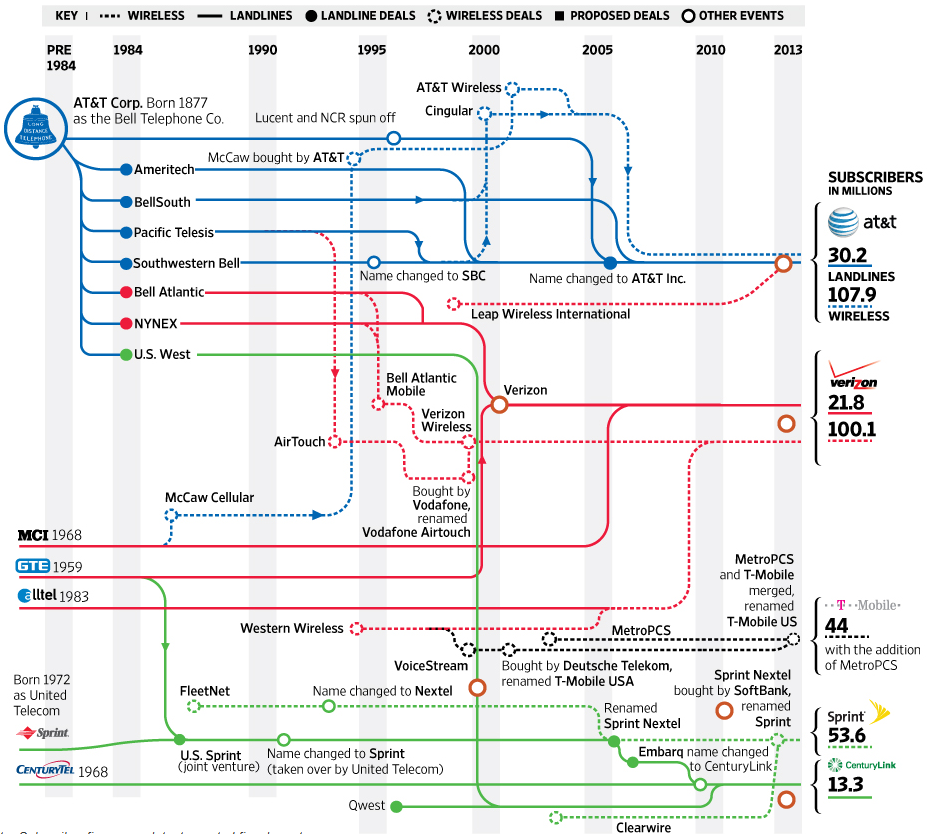

Here is a spaghetti chart created by the WSJ of the US telecom space. It lays out roughly how many current subscribers (many from other carriers) pass through US telecom giant, AT&T.

Submitted by Tyler Durden on 09/02/2013 16:02 -0400 www.zerohedge.com

The reason for this is that according to the latest revelations from the NYT, which following recent work-sharing with the Guardian is now another official distributor of the Edward Snowden leaks (who in a brilliant move has decided to spread out his disclosures week after week, many times allowing such staggered disclosures to catch the administration – which has no idea what is coming next – in flagrant lies), the chart shows that 140 million landline and wireless paying AT&T customers is the minimum number of affected Americans whose every call is recorded, however not directly or indirectly by the government, but rather by a private corporation working in collaboration with the US government.

According to the NYT the name of the collaboration is: the Hemisphere Project, fomerly known as Hudson Hawk.

“Minimum” because the number of affected American citizens is far greater than just AT&T customers. As the NYT reports, every call that crosses through an AT&T switch, not just calls made by AT&T customers which means virtually every US phone call, is recorded in a formerly top secret AT&T database that has existed since 1987 and whose “scale and longevity of data storage appears to be unmatched by other government programs, including the N.S.A.’s gathering of phone call logs under the Patriot Act.” It is a database which adds 4 billion call records every single day and which unlike the N.S.A.’s also includes information on the location of callers.

In other words, before the NSA was recording every phone call, that task was being handled by another entity: AT&T. The cover back then, just like the Patriot Act is the cover for the continuation of the NSA’s espionage operation against America’s own people, so Hemisphere was in collaboration with counternarcotics agents and federal and local drug officials. And of course, just like with the NSA and its utmost secrecy, there is no way to monitor and observe what if any checks on the violation of privacy rights exists. One can simply hope that unlike in every other instance, that US government officials never had an inkling to abuse this treasure trove of phone records for non-drug related offenses.

A snapshot of the “Project” from the NYT:

For at least six years, law enforcement officials working on a counternarcotics program have had routine access, using subpoenas, to an enormous AT&T database that contains the records of decades of Americans’ phone calls — parallel to but covering a far longer time than the National Security Agency’s hotly disputed collection of phone call logs.

The Hemisphere Project, a partnership between federal and local drug officials and AT&T that has not previously been reported, involves an extremely close association between the government and the telecommunications giant.

The government pays AT&T to place its employees in drug-fighting units around the country. Those employees sit alongside Drug Enforcement Administration agents and local detectives and supply them with the phone data from as far back as 1987.

The scale and longevity of the data storage appears to be unmatched by other government programs, including the N.S.A.’s gathering of phone call logs under the Patriot Act. The N.S.A. stores the data for nearly all calls in the United States, including phone numbers and time and duration of calls, for five years.

Hemisphere covers every call that passes through an AT&T switch — not just those made by AT&T customers — and includes calls dating back 26 years, according to Hemisphere training slides bearing the logo of the White House Office of National Drug Control Policy. Some four billion call records are added to the database every day, the slides say; technical specialists say a single call may generate more than one record. Unlike the N.S.A. data, the Hemisphere data includes information on the locations of callers.

Not surprisingly, the secrecy surrounding Hemisphere is just as great as that around the NSA’s covert surveillance:

The program was started in 2007, according to the slides, and has been carried out in great secrecy.

“All requestors are instructed to never refer to Hemisphere in any official document,” one slide says. A search of the Nexis database found no reference to the program in news reports or Congressional hearings.

The Obama administration acknowledged the extraordinary scale of the Hemisphere database and the unusual embedding of AT&T employees in government drug units in three states.

But they said the project, which has proved especially useful in finding criminals who discard cellphones frequently to thwart government tracking, employed routine investigative procedures used in criminal cases for decades and posed no novel privacy issues.

It’s unknown for now how useful the project has proven when heartbroken “drug-enforcement” officials, or anyone else with access to the AT&T database for that matter, seek to find dirt on their exes. Like NSA agents for example.

What is known, at least on paper, is that unlike the FISA Court which decides what surveillance requests are granted (all of them), the inquirer in this case is the D.E.A., which submits a request to AT&T, which then scours through its trillions of records to find what the DEA is looking for.

Crucially, they said, the phone data is stored by AT&T, and not by the government as in the N.S.A. program. It is queried for phone numbers of interest mainly using what are called “administrative subpoenas,” those issued not by a grand jury or a judge but by a federal agency, in this case the D.E.A.

Brian Fallon, a Justice Department spokesman, said in a statement that “subpoenaing drug dealers’ phone records is a bread-and-butter tactic in the course of criminal investigations.”

Mr. Fallon said that “the records are maintained at all times by the phone company, not the government,” and that Hemisphere “simply streamlines the process of serving the subpoena to the phone company so law enforcement can quickly keep up with drug dealers when they switch phone numbers to try to avoid detection.”

In other words, more of the same justification: in order to find the needle, the US needs to record every component of the haystack going back decades. Or a blanket, pervasive wiretap of anyone and everyone, with the only gating factor being the DEA’s decision to single out someone as a potential perpetrator, thus unlocking all of their personal phone records at a moments notice.

But Mr. Richman said the program at least touched on an unresolved Fourth Amendment question: whether mere government possession of huge amounts of private data, rather than its actual use, may trespass on the amendment’s requirement that searches be “reasonable.” Even though the data resides with AT&T, the deep interest and involvement of the government in its storage may raise constitutional issues, he said.

Immediately the logical question arises: if it is justifiable, and due to its vastness and complexity, certainly has a deterrent effect on would be criminals, why keep it secret? The ACLU has some thoughts:

Jameel Jaffer, deputy legal director of the American Civil Liberties Union, said the 27-slide PowerPoint presentation, evidently updated this year to train AT&T employees for the program, “certainly raises profound privacy concerns.”

“I’d speculate that one reason for the secrecy of the program is that it would be very hard to justify it to the public or the courts,” he said.

Mr. Jaffer said that while the database remained in AT&T’s possession, “the integration of government agents into the process means there are serious Fourth Amendment concerns.”

That one probably falls under the “obvious” category. Just as obvious is the lack of willingness by AT&T, or its peers, to provide any additional information now that the Project has been exposed:

Mark A. Siegel, a spokesman for AT&T, declined to answer more than a dozen detailed questions, including ones about what percentage of phone calls made in the United States were covered by Hemisphere, the size of the Hemisphere database, whether the AT&T employees working on Hemisphere had security clearances and whether the company has conducted any legal review of the program

“While we cannot comment on any particular matter, we, like all other companies, must respond to valid subpoenas issued by law enforcement,” Mr. Siegel wrote in an e-mail.

Representatives from Verizon, Sprint and T-Mobile all declined to comment on Sunday in response to questions about whether their companies were aware of Hemisphere or participated in that program or similar ones. A federal law enforcement official said that the Hemisphere Project was “singular” and that he knew of no comparable program involving other phone companies.

The good news: There are some alleged success stories (but once again, not preventing the Boston bombing).

In March 2013, for instance, Hemisphere found the new phone number and location of a man who impersonated a general at a San Diego Navy base and then ran over a Navy intelligence agent. A month earlier the program helped catch a South Carolina woman who had made a series of bomb threats.

And in Seattle in 2011, the document says, Hemisphere tracked drug dealers who were rotating prepaid phones, leading to the seizure of 136 kilos of cocaine and $2.2 million.

The bad news, personal privacy no longer exists in any capacity, in which the public-private complex collaborates against its citizens without express prior public knowledge or permission, and in which “some” have access to all private information merely “for the greater good.” Naturally, any abuse of the greater good, is at the fault of the “isolated” perpetrator, not the enabling behemoth government which has George Orwell spinning in his grave.

Article composed by www.zerohedge.com

Happy Labor Day 2013

Posted By thestatedtruth.com on September 2, 2013

There are now 130 Million citizens that are not currently employed… off we go with another letter to OUR (We The People) self serving Congress and Senate. Even they can understand the picture below (we thinx).

(h/t @Not_Jim_Cramer) www.zerohedge.com

In All Fairness….The Founding Fathers Would Be Offended By These Facts: That The U.S.Senate And The U.S. Congress Don’t Abide By The Same Laws Of The Land, But The Rest Of Us Do!

Posted By thestatedtruth.com on August 28, 2013

Print and send or forward this to your US Senator and US Congressman or Congresswoman! You can say www.TheStatedTruth.com sent you!

THIRTY FIVE STATES SO FAR….AND IT’S GROWING

Governors of 35 states have filed suit against the Federal Government for imposing unlawful burdens upon them. It only takes 38 (of the 50) States to convene a Constitutional Convention.

This will take less than thirty seconds to read. If you agree, please pass it on. This is an idea that we should’ve addressed long ago.

For too long we have been too complacent about the workings of Congress. The latest is to exempt themselves from the Healthcare Reform that passed … in all of its forms. Somehow, that doesn’t seem logical. We do not have an elite that is above the law. I truly don’t care if they are Democrat, Republican, Independent or whatever . The self-serving must stop.

If each person that receives this will forward it on to 15 people, in three days, most people in The United States of America will have the message. This is one proposal that really should be passed around.

Proposed 28th Amendment to the United States Constitution: “Congress shall make no law that applies to the citizens of the United States that does not apply equally to the Senators and/or Representatives; and, Congress shall make no law that applies to the Senators and/or Representatives that does not apply equally to the citizens of the United States …”

You are one of our 15….or 1,000,000 or maybe it will be 10 million!

Wise Dog

The China Plan…In Gold We Trust

Posted By thestatedtruth.com on August 25, 2013

The China plan would look to eventually back the Chinesse Renminbi currency with Gold, creating a direct trading challenge to the U.S. Dollar. Russia’s Putin has in the past hinted at something similar for the Russian Ruble!

Chinese Gold Imports – China Imports 104 Tonnes of Gold in June

China just imported 104 tonnes of gold in June.

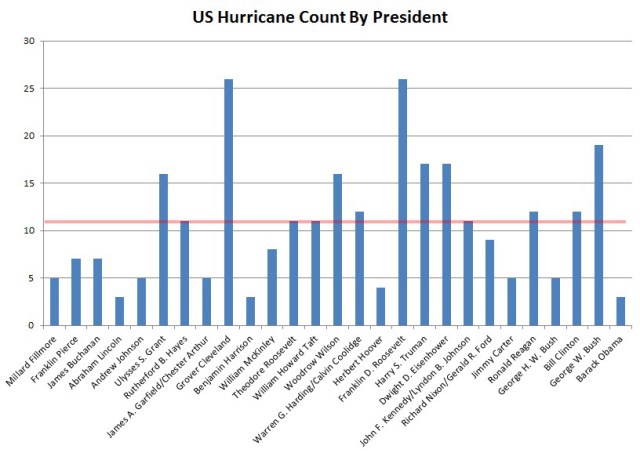

We Currently Have The Slowest Start To A Hurricane Season On Record…There Have Been None…Not A One, Zippo, Zero, Ziltch!

Posted By thestatedtruth.com on August 25, 2013

Unbelievable! Ok, now we understand better why the commodity market is so unusually tame, especially the softs which have been weak all summer…By definition a soft commodity is a commodity such as coffee, cocoa, sugar, corn, wheat, soybean and fruit. This term generally refers to commodities that are grown, rather than mined, drilled for or raised such as animals. So now you know.

As we approach the end of August, there have been no Atlantic hurricanes. But by this date in the year 1886, there had already been seven hurricanes – including three major hurricanes, one of which wiped the city of Indianola, Texas off the map.

Welcome To The Middle East And Have A Nice Day

Posted By thestatedtruth.com on August 25, 2013

Sounds like an old Abbott and Costello routine? Who’s on first…..

From K-N Al-Sabah, posted in the FT:

Iran is backing Assad. Gulf states are against Assad!

Assad is against Muslim Brotherhood. Muslim Brotherhood and Obama are against General Sisi.

But Gulf states are pro Sisi! Which means they are against Muslim Brotherhood!

Iran is pro Hamas, but Hamas is backing Muslim Brotherhood!

Obama is backing Muslim Brotherhood, yet Hamas is against the US!

Gulf states are pro US. But Turkey is with Gulf states against Assad; yet Turkey is pro Muslim Brotherhood against General Sisi. And General Sisi is being backed by the Gulf states!

Yep…..

New Home Sales Fall To Lowest Level Since Last October While Builder Confidence Rises To Its Highest Level Since November 2005, No Typo, 2005!

Posted By thestatedtruth.com on August 23, 2013

So, it’s said by a number of Realtors that interest rate spikes don’t matter to home buyers….um, maybe they should rethink that idea? Yep, maybe rethink it twice!

Purchases of new U.S. homes plunged in July by the most in more than three years while previous month saless were revised down. Housing in July showed that a tiny 35K new houses were sold (with just 3K sold in the Northeast, and just 19K in the otherwise strong South), of which 13K houses were not even started. This translated into a puny 394K seasonally adjusted annualized sales, missing expectations of 487K by nearly a massive 100K, and in addition the June print was revised much lower from 497K to 455K (which back in July beat expectations of 484K and was trumpeted as the highest print since 2008 – so much for that). Also, the median home sale price decline continued, and in July dropped to $257.2K down from $258.5.

The supply of homes at the current sales rate rose to 5.2 months from 4.3 months in June. There were 171,000 new houses on the market at the end of July, up from 164,000 the month before.

Does anybody really believe the NAHB (National Association Of Home Builders)? They revise downward almost every (opportunistic) number they announce…

Hindenburg Omen Continues!

Posted By thestatedtruth.com on August 18, 2013

The dreaded Hindenburg Omen continues through August 14….. For the 6th day in the last 8, the market has flashed a string of Hindenburg chart warnings that suggest that all is not well in a stock market considered by some to be “ government driven”. See our review of this several posts below, it will explain the Hindenberg Omen in detail.

Not Sounding Good…Especially Since We’re In An Economic Recovery (Sort Of)

Posted By thestatedtruth.com on August 18, 2013

Things that make you wonder….and then question, how could this happen!

76% of Americans live paycheck to paycheck

27% of American have no savings at all

46% of Americans have less than $800 in savings

The conversion of America into a part-time working society and the country’s second largest employer – a temp agency.

The college trap and the student loan bubble that’s bigger then all credit card debt!

And of course, foodstamps, foodstamps, foodstamps and the nearly 50 million poverty-level Americans who need them to survive.

Currently, Stock Markets Of The World Show Little Fear…But Maybe They Should!

Posted By thestatedtruth.com on August 13, 2013

Why, you say….

It’s the dreaded Hindenburg Omen!

“The Hindenburg Omen is a technical analysis that attempts to predict a forthcoming stock market crash. It is named after the Hindenburg disaster of May 6th 1937, during which the German zeppelin was destroyed in a sudden conflagration.”

The Hindenburg Omen is not a guarantee of a crash, and five criteria must be met for a Hindenburg trigger, and typically need to reoccur within 36 days for reconfirmation. Yet the statistics are startling: “Looking back at historical data, the probability of a move greater than 5% to the downside after a confirmed Hindenburg Omen was 77%, and usually takes place within the next forty-days.” The last Hindenburg Omen occurred during the lows of 2009. Today, we just had another (unconfirmed) Hindenburg Omen. It is time to batten down the hatches – something big is coming.

Here are the 5 criteria of the Omen are as follows:

- That the daily number of NYSE new 52 Week Highs and the daily number of new 52 Week Lows must both be greater than 2.2 percent of total NYSE issues traded that day.

- That the smaller of these numbers is greater than or equal to 69

(68.772 is 2.2% of 3126). This is not a rule but more like a checksum.

This condition is a function of the 2.2% of the total issues. - That the NYSE 10 Week moving average is rising.

- That the McClellan Oscillator is negative on that same day.

- That new 52 Week Highs cannot be more than twice the new 52 Week

Lows (however it is fine for new 52 Week Lows to be more than double new 52 Week Highs). This condition is absolutely mandatory.

Today, all five conditions were satisfied. June 2008 was another such reconfirmed event. Barron’s pointed out then, “there’s a 25% probability of a full-blown stock-market crash in the next 120 days….

How LIBOR Sets Interest Rates

Posted By thestatedtruth.com on August 8, 2013

Did you ever wonder just what LIBOR stands for…….well now you know!

Until July 2012, the London Interbank Offered Rate (LIBOR) was the biggest little number that nobody outside finance understood, and yet it touched the lives of virtually everybody.

LIBOR is an interest rate that gets calculated for ten currencies and fifteen borrowing periods that range from overnight to one year. It is published every day in London after submissions from a group of major banks. Currently, eighteen banks contribute to the fixing of US dollar Libor, for example. The LIBOR rate is calculated by taking estimates from each of the banks, throwing out the highest and lowest four indications and averaging the remaining ten.

The resulting number itself is measured in mere basis points (hundredths of one percentage point), but it underpins a staggering $350 TRILLION in derivatives and is a vital component in setting the price on hundreds of thousands of OTC transactions around the globe every day. The wonder of leverage at work….

Say It Ain’t So….

Posted By thestatedtruth.com on August 6, 2013

There are 28 million Americans with federal student loans, 60%, or 17 million, don’t pay the U.S. government a single cent! Yep, nota, zippo, zero….not a penny!

Velocity Of Money Sits At Historic Lows….

Posted By thestatedtruth.com on August 6, 2013

What this means is that money is not being circulated through the system, instead it is parked in things that don’t ecourage growth in the economy. Velocity of Money is now at all time lows.

Here is how to explain it: The velocity of money (also called velocity of circulation and, much earlier, currency) is the average frequency with which a unit of money is spent on new goods and services produced domestically in a specific period of time. Velocity has to do with the amount of economic activity associated with a given money supply.

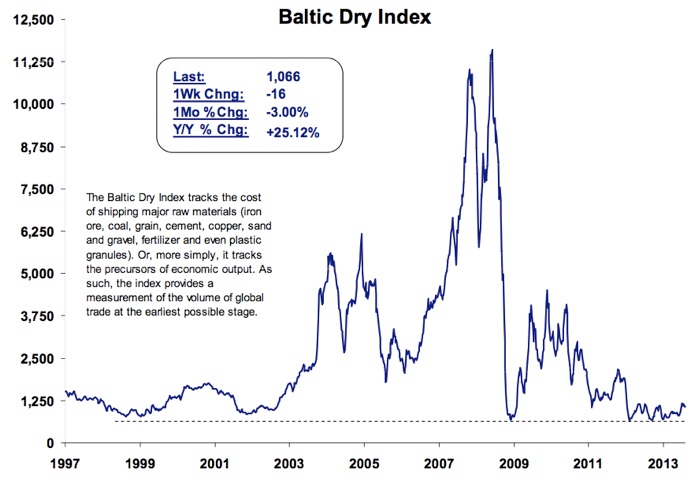

Baltic Dry Index…A Sinking Ship

Posted By thestatedtruth.com on August 6, 2013

Reviewing the overall global trade activity, the Baltic Dry Index shows we remain in record low territory. The global economy is moving at stall speed….

U.S. Housing Rents Hit Record Highs As Homeownership Falls To 18 Year Lows!

Posted By thestatedtruth.com on July 30, 2013

Never say things can’t get worse… Murphys Law says otherwise.

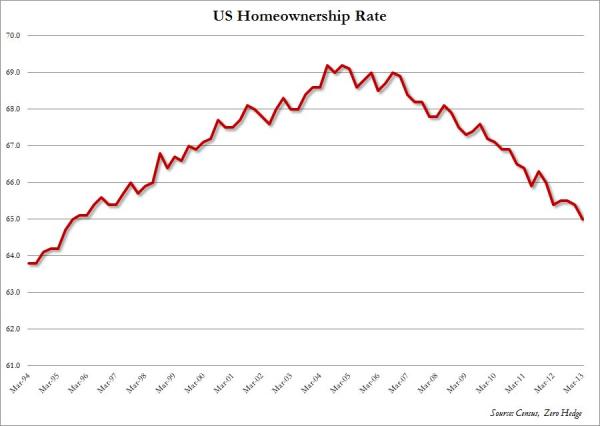

According to the latest quarterly homeownership data released by the Census Bureau, the raw homeownership rate of 65.0% was unchanged from last quarter and 0.4% lower than a year ago. And on a seasonally adjusted basis the percentage of Americans who have a house declined from 65.2% to 65.1%: the lowest since 1995.

The flipside is that many “children” in their mid-30s are still living in their parents’ basements.

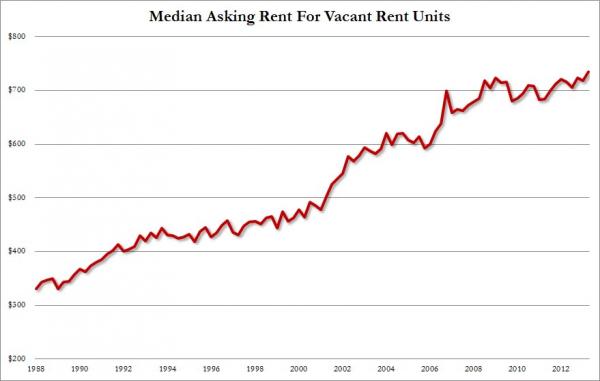

The median asking rent for US vacant housing units just hit an all time record high of $735 per month.

Hard To Believe…..But True

Posted By thestatedtruth.com on May 27, 2013

Here are some statistics that seem unbelievable…..

An astounding 53 percent of all American workers make less than $30,000 a year.

In the United States today, the wealthiest one percent of all Americans have a greater net worth than the bottom 90 percent combined.

The six heirs of Wal-Mart founder Sam Walton have as much wealth as the bottom one-third of all Americans combined.

Today, the number of Americans on Social Security Disability now exceeds the entire population of Greece, and the number of Americans on food stamps now exceeds the entire population of Spain.

The number of Americans on food stamps now exceeds the combined populations of “Alaska, Arkansas, Connecticut, Delaware, District of Columbia, Hawaii, Idaho, Iowa, Kansas, Maine, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Oklahoma, Oregon, Rhode Island, South Dakota, Utah, Vermont, West Virginia, and Wyoming.”

According to The Economist, the United States was the best place in the world to be born into back in 1988. Today, the United States is only tied for 16th place.

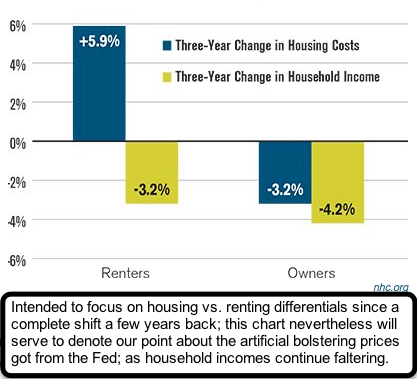

Housing and Household Incomes

Posted By thestatedtruth.com on May 6, 2013

Hmm….Courtesy of our good friend Gene Inger.

Home Ownership Rates Continue To Fall

Posted By thestatedtruth.com on April 30, 2013

The US Census Bureau reported earlier today that the US homeownership rates in the first quarter of 2013 dropped by 0.4% to a new 18 year low. It now sits at 65% which is it’s lowest rate since 1995!

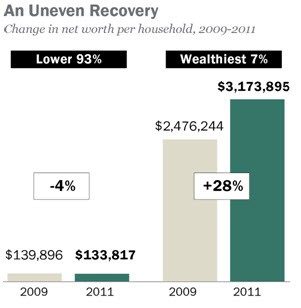

The Rich Get Richer, And ….Well, You Know The Drill

Posted By thestatedtruth.com on April 23, 2013

It’s now a rich mans world, but it wasn’t always this way!

As the Pew Research Center finds, during the first two years of the US economic ‘recovery’, the mean net worth of households in the upper 7% of the wealth distribution rose by an estimated 28%, while the mean net worth of households in the lower 93% dropped by 4%. As they explain, affluent households typically have their assets concentrated in stocks and other financial holdings, while less affluent households typically have their wealth more heavily concentrated in the value of their home. Due to these differences, wealth inequality increased during the first two years of the recovery. The upper 7% of households saw their aggregate share of the nation’s overall household wealth pie rise to 63% in 2011, up from 56% in 2009, with the mean wealth of affluent households now 24x the less affluent group (up from 18x in 2009)

Uh….We Wait With Heightened Interest

Posted By thestatedtruth.com on April 21, 2013

This is either a big Scoop, or a pile of Poop. Glenn Beck sounds off about his knowledge of a top security matter.

In the chaotic timeline of events that took place after the Boston bombing, one story that circulated was that a Saudi National had been take into custody and labeled a “Person of Interest”. Apparently he was kept under heavy guard at the hospital, and his apartment was searched.

Since then the story has died down. However on Friday, Glenn Beck said on his radio show that he has information on this person, and that there is something going on behind the scenes that the Government is trying to keep us in the dark on (raise your hand if you’d be surprised).

He says in the following clip, that the Government has until Monday to come clean on the details, or else he will.

Does he have anything of substance? We’ll soon find out.

Here’s a clue….he thinks this is going to be a big big deal!

http://www.youtube.com/watch?feature=player_embedded&v=LiEpSggvZFU

Is The System Rigged Or Is It Just Magic…It’s Your Call!

Posted By thestatedtruth.com on April 21, 2013

The U.S. GDP Will Be Revised Higher By $500 Billion Following Addition Of “Intangibles” To Economy

Those who have been following the US debt to GDP ratio now that the US officially does not have a debt ceiling indefinitely, may have had the occasional panic attack seeing how this country’s leverage ratio is rapidly approaching that of a Troika case study of a PIIG in complete failure. And at 107% debt/GDP no explanations are necessary. Luckily, the official gatekeepers of America’s economic growth (with decimal point precision), the Bureau of Economic Analysis have a plan on how to make the US economy, which is now growing at an abysmal 1.5% annualized pace, or about 5 times slower than US debt growing at 7.5% annually, catch up: magically make up a number out of thin air, and add it to the total. And it literally is out of thin air: according to the FT the addition will constitute of a one-time addition of intangibles, amounting to 3% of total US GDP, or more than the size of Belgium at $500 billion, to the US economy.

From FT (Financial Times):

The US economy will officially become 3 per cent bigger in July as part of a shake-up that will see government statistics take into account 21st century components such as film royalties and spending on research and development.

Billions of dollars of intangible assets will enter the gross domestic product of the world’s largest economy in a revision aimed at capturing the changing nature of US output.

Brent Moulton, who manages the national accounts at the Bureau of Economic Analysis, told the Financial Times that the update was the biggest since computer software was added to the accounts in 1999.

“We are carrying these major changes all the way back in time – which for us means to 1929 – so we are essentially rewriting economic history,” said Mr Moulton.

What exactly will constitute GDP growth going forward? In a word, intangibles: films, books, magazines and iTunes songs.

“We’re capitalising research and development and also this category referred to as entertainment, literary and artistic originals, which would be things like motion picture originals, long-lasting television programmes, books and sound recordings,” said Mr Moulton.

At present, R&D counts as a cost of doing business, so the final output of Apple iPads is included in GDP but the research done to create them is not. R&D will now count as an investment, adding a bit more than 2 per cent to the measured size of the economy.

Nothing like adding intangibles in the fluid, ever-changing definition of what constitutes an economy.

Naturally, the only reason for this artificial “boost” to the US economy which apparently can be any old arbitrary number agreed upon by a few accountants, and which always goes up post revision, never down, is to make US debt/GDP under 100% once again, if only very briefly. Surely a few months later something else can be “added” to GDP making the US economy appear better than it is once more.

Finally, all of the above is a distraction for idiots.

As most people should know by know (this logically excludes economists), the only factor leading to economic “growth” is the expansion of liabilities of the financial system, whereby new credit (in a healthy environment, not one centrally-planned by several Princeton real-world rejects, where the central bank is forced to create all credit expansion with money that never leaves the banks and the capital markets closed loop) creates new money, creates demand for products and services, and circulates in the economy.

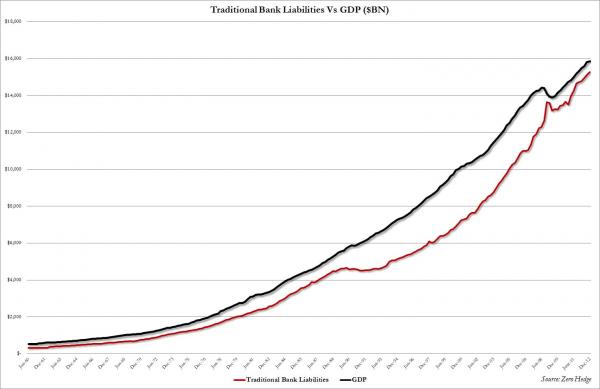

This can be seen in the chart below which shows the nearly perfect correlation between total bank liabilities in the US, as per the Fed’s Flow Of Funds report, and total US GDP.

Bottom line: the BEA can capitalize air consumption if it thinks it will make US GDP soar, but unless new credit and bank liabilities are created not due to forced supply but demand, and unless the private financial sector is finally willing to start lending money (which for the entire duration of QE it has not) US growth will stall and then proceed to decline.

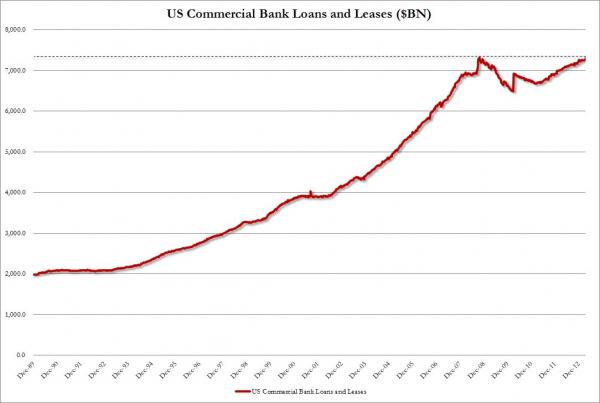

Case in point: total US commerical bank loans are still lower than they were the day Lehman filed.

In other words, all the GDP “growth” since the Lehman failure has come on the back of money “created” by the Fed.

And there are still those who think the Fed will ever unwind…

The Titanic vs Seas of Royal Caribean

Posted By thestatedtruth.com on April 20, 2013

Oh how things have changed over the last 101 years……

In 1912 the infamous Titanic was the biggest ship in the world. See this clever image, comparing the 46,000-ton Titanic to the biggest liner afloat today, the 225,000-ton, Allure of the Seas of Royal Caribbean.

Bad Seats…Hey Buddy!

Posted By thestatedtruth.com on March 12, 2013

Hmm…This from the very successful Kyle Bass

We are right back there! The brevity of financial memory is about two years.

I don’t get paid to be an optimist, I don’t get paid to be pessimist, I get paid to be a realist – and a prudent fiduciary of the capital, and then if i have time I care about the social issues of the world.

If I am right, the social issues are going to be very difficult.I don’t think we devolve into anarchy and I do think the payment systems will continue to work but what they will pay with will be wumpum…

We will go thru a period where its a little tougher…

We went through a period where it was briefly tough and now there are 1400 new billionaires in the world– maybe some capital was misallocated…

Copyright © 2025 The Stated Truth