Posted By thestatedtruth.com on July 12, 2012

Can small town America survive a local Wal-Mart……Our opinion is that anytime one company controls so many things, it’s not good for anyone!

A study of small and rural towns in Iowa showed lost sales for local businesses ranging from -17.2% in small towns to -61.4% in rural areas, amounting to a total dollar loss of $2.46 BILLION over a 13-year period.

The following are 20 facts about Wal-Mart that will absolutely shock you….

#1 The average U.S. family now spends more than $4000 a year at Wal-Mart.

#2 In 2010, Wal-Mart had revenues of 421 billion dollars. That amount was greater than the GDP of 170 different countries including Norway, Venezuela and the United Arab Emirates.

#3 If Wal-Mart was a nation, it would have the 23rd largest GDP in the world.

#4 Wal-Mart now sells more groceries than anyone else in America does. In the United States today, one out of every four grocery dollars is spent at Wal-Mart.

#5 Amazingly, 100 million customers shop at Wal-Mart every single week.

#6 Wal-Mart has opened more than 1,100 ”supercenters” since 2005 alone.

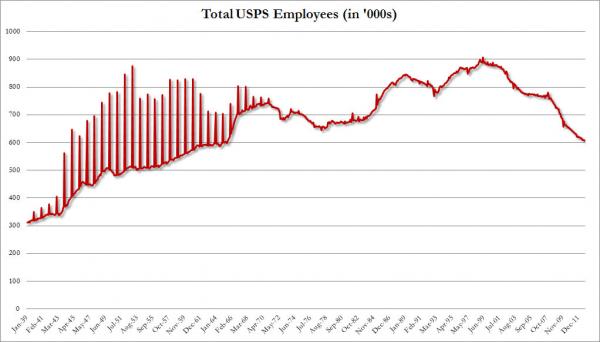

#7 Today, Wal-Mart has more than 2 million employees.

#8 If Wal-Mart was an army, it would be the second largest military on the planet behind China.

#9 Wal-Mart is the largest employer in 25 different U.S. states.

#10 According to the Economic Policy Institute, trade between Wal-Mart and China resulted in the loss of 133,000 manufacturing jobs in the United States between 2001 and 2006.

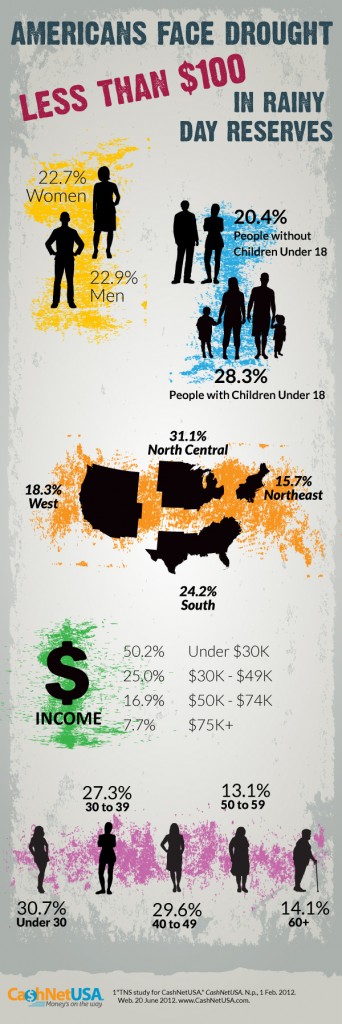

#11 The CEO of Wal-Mart makes more in a single hour than a full-time Wal-Mart associate makes in an entire year.

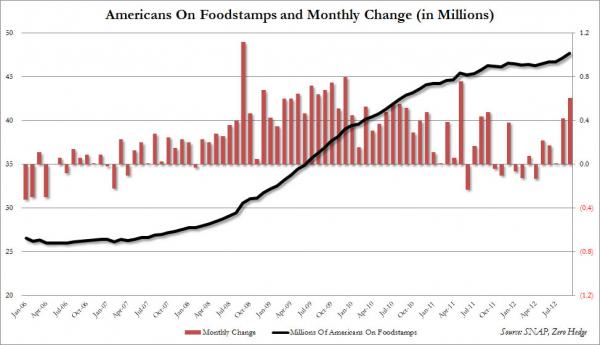

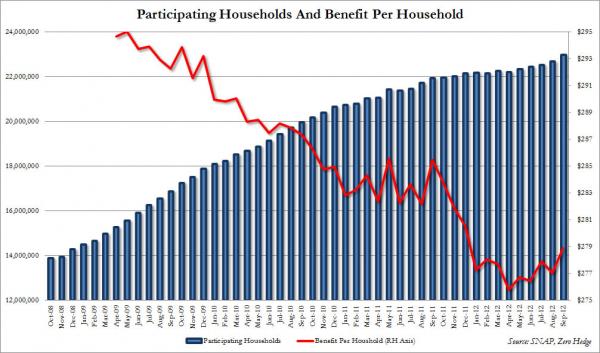

#12 Tens of thousands of Wal-Mart employees and their children are enrolled in Medicaid and are dependent on the government for healthcare.

#13 Between 2001 and 2007, the value of products that Wal-Mart imported from China grew from $9 billion to $27 billion.

#14 Sadly, about 85 percent of all the products sold at Wal-Mart are made outside of the United States.

#15 It is being reported that about 80 percent of all Wal-Mart suppliers are in China at this point.

#16 Amazingly, 96 percent of all Americans now live within 20 miles of a Wal-Mart.

#17 The number of “independent retailers” in the United States declined by 60,000 between 1992 and 2007.

#18 According to the Center for Responsive Politics, Wal-Mart spent 7.8 million dollars on political lobbying during 2011. That number does not even include campaign contributions.

#19 Today, Wal-Mart has five times the sales of the second largest U.S. retailer (Costco).

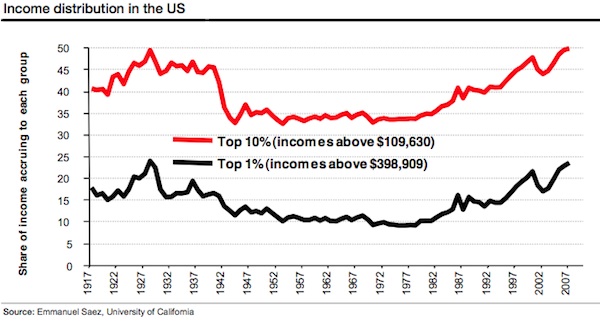

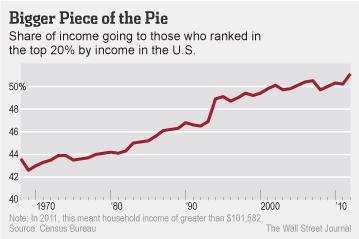

#20 The combined net worth of six members of the Walton family is roughly equal to the combined net worth of the poorest 30 percent of all Americans.

All over the country, independent retailers are going out of business because they cannot compete with Wal-Mart and their super cheap Chinese products. Often communities will give Wal-Mart huge tax breaks just to move in to their areas.

But what many communities don’t take into account is that the introduction of a Wal-Mart is often absolutely devastating to small businesses….

From… yolo.com

Category: Commentary, Economy, National News, Retail, World News |

13 Comments »

Tags: Big Stores, Control, Large Company, retail, spending, Super Stores, walmart