Can You Name This Tune…Er Bubble?

Posted By thestatedtruth.com on March 12, 2012

Hmm…This one’s easy, it’s student loans! Just a freckle short of a trillion dollars!

Posted By thestatedtruth.com on March 12, 2012

Hmm…This one’s easy, it’s student loans! Just a freckle short of a trillion dollars!

Posted By thestatedtruth.com on March 12, 2012

U.S. Budget Deficits – A picture is worth um, $580 billion, here’s why… in the first 5 months of the fiscal year, the U.S. has racked up $580 billion in deficits,

Posted By thestatedtruth.com on March 12, 2012

We’re on the right track….but have a long way to go.

U.S. crude oil production came in at 5.6 million barrels a day for 2011 vs. 5.48 million barrels a day in 2010. It’s the highest U.S. oil production since 2003.

And…

The U.S. has been the world’s largest producer of natural gas since 2009, the report says. But, use of renewable sources of energy, such as wind and solar has lagged, and is still relatively small even though it has doubled since 2008.

Now lets compare this to Russia…..which is the world’s largest crude-producing nation. Yes, you read that right, the worlds largest oil producing nation is Russia.

In Russia, oil production grew to an average of 10.27 million barrels a day, according to preliminary data from the Energy Ministry’s CDU-TEK unit. This is a record level for the post-Soviet era!

Posted By thestatedtruth.com on March 10, 2012

Stress and fear in the system is receding….for the time being.

Posted By thestatedtruth.com on March 7, 2012

They got to be kidding….nope, consumer credit rose $17.8 billion in the latest monthly data, on expectations of $10.5 while non-revolving credit, i.e., auto and mostly student debt rose $20.723 billion and had the highest sequential jump in this category ever! Yes EVER!

At the same time…after tax incomes fell for the second time in three months after adjustments, according to the Commerce Dept.

The just released consumer credit data would make one believe that the US consumer is getting back into old spending habits and the velocity of money is finally starting to ramp up as the headline January number came at a whopping +$17.8 billion on expectations of +10.5 billion. January revolving credit, as in that used on one’s credit card, actually declined by $2.9 billion compared to December, and was back to $800.9 billion: the first decline in 4 months as consumers spend less following the holiday season. Yet offsetting this was an absolutely massive surge in Non-revolving credit, i.e., mostly student debt, which soared by $20.7 billion in the month, the highest sequential jump in this category in history! And when spread by sources of credit, the only place where credit came from was the US government, which funded a near record $28 billion, all of it going into student loans, even as every other source of credit declined in the month!

Total revolving and non-revolving credit:

Posted By thestatedtruth.com on March 6, 2012

Bonus time…or maybe not! Bankers and Wall Street listen up…The O in cheerios stands for zero bonus! Capice!

Posted By thestatedtruth.com on March 5, 2012

Bad seats, hey buddy……especially if you have a student loan! We have said repeatedly that this was going to happen, and rest assured we feel it will get worse. Lots worse! 10 percent of the outstanding loan balance shows delinquent in the third quarter of 2011, and as many as 47 percent of student-loan borrowers “appear to be in deferral or forbearance”.

And while this is happening, the schools and universities continue to spend money on building new dorms and expanding into other areas that are now considered to be a (new) school profit center, and to which the schools can pitch incoming students of the merits to borrow on student loans and go deep into debt, a debt that cannot be discharged or written off, EVER. It’s all wrong! And to boot…statistics show that only about 50% of the students with loans graduate!

Approximately $85 billion in U.S. student loan debt, or 10 percent of the outstanding balance, shows delinquent in the third quarter of 2011.

Of the 37 million borrowers who have student-loan balances, 14 percent, or about 5.4 million people, have at least one past due student-loan account, according to a report posted today on the Federal Reserve Bank of New York’s website.

As many as 47 percent of student-loan borrowers “appear to be in deferral or forbearance,” and didn’t have to make payments as of the third quarter, according to the report. The district bank reported last week that debt from educational loans in the fourth quarter was $867 billion, higher than credit-card debt, according to a survey of consumer credit.

And being that it’s a government loan, it has…“Some special accounting used for student loans, not applicable to other types of consumer debt”, and it also “makes it likely that the delinquency rates for student loans are understated,” wrote economists, Meta Brown, Andrew Haughwout, Donghoon Lee, Maricar Mabutas and Wilbert van der Klaauw.

“The student loan delinquency picture is not fully captured in the broad statistics since a significant proportion of borrowers and balances are not yet in the repayment cycle,”they wrote.

The average outstanding student-loan balance per person is $23,300, according to the report. A third of the borrowers are under the age of 30.

Posted By thestatedtruth.com on March 3, 2012

Here we are with bad demographics again, add to that another broke social security system, and guess what island are we standing on. Yep, it’s Japan! Now the Japanese government has had an epiphany, and all of a sudden seeks to save a broken down social security system, and “rein in soaring welfare costs”. Question: But uh, isn’t that a problem worldwide? Yes it is. So now, if you raise taxes as proposed, what will happen to this mess! Well, it will automatically slow growth things, then soon the situation gets even worse. Capice!

Japanese Prime Minister Yoshihiko Noda said yesterday he thinks he can reach a deal with the opposition to double the 5 percent consumption tax in order to shore up the country’s social security system.

“I believe we can come to an understanding,” Noda told journalists from overseas media organizations yesterday at his official residence in Tokyo. “I sense that our debate is beginning to jibe.”

The combination of an aging society and a declining birthrate has put Japan in an “unprecedented situation” as the government seeks to rein in soaring welfare costs, Noda said. All political parties understand the urgency and must work together as “the question is how to secure stable financing for a sustainable social security system.”

Posted By thestatedtruth.com on March 2, 2012

As of December, per SNAP (Supplemental Nutrition Assistance Program) this number just hit another record high of 46.5 million, an increase of 384,000 in one month, an increase of 2.4 million for the year 2011 (about as many as have dropped out of the Labor force, hmmmm), and 14.3 million since Obama took office.

The food stamp program, part of the Department of Agriculture, is pleased to be distributing the greatest amount of food stamps ever.

Meanwhile, the Park Service, also part of the Department of Agriculture, asks us “Please Don’t Feed the Animals” because the animals may grow dependent and not learn to take care of themselves. Capice

Posted By thestatedtruth.com on March 2, 2012

Here we go….it feels like we could be at the peak of the good feeling time for this economic rebound. Things are getting hot everywhere we look. People are feeling better and the talk is that things are headed back to the good old times, which many consider to be normal. But gasoline prices are sky high, and prices are rising on virtually everything else one buys. We know of many people that have lost houses but recently bought new cars and other high ticket things because they feel good again, and can get financed. This won’t last, as savings have been falling, while most of this consumption has come from borrowing. It seems like people are creatures of habit, and often never learn from failures. Come to think of it, neither do the governments of the world.

From Bank of America

While we are quite concerned about second-half growth, we expect continued mixed news in the near term. Four fair winds are supporting growth: the fading shocks from the Arab Spring; the rebound in Japanese-related manufacturing after last year’s tsunami; reduced home foreclosures as banks wait for clarification on the rules; and mild winter weather. On the back of a very weak consumption report, we have lowered Q1 GDP growth from 2.2% to 1.8%. However, the early data for February has been healthy: although the national PMI weakened, jobless claims continue to drift lower, measures of consumer confidence continue to rebound and auto sales inched higher (Table 1). In the week ahead, we expect more of the same, with a solid 215,000 reading for February payrolls.

Unfortunately, the winds are starting to shift. In the spring the weather is much less important to economic activity than in the winter. Hence, the mild-weather induced bump up in the data should fade. Gasoline prices are up roughly 50 cents from their December lows and with the usual lags this could impact spending (Chart 1). The Attorney General Agreement in February paves the way for a ramp up in foreclosures over the next several months, dampening home prices and potentially construction. And the recovery in the auto sector now seems complete, suggesting a return to a slower pace of growth in sales and production. Based on these cross winds, we expect the data surprises to turn negative over the course of this spring.

When the facts change…

A popular indicator among clients is the Economic Cycle Research Institute (ECRI) leading index. Back in September ECRI argued that a recession was “inescapable,” pointing not just to their publicly released index, but to a series of other proprietary indexes. “Once the [negative] feedback loop starts,” they warned, “it’s more powerful than any policy response.” In the past week, they were back on the airwaves, saying “our call stands”: a recession is still likely in the first half of this year. Indeed, they argue, “when you look at the hard data that is used to officially date business cycle recessions, it has been getting worse, not better, despite…the consensus view of an improving economy

Risk of recession rises in the second half

The deterioration in leading indicators last summer was mainly because of waves of financial market stress coming from Europe and weak US data due to the oil and Japan shocks. Those shocks have now faded and the risk of a near-term recession has in our view fallen back to normal levels. Unfortunately, we believe the risk of a recession rises in the second half. The sudden stop in fiscal policy at the end of the year will likely cause a sharp slowing in growth. If it is handled badly, it could cause an outright recession. However, this has nothing to do with the now out-of-date signals from last fall.

Posted By thestatedtruth.com on March 1, 2012

The food stamp program, part of the Department of Agriculture, is pleased to be distributing the greatest amount of food stamps ever.

Meanwhile, the Park Service, also part of the Department of Agriculture, asks us “Please Don’t Feed the Animals” because the animals may grow dependent and not learn to take care of themselves.

Posted By thestatedtruth.com on March 1, 2012

Housing Tid Bits…..

The latest quarterly report out of CoreLogic is full of insights about the state of U.S. housing. Key among them is that “negative equity and near-negative equity mortgages accounted for 27.8 percent of all residential properties with a mortgage nationwide in the fourth quarter, up from 27.1 in the previous quarter.

Nationally, the total mortgage debt outstanding on properties in negative equity increased from $2.7 trillion in the third quarter to $2.8 trillion in the fourth quarter.” The facts are that there is at least $2.8 trillion in debt held by investors (read banks and GSEs) that is marked at par and actually should be impaired. And one wonders why Fannie lost $16.9 billion in 2011. Duh.

Among Other findings:

Here is what the LTV histogram of U.S. housing looks like:

More in the full report.

Posted By thestatedtruth.com on February 29, 2012

So, how do we do it…deleverage we mean? Uh, well, we need to spend less on cars and gas, and food, and housing and…healthcare, and buy less other things, and save more – oh, sorry about that last one, nothing left to save…..

From Today’s Bloomberg Brief:

The slow pace of deleveraging will continue to weigh on growth over the next few years – even as they have drawn down debt as a percentage of personal income from its peak in June 2009 at 114.76% to 101.1% at the end of 2012. There is a long way to go to the apparent Maginot line of supposedly sustainable 90% and with wage growth stagnant, the bulk will come from debt reduction in true balance-sheet-recession style – putting still more pressure on a perniciously polarized government to do anything about it.

For the US Household to get to supposedly sustainable levels of debt to personal income…look at the chart below. the area of 2002 is a long ways off, and that was still on the high side.

Posted By thestatedtruth.com on February 28, 2012

Here’s the scoop on gasoline (these charts go back to 1991)….prices are moving to the upside rapidly while demand is falling. Hmm Oh, and it’s official… gas prices have set an all time record for the month of February.

Posted By thestatedtruth.com on February 28, 2012

Bill Gross talking here…It’s the new normal, and a sign of the times as bank accounts and money market accounts basically yield nothing…and who gets the smelly end of the stick, yep… main street is the one taking it up the wazoo, yet again!

Chart 1 shows that since 1981, which marks the beginning of the secular decline of interest rates, personal interest income has rather gradually (and now somewhat suddenly) shrunk relative to household debt service payments. It is Main Street that has failed to keep up with Wall Street and corporate America in the race to see who can benefit more from lower yields. As the interest component of personal income gradually weakens, the ability of the consumer to keep up its frenetic spending is reduced.

Posted By thestatedtruth.com on February 28, 2012

There is no housing recovery as of yet….that according to Case Shiller. The Case Shiller housing index just showed a 8th consecutive month of home price declines. During this time we’ve had one of the most favorable winter buying periods ever, caused by favorable weather conditions accross the United States with one of the warmest winters on record (other then in Alaska). And let’s not forget the record low interest rates on mortgages. Anyone wonder how things might have looked like if the tables were turned and we had a severe cold winter…ah, we won’t even go there! The Case-Shiller National Composite Index fell by 3.8% in the fourth quarter alone, and is down 33.8% from its 2nd quarter 2006 peak. It is now at a new record low.

The December Case Shiller Index printed at 136.71 on expectations of 137.11, with the prior revised to 138.24. The top 20 City composite was down -0.5% on expectations of a 0.35% drop. 18 out of 20 MSAs saw monthly declines in December over November, with just the worst of the worst – Miami and Phoenix – posting a dead cat bounce, rising 0.2% and 0.8% respectively. And granted the data is delayed, but the fact that we have now had 8 consecutive months of home price declines even with mortgage rates persistently at record lows, as Case Shiller’s David Blitzer says: “If anything it looks like we might have reentered a period of decline as we begin 2012.”

From the report:

“In terms of prices, the housing market ended 2011 on a very disappointing note,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “With this month’s report we saw all three composite hit new record lows. While we thought we saw some signs of stabilization in the middle of 2011, it appears that neither the economy nor consumer confidence was strong enough to move the market in a positive direction as the year ended.

“After a prior three years of accelerated decline, the past two years has been a story of a housing market that is bottoming out but has not yet stabilized. Up until today’s report we had believed the crisis lows for the composites were behind us, with the 10-City Composite originally hitting a low in April 2009 and the 20-City Composite in March 2011. Now it looks like neither was the case, as both hit new record lows in December 2011. The National Composite fell by 3.8% in the fourth quarter alone, and is down 33.8% from its 2nd quarter 2006 peak. It also recorded a new record low.

“In general, most of the regions also posted weak data in December. Eighteen of the cities saw average home prices fall in December over November. Seventeen of the cities have seen monthly declines for at least three consecutive months. In addition to both monthly composites, 10 of the cities saw home prices fall by more than 1.0% during the month of December. The pick-up in the economy has simply not been strong enough to keep home prices stabilized. If anything it looks like we might have reentered a period of decline as we begin 2012.”

8 Consecutive Months of Declines:

Long-Term Case-Shiller:

Posted By thestatedtruth.com on February 25, 2012

Part of this is demographics.

Posted By thestatedtruth.com on February 24, 2012

Wow…every one’s celebrating like it’s 1999, but it isn’t…try 2012?

And…we continue to see record lows of Completed Houses for sale. Anyone still want to celebrate about this?

Posted By thestatedtruth.com on February 24, 2012

We wouldn’t call this a surprise. Judging from the waiting time at the local restaurants, people are in a spending mood….and to boot we see a lot more construction going on, especially in light of a huge commercial and housing overhang.

Confidence among U.S. consumers rose in February as Americans continued more hopeful about economic growth.

The Thomson Reuters/University of Michigan final index of consumer sentiment increased to 75.3 from 75 in January. The median estimate in a Bloomberg News survey called for 73, which was above the 72.5 preliminary reading. The gauge averaged 89 in the five years before the 18-month recession that ended in June 2009.

Posted By thestatedtruth.com on February 20, 2012

Moore’s law states that the number of transistors that can be placed on an integrated circuit doubles every 18 months to two years, and it’s predicted to reach its limit with existing technology in 2020.

But…Cutting the size of a transistor to a single atom may change that concept. Then again, it’s going to take a while to get a quantum computer working at its operating temperature of minus-391 degrees Fahrenheit which is needed to keep it from migrating out of its channel. Oh well, so now you know!

Feb. 20 (Bloomberg) — Scientists have taken a first early step toward escaping the limits of a technological principle called Moore’s Law by creating a working transistor using a single phosphorus atom.

The atom was etched into a silicon bed with “gates” to control electrical flow and metallic contacts to apply voltage, researchers reported in the journal Nature Nanotechnology. It is the first such device to be precisely positioned using a repeatable technology, they said, and may one day help ease the way toward creation of a so-called quantum computer that would be significantly smaller and faster than existing technology.

But, there is a limitation to the latest finding: The atom must be kept at minus-391 degrees Fahrenheit to keep it from migrating out of its channel, the report said. Because of this, the result should be seen as a proof of principle rather than an initial step in a manufacturing process, the researchers said.

Read more: http://www.sfgate.com/cgi-bin/article.cgi?f=/g/a/2012/02/20/bloomberg

Posted By thestatedtruth.com on February 18, 2012

A New House Cost $10,000

Average Annual Income $ 4,000

One Gallon Gas $ .22

Average New Car $ 1,700

Loaf Of Bread $ .16

First Class Stamp $ .03

Kodak Brownie Camera $ 13.00

Posted By thestatedtruth.com on February 16, 2012

Sounds plausible!

As part of its social media survey Goldman Sachs asked respondents what is the main reason for people to “log on” to various social networking venues. The answer, by a wide margin, is the expected one: namely to spy, and to compare whether our lives are more boring, less glitzy and exciting, with fewer gadgets, gizmos, smaller houses or cars, and generally more in debt, than our “friends.” Of course, the politically correct way of saying this is “to see what my friends are doing.” In other words, there is nothing new about social media but a millennia-old regurgitated phenomenon- it is merely a new locus of exhibiting and observing social status, to see and be seen. One which can be enjoyed 24/7.

Posted By thestatedtruth.com on February 16, 2012

It looks like we’ve seen the bounce in consumer net worth and now as we head back the other way, reality may set in! Or… maybe not, it being an election year and all.

Posted By thestatedtruth.com on February 16, 2012

In the new normal let’s review some definitions: (Discretionary spending is a spending category through which governments can spend through an appropriations act.) This spending is optional as part of fiscal policy, in contrast to entitlement programs for which funding is mandatory.

As the Budget Control Act cuts discretionary spending to a 50-year low (close to only 5% of GDP), it is the rise in entitlements (and of course interest costs) that appear mandatory for now and will need to be ‘balanced’ with tax revenue growth that is expected to rise from 15% of GDP to 20% of GDP by 2022 (thanks largely to a belief that a cyclical recovery will save us). As the real ranks of the long-term unemployed and now disabled benefit receivers swell, the future of these entitlements will be in need of change or they will migrate toward being permanent.

The Administration projects that tax revenues will rise from their current 15% of GDP to 20% by 2022, and that spending will decline from 24% of GDP to 23%. Both numbers need to be dissected in order to make sense of them. The projected revenue increase is as much from an assumed cyclical recovery as it is a product of tax legislation. Secondly, the modest decline in spending as a % of GDP obscures cuts in some categories and increases in others: the Budget Control Acts cut discretionary spending to a 50-year low close to 5% of GDP, but is offset by continually rising entitlement and interest costs (mandatory items). Budget negotiations of the future are likely to revolve around the trade-offs between tax revenue increases and entitlement reform. The discretionary spending well is empty.

Posted By thestatedtruth.com on February 15, 2012

So…. for Americans to get debt levels back to the happier times of 2002-03 levels, we’ll need about a 21% debt drop from the peak and a 17% drop from right where we are now. Back to 2000 will take longer. We’re talking many years for this to unwind.

Posted By thestatedtruth.com on February 13, 2012

Nobody on the planet is expecting GDP growth this high….2.7% never happens! You heard it first here. The smartest guys in the universe are much more conservative.

From Bridgewater: Recent better-than-expected news on the U.S. economy is unlikely to be the start of a healthy expansion. The uptick in economic growth has been fueled by a decline in the savings rate, which, without material income and employment gains, is unlikely to be sustainable as long-term credit growth also remains weak. PIMCO has also projected the same theme …..

The Obama administration’s new budget expects the U.S. economy will grow 2.7 percent this year, a forecast that’s more optimistic than those of private economists and Federal Reserve policy makers.

Federal Reserve policy makers on Jan. 25 forecast the U.S. economy would grow between 2.2 percent and 2.7 percent this calendar year, while the International Monetary Fund estimates a 1.8 percent increase.

The White House projections released today call for GDP (growth domestic product) growth of 3.6 percent in 2014 and 4.1 percent in 2015. They foresee the jobless rate dropping to 8.1 percent in 2014 and 7.3 percent in 2015.

In today’s budget report, the administration projected theconsumer price index would rise 2.2 percent this year, 1.9 percent in 2013 and 2 percent the following year.

Posted By thestatedtruth.com on February 10, 2012

Gasoline deliveries have in the past reflected recession or growth. If so, the recent drop in retail gasoline deliveries may signal a sharp economic contraction dead ahead. Or… a new normal because of rising fuel economy?

Note that petroleum usage is back to 1997 level and gasoline usage is back to 2001 level. Moreover, two out of the last three weeks gasoline usage has dropped below 8,000,000 barrels per day.

A mild winter can explain part of the drop in petroleum usage (heating oil), and fuel economy is improvinng, that is true, but it does not explain the whole decline in gasoline usage or the overall trends.

From the U.S. Energy Information Administration: (EIA)

Posted By thestatedtruth.com on February 10, 2012

So, Governor Brown, what happened to the big recovery you were expecting…and how about the giant consumer spending binge of the last two months fueled mostly on credit……just asking? This is a disaster to the state budget. Spending up as reflected in sales taxes, while income is down, relected in income taxes.

California collected $528 million less in taxes (gulp) in January than Governor Jerry Brown estimated in his latest budget, Controller John Chiang said.

The majority of the shortfall was in income taxes, down $525 million, or 6.3 percent less than projected in the spending plan Brown released Jan. 5, Chiang said. Corporate taxes were down $127.9 million, while sales taxes were up $42.8 million.

California’s cash may be exhausted by March, Chiang reported Jan. 31. The nation’s most populous state will need $3.3 billion by mid-April without additional borrowing and payment delays, because it has spent more and received less than anticipated for the current fiscal year.

“January revenues were disappointing on almost every front,” Chiang said today in a statement. “Thankfully, the decisive actions taken recently by the state to stabilize its cash flow will ensure that California can pay its bills through the end of the fiscal year.”

Posted By thestatedtruth.com on February 10, 2012

Many parts of our economy now seem to be controlled (rigged) by the government. If housing would have been left alone, then things could have been cleaned up by now and a true bottom might have been reached, but instead this mess will drag on for years to come much like Japans nightmare!

Federal Reserve Chairman Ben S. Bernanke said the central bank’s efforts to spur economic growth are being blunted by impediments to mortgage lending.

“We have helped lower mortgage rates to the lowest point in many, many decades,” Bernanke told homebuilders today in Orlando, Florida. “Yet we are not seeing as much activity as we would like to see.”

Bernanke said that the pace of the recovery has been “frustratingly slow and,” didn’t discuss the outlook for monetary policy. He devoted part of his speech to recommendations from a Fed study on housing that was sent to Congress last month and which prompted criticism from some lawmakers, who said the Fed has overstepped its authority.

“The state of housing and mortgage markets may also be holding back the recovery of our financial system and the normalization of credit conditions,” Bernanke said today to the National Association of Homebuilders International Builders’Show.

Referring to the high standards of lenders following the housing bust, Bernanke said that “some tightening was no doubt necessary.”

Posted By thestatedtruth.com on February 8, 2012

Student debt is rising to records with almost every government consumer report, and for a mulitude of reasons. They include steadily spiraling college costs, financial aid cutbacks at public universities and a weak economy to name a few. And schools across the country are encouraging it because they need the money, most having expanded rapidly in the past few years to accommodate growing but seemingly unsustainable enrollments(let’s not forget the negative demographics problem going forward). This all makes things difficult for graduates once they get to the real world trying to find jobs because they are burdened with an instant debt load which seemed like monopoly money while in school. But the fact is, it’s not monopoly money, and student loans aren’t discharged in a bankruptcy….. definitely food for thought!

Student loan debt is pushing an increasing number of young people and their parents toward bankruptcy, according to a survey released Tuesday.

More than four-fifths of bankruptcy attorneys say they’ve seen a notable jump in the number of potential clients with student loan debt, with nearly half the lawyers reporting a significant increase in such cases, according to the report by the National Assn. of Consumer Bankruptcy Attorneys.

Nearly one-quarter of attorneys say the number of potential student loan clients has risen 50% to 100%, while 39% of attorneys report increases of 25% to 50%.

The average student loan debt of 2010 college graduates topped $25,000 — the first time it has exceeded that inglorious mark. Graduating seniors had an average loan burden of $25,250, up 5.2% from the $24,000 owed by the class of 2009, according to the Project on Student Debt in Oakland.

Unlike many other forms of personal debt, student loans cannot be discharged in bankruptcy, meaning the debt can hang over students well into their adult lives. And that is looking more and more like the new normal.

The bankruptcy attorneys group says worsening debt levels could spur a financial crisis similar to the mortgage meltdown.

“Take it from those of us on the frontline of economic distress in America,” said William E. Brewer Jr., the group’s president. “This could very well be the next debt bomb for the U.S. economy.”

Parts from Walter Hamilton of the LA Times

Posted By thestatedtruth.com on February 7, 2012

Bank of America Plaza, the tallest tower in the U.S. Southeast, was sold at a public auction today on the steps of the Fulton County Courthouse after landlord BentleyForbes missed its mortgage payments. It was purchased for $436 million back in 2006, but off she goes for $235 million here in 2012.

The noteholder had a winning bid of $235 million, according to attorney Howard Walker of McGuire Woods LLP, who ran the auction. Holders of commercial mortgage bonds took ownership through a “credit bid” placed by LNR Partners, David Levin said in an e-mailed statement. Levin is vice chairman of Miami Beach, Florida-based LNR Property LLC, the parent company of LNR Partners, the tower’s special servicer.

BentleyForbes, paid $436 million to acquire the 55-story Atlanta skyscraper in 2006 from Bank of America Corp. and Cousins Properties Inc.

Posted By thestatedtruth.com on February 7, 2012

Alaska produces about 10% of the oil in the U.S. But one look at this chart will explain where we’ve been and where we’re going… in Alaska!

Posted By thestatedtruth.com on February 7, 2012

So…the consumer confidence level is soaring right along with the consumer debt, and the savings rate is plunging. Now we understand why the Federal reserve has been so worried lately. The worry is that this consumer spending binge is totally unsustainable and likely to burn out soon!

A report from the Labor Department today also showed there were almost four unemployed Americans vying for each job vacancy in December, more than twice the number before the recession began in December 2007. That may explain why wages have yet to pick up, prompting households to borrow.

Consumer borrowing in the U.S. rose more than forecast in December (by a wide margin), driven by demand for auto and student loans.

Credit increased by $19.3 billion to $2.5 trillion, Federal Reserve figures showed today in Washington. The gain topped the $7 billion median forecast of economists surveyed by Bloomberg News and followed a $20.4 billion advance the prior month.

The back-to-back increase at the end of 2011 was the biggest since October-November 2001.

Non-revolving debt, including educational and auto loans increased by $16.6 billion in December, the biggest gain since November 2001, today’s report showed.

NSA sequential change in consumer credit:

SA sequential change in consumer credit by revolving and non-revolving.

Posted By thestatedtruth.com on February 3, 2012

Here is the latest from John Williams

– Basic Economic Outlook Unaltered by Stronger Labor Data

– January Jobs Reading Still at Levels of 11 Years Ago

– January Unemployment: 8.3% (U.3), 15.1% (U.6), 22.5% (SGS)

– Money Supply M3 Growth Is Picking Up

Posted By thestatedtruth.com on February 3, 2012

A Novel Idea….Let’s Call It…. The Congressional Common Sense Act of 2012

1. No Tenure / No Pension.

A Congressman/woman collects a salary while in office and receives no

pay when they’re out of office.

2. Congress (past, present & future) participates in Social

Security.

All funds in the Congressional retirement fund move to the

Social Security system immediately. All future funds flow into

the Social Security system, and Congress participates with the

American people. It may not be used for any other purpose.

3. Congress can purchase their own retirement plan, just as all

Americans do.

4. Congress will no longer vote themselves a pay raise.

Congressional pay will rise by the same amount as a social security recipient.

5. Congress loses their current health care system and

participates in the same health care system as the American people.

6. Congress must equally abide by all laws they impose on the

American people.

Serving in Congress is an honor, not a career. The Founding Fathers

envisioned citizen legislators, so when done serving their

term(s), they can move on to other things.

Posted By thestatedtruth.com on February 3, 2012

Whopper of a NFP (non farm payroll) number, which prints at 243K, higher than the biggest forecast of 225K, on consensus expectations of 140K, the biggest jump since February 2009.

But the devil’s in the details…….

As is well known, banks have been firing workers left and right: these are the jobs that actually matter in the grand withholding taxes scheme of things. Yet someone is getting hired supposedly. Well, it seems this is merely rotation from high paying jobs to “low-wage jobs.” Here’s what CRT Capital says. Per Bloomberg: About 113k of NFP gain from “low wage jobs,” David Ader, strategist at CRT Capital Group, writes in note. Additionally, “we didn’t see the drop in courier and messengers as expected – but suspect we will.” Moreover, ‘‘long-term stress remains at the U6 measure at 15.1% is still high, but likely falling due to people leaving labor force, and duration on unemployment remains over 40 weeks.”

Then we read…..about a new record just set!

People not in the labor force exploded by an unprecedented record 1.2 million. No, that’s not a typo: 1.2 million people dropped out of the labor force in one month! So as the labor force increased from 153.9 million to 154.4 million, the non institutional population increased by 242.3 million meaning, those not in the labor force surged from 86.7 million to 87.9 million. Which means that the civilian labor force tumbled to a fresh 30 year low of 63.7% as the BLS (U.S. Bureau of Labor Statistics) is seriously planning on eliminating nearly half of the available labor pool from the unemployment calculation. As for the quality of jobs, as withholding taxes roll over Year over year, it can only mean that the U.S. is replacing high paying FIRE jobs with low paying construction and manufacturing. So much for the improvement.

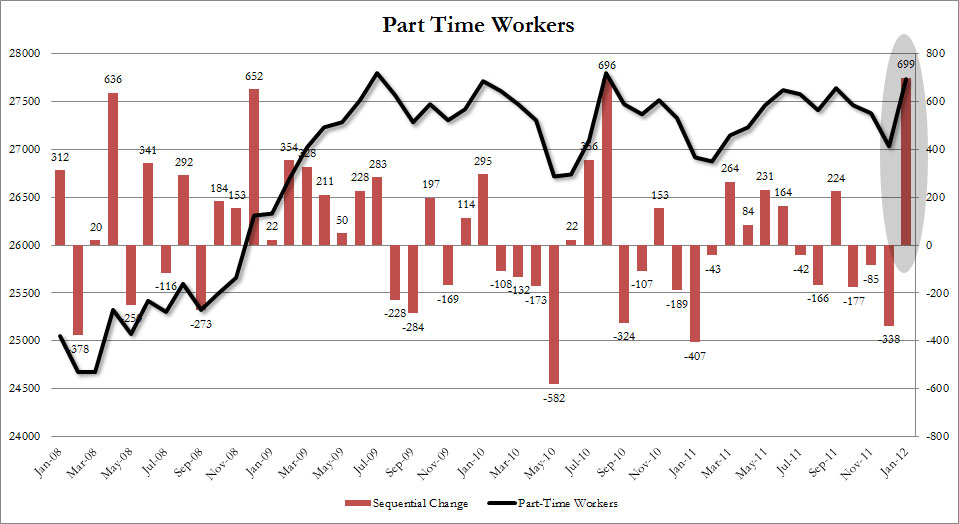

So finally we go to the Household Data Survey, and specifically the breakdown between Full Time and Part Time Workers (defined as those “who usually work less than 35 hours per week”). We won’t spend too much time on it, as it is self-explanatory. In January, the number of Part Time workers rose by 699K, the most ever, from 27,040K to 27,739K, the third highest number in the history of this series. How about Full time jobs? They went from 113,765 to 113,845. An 80K increase. So the epic January number of 141.6 million employed, which rose by 847K at the headline level: only about 10 % of that was full time jobs: surely a questionable indicator of the so called resurgent U.S. economy… in which employers can’t even afford to give their workers full time employee benefits.

www.zerohedge.com

Posted By thestatedtruth.com on January 31, 2012

Looks like we have slow learners here, folks…..$100 billion in write downs, give me a break!

Shipping Loans Now Go Bad For European Banks

With China rolling over, the large ship containers are increasingly lined up and stacked in Asian harbors around the world.

The IHT is out quoting industry observers stating that European banks may be facing write-downs on these loans on the order of $100 billion, which is even more than their Greek losses.

More: http://www.ilghirlandaio.com/ftp/telpress/2012012701974403970.PDF

Posted By thestatedtruth.com on January 31, 2012

We ask Governor Brown of California, what happened to those Rosie optimistic solutions and improving tax receipts that you talked about not to long ago? Looks like we have the same skid marks on the road as last year…Can’t anybody come up with a conservative assumption going forward. Oh ya, that’s right… you were thinking that residents will vote for a tax hike on themselves in a recession. Basically, we’re dealing with government morons and that’s official!

From the Sacramento Bee:

“California will run out of cash by early March if the state does not take swift action to find $3.3 billion through payment delays and borrowing, according to a letter state Controller John Chiang sent to state lawmakers today. The announcement is surprising since lawmakers previously believed the state had enough cash to last through the fiscal year that ends in June.”

“But Chiang said additional cash management solutions are needed because state tax revenues are $2.6 billion less than what Gov. Jerry Brown and state lawmakers assumed in their optimistic budget last year. Meanwhile, Chiang said, the state is spending $2.6 billion more than state leaders planned on.”

Posted By thestatedtruth.com on January 31, 2012

Oh well…the Fed said recently… they worried that much of the recent spending uptick was coming from savings and inventory build up, and it was unlikely to last much longer without an improving fundamental environment!

The gradual re-softening of the economy is starting to materialize. The January Chicago PMI just printed at 60.2, missing expectations of an increase to 63, and down from December’s 62.2, while the employment index came in at its lowest since August at 54.7, and the order backlog number came at 48.2, the lowest since October 2009.

Copyright © 2025 The Stated Truth