Posted By thestatedtruth.com on November 25, 2013

Op-Ed The Stated Truth

Elitist Defeatism Of Real Competition In A Slow Growth World

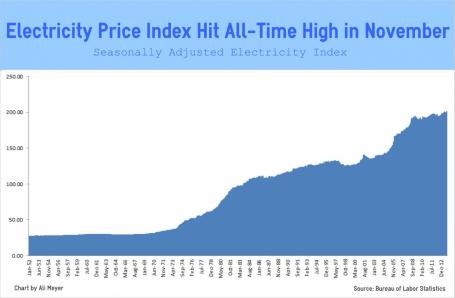

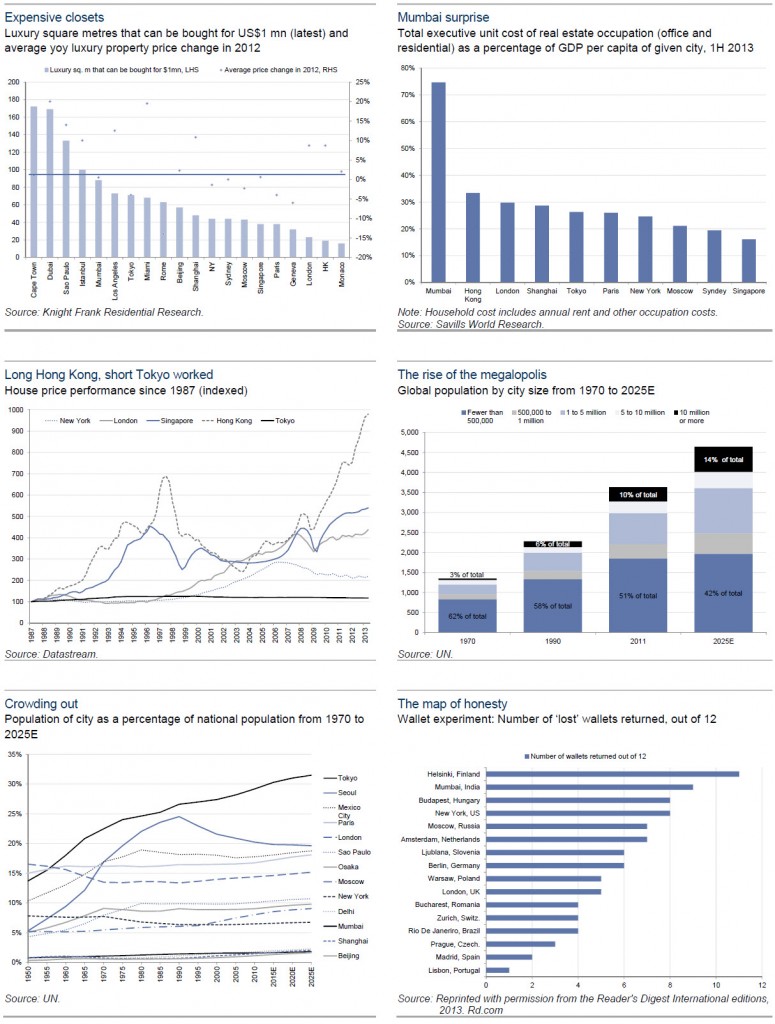

For markets to grow in a capitalist society, it is imperative to have high levels of competition. The more competition the better. This helps innovation and has been the backbone of our economy over the last 102 years or to be more precise (since May 5, 1911, when on this day Standard Oil was ordered broken up by the Sherman Antitrust Act of 1890). But things have taken a turn and are now much the opposite. As an example, banks that are “Too Big To Fail” have bought up the competition, allowing the big five as they are known to control 56% of the U.S. economy as of 2012.

Five banks — JP Morgan Chase & Co. (JPM), Bank of America Corp. (BAC), Citigroup Inc., Wells Fargo & Co. (WFC), and Goldman Sachs Group Inc. — held $8.5 trillion in assets at the end of 2011, equal to 56 percent of the U.S. economy, according to central bankers at the Federal Reserve.

Five years earlier, before the financial crisis, the largest banks’ assets amounted to 43 percent of U.S. output. The Big Five today are about twice as large as they were a decade ago relative to the economy.

The same goes for department stores, oil companies, communications companies and food companies. We could go on and on about this, but it is why we as a country can’t seem to grow anymore. Too big to fail is also too big to manage easily!

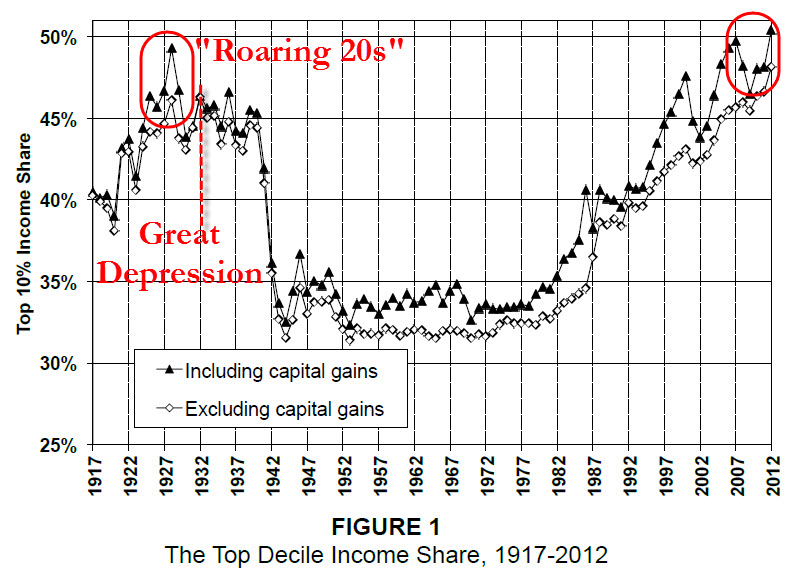

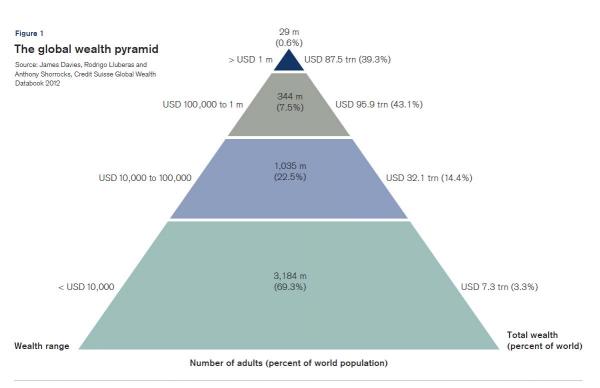

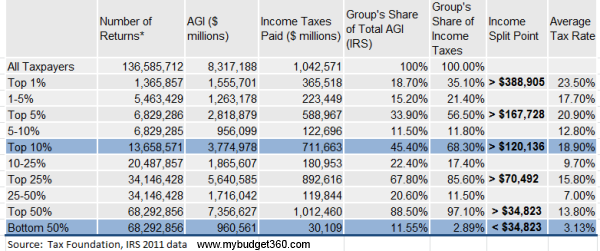

It’s not because we don’t have the want or will to grow, it’s because we don’t have the way. It was taken away from us by the elitists (the top .06 of 1% that control 40% of the wealth) with the help of self serving government politicians who by definition have enhanced their own interests at the expense others, but mostly effecting the middle class and the common man. This is not what our forefathers intended way back in 1776. We need to get back to the norm and the norm is where a family in Gary, Indiana or New Orleans or Detroit, or for that matter any city in America can have a job paying a resonable living wage. It is in the best interests of everyone including the wealthy elitists to work towards this objective, or history tells us that society will force these changes on them. For the middle class, the best way and maybe the onlyway to change this is to form a new third political party and vote out the current batch of political self serving bucketeers, and we mean both the Democrats and Republicans! The time is right.

Back in 1890, The Sherman Act of 1890 attempted to outlaw the restriction of competition by large companies, who co-operated with rivals to fix outputs, prices and market shares, initially through pools and later through trusts. Fast forward to 2013 and follow the flow chart below. Looks to us like the more things change, the more they look like before but with a little differant twist, and the question becomes… does antitrust even exist anymore?

So let’s look at some examples of this twist from recent times. Back in 1998 the largest oil company Exxon bought the second largest oil company Mobil, and created a new even bigger ‘largest oil company’ in the world. It was considered to be the largest corporate merger in history at the time.Why were these two bemouths allowed to merge? Theywere part of the Standard oil breakup in 1911. Did it help competition or hurt it? Well, it surely didn’t help.

How about #3 Chevron buying # 4Texaco back in 2001, did it help or hurt competition? It made the shareholders richer, but did it help competition? No.

How about retailer Federated ( Macy’s) buying May Company back in 2005, does anybody remember the huge number of malls that were anchored by both Macy’s or Macy’s corporate unbrella brand names and May Co. Then what happened? Well there was one less competitor in the department store segment in most malls and in fact many malls had a Macy’s owned stores anchored on each end, doesn’t that seem monopolistic. How was that good for competition? IT WASN’T. And what are we forgetting here….Macy’s almost went bankrupt during the 2008- 2009 financial crisis, alas they were (you guessed it) too big to fail!

We’ve now become a nation of ‘too big to fail’ (or manage) with large controlling companies in most market segments. It’s no wonder that the economy can’t grow. Back when AT&T split up in 1984, what happened… the baby bells were cut lose from the big slumbering giant and presto, we had rapid growth in almost all the baby bells as they were called back in the day.

The breakup led to a surge of competition in all areas of telecom including the long distance telecommunications. But years later what happened? The baby bells started buying or merging with each other and bingo, back we went to the big be-mouth large giants that we set out to separate. The’ new’ A T&T composed of a re- combination of baby bells, supports 5.27 billion shares outstanding, shows a massive debt of $76.78 billion (yes, you read that number right) and has only $ 1.37 billion of cash. How long can any company with this amount of debt maintain itself, no matter how effiecent, even without world economic problems to deal with.

Can’t our government see that this kind of massive debt accross all levels of corporate society isn’t the secret to rapid growth. Too big to fail is just that. They are big risk takers for all the wrong reasons. They are hard to manage efficiently because they’re too big. Where did Facebook come from, or Tweeter….they came from entrepreneurs, not from ‘too big too fail old corporate Dinosaurs. And in comparison to A T&T, Facebook has $9.33 billion in cash and about $500 million in debt. How is that possible you say, well Facebook is young and inovative. Do we need to say more! There are many more cases like this. Read the hand writting on the wall. It’s the future.

In today’s world the bigger the corporation you are, the more power you have with the politicians. It’s all that matters, and it’s a simple formula. It is not the will of the people. It does not and never will create growth. Our forfathers would turn over in their graves, probably already have because of this.

As an incentive to get the “too big to fail or manage” corporate interest on board for splitting into smaller more inovative companies the government could offer tax breaks, technology upgrade depreciation and tax credits, along with allowing repatriated money from abroad to come home without taxation but with provisions. Shareholders could recieve special tax rights excluding capital gains tax credits if they remain original holders of these stocks after the split up. Maybe the most important part of these incentives would require businesses to come back to the United States and hire Americans. If the strategy of money printing and quantitative easing was to be redirected with incentives for the rebuilding of the United States, it would pay for itself starting almost immediately and project to a new brighter future for all. It would also narrow the large gap of wealth between the rich and poor along with giving the middle class and poor a sense of hope and encouagement again.

The United States will be self sufficient in oil by 2019, and no longer needs to be the worlds bully or the worlds policeman. If we don’t change our bad habits, our future will stagnate into a class revolt as the rich elitists will (continue to) destroy the common man which consists of the middle class and poor, and the gap between the two will ultimately take down all of capitalism. Whether by accident or design, it matters not. These problems won’t go away. Time is short and there is work to be done. Capice!

P.S Can an elitist be friendly and compassionate towards the common man? Yes, Warren Buffett is the perfect example of a very successful and rich man. But he understands the situation of the common man. He has often said that gap between the rich and poor is way too large, and the wealthy need to be taxed differently then they are now. He also has stated that when he dies, most of his wealth will be given away, leaving only a small bit for his children. There are also many others that feel the same way, Bill Gates, co-founder of Microsoft has a similar opinion as Buffett. In fact we’ve heard that they even play bridge together. So, we would not stereotype everyone as an elitist, but you get our drift about the subject.

The Original Sherman Act

*So let’s review some of the intent of the original Sherman Act

Section 1 of the Sherman Act declared illegal “every contract, in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations”. Section 2 prohibits monopolies, or attempts and conspiracies to monopolize. Following the enactment in 1890 US court applies these principles to business and markets. Courts applied the Act without consistent economic analysis until 1914, when it was complemented by the Clayton Act which specifically prohibited exclusive dealing agreements, particularly tying agreements and interlocking directorates, and mergers achieved by purchasing stock. From 1915 onwards the rule of reason analysis was frequently applied by courts to competition cases. However, the period was characterized by the lack of competition law enforcement. From 1936 to 1972 courts’ application of anti-trust law was dominated by the paradigm of the Harvard School. From 1973 to 1991, the enforcement of anti-trust law structure-conduct-performance was based on efficiency explanations as the Chicago School became dominant. Since 1992 game theory has frequently been used in anti-trust cases.

Wikipedia has more on this matter: http://en.wikipedia.org/wiki/Competition_law

PolicyMic notes, notes these ten mega corporations control the output of almost everything we buy – from household products to pet food and from jeans to jello. The so-called “Illusion of Choice,” that these corporations (and their nepotistic inter-relationships) create is remarkable…

Sources: Wise Dog Research, Zero Hedge, PolicyMic, Wikipedia

Category: Commentary, Economy, Finance, Inspirational, National News, Pensions and Retirement, Personal Net Worth, Research, Technology, Tid Bits, Uncategorized, Wall Street, World News |

3 Comments »

Tags: Anti Trust, Baby Bells, Bucketeers, Competition, Corporations, Credits, Elitist, Finanacial Crisis, Growth, Money, Monopoly, New World, Risk takers, Sherman Act of 1890, Stated truth, Tax Credits, Tax Incentives, The Stated, Too Big To Fail